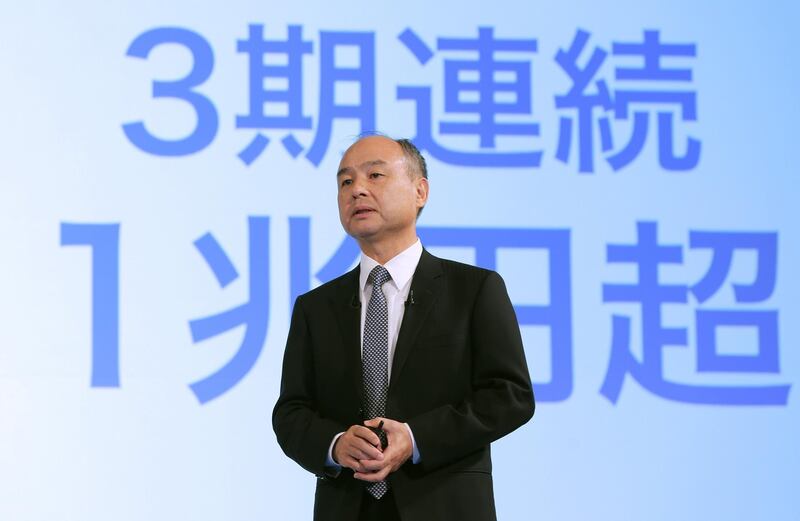

It wasn’t until the very end of Masayoshi Son’s investor presentation on Thursday that he addressed one of the questions vexing observers of his SoftBank Vision Fund.

“IPO? There are rumors about an IPO. But I cannot make any comment now.”

Mr Son confirmed plans for a possible second fund. Vision Fund II would be of a similar size to the first ($100 billion), but this time SoftBank would start it 100 per cent on its own, then invite investors to join. There’s been a lot of interest from around the world, Mr Son said.

That he didn't deny the report in The Wall Street Journal last week, shows that he sees this as a savvy way to offer investors yet another avenue to give him more cash.

Since that first Vision Fund burst on to the scene over two years ago, SoftBank has come to be seen as the new exit. The case of Uber Technologies shows how early and mid-stage investors managed to cash out at great profit well before the IPO simply by selling to the Vision Fund. Start-ups can just sell to the fund instead of going the laborious route of fundraising after fundraising followed by IPO, or so the thinking goes.

And when choosing between an IPO or the Vision Fund, it’s important to remember a simple precept in venture-capital investing: the measure of success isn’t building a profitable company (although that would be nice), it’s finding someone to buy your stake for more than you paid for it. It’s a high-priced game of hot potato that continues until exit. In the case of an IPO, that final buyer is likely to be your pension fund, your mutual fund, or the ETF you chuck money into every month.

For a manager of $100bn that’s been sunk into a string of high-profile and largely unprofitable unicorns, the exit route isn’t clear. SoftBank Vision Fund’s huge return on its Uber investment is only paper profits. Lock-ups aside, it won’t be easy to turn its 16.3 per cent stake into cash because that’s too large a holding to sell, and Uber’s lack of profit makes it unlikely to generate cash flow to the fund anytime soon.

Its own IPO, however, could serve that purpose. The fund itself probably won’t be listed. Instead, SoftBank Group may choose to sell shares in a holding or management company that holds a stake. That’s not quite an exit, but it would serve the larger purpose: turning huge illiquid assets into cash. All the better to serve the piles of debt Mr Son has built throughout his empire.

Yet SoftBank Group stands as a warning. As Mr Son himself pointed out, the company trades on public markets at around a 55 per cent discount to the value of the equity stakes it holds. Its investment in Alibaba Group alone is worth more than the entire market cap of SoftBank Group. Debt is a reason for some of that markdown, but many think investors’ main reason to curb their enthusiasm is the illiquidity and general uncertainty surrounding those holdings. Alibaba, for example, would be tough to sell since Softbank owns the Chinese-domiciled company and not the US listed shares.

Such a discount will probably apply to a listed incarnation of the Vision Fund. Most of its holdings by value aren’t likely to become profitable anytime soon, with the size of these unicorns making an IPO exit about the only possibility.

Yet, like Uber, lock-ups and SoftBank’s large stake make it difficult for the Vision Fund to enjoy anything more than quarterly mark-to-market profits - that is, paper gains.

For SoftBank, though, this may not even be the point. Cash flow is the name of the game, and if Mr Son can keep finding new avenues for investors to give him money, then that cash will keep on flowing.

He won’t get burnt as long as he keeps passing that hot potato.

Bloomberg