Japan's SoftBank booked a 24 per cent rise in quarterly profit on Tuesday as users switched to data-heavy plans, pinning future growth on the rise of 5G services in the mobile carrier's first earnings report as a public company.

With concerns over a changing mobile market keeping its shares below their blockbuster IPO price, investors are looking for reassurance that the company can keep its promise of paying 85 per cent of annual profit in dividends.

Investors are looking for any hint of the health of majority shareholder SoftBank Group, which relies on cash from Japan's third-biggest network provider to fund investments.

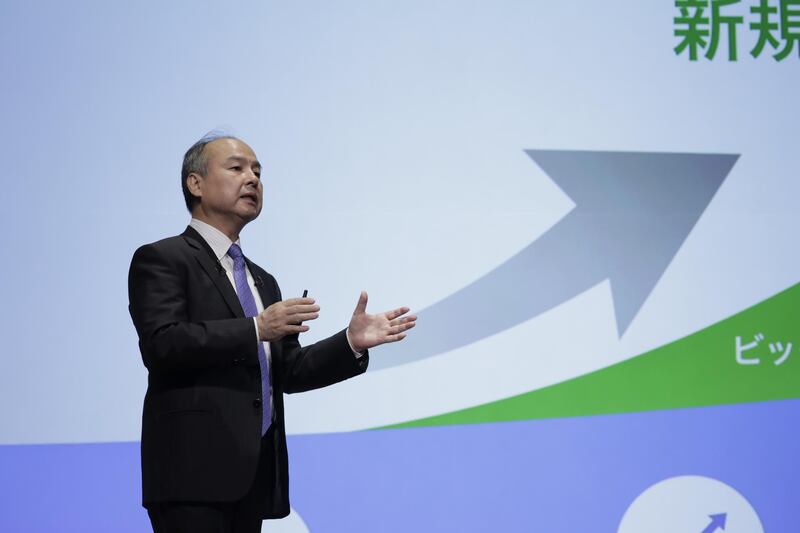

Echoing the expansive rhetoric of founder Masayoshi Son, SoftBank's chief executive Ken Miyauchi said new services and the adoption of high-speed 5G networks meant the smartphone market had ample room for growth.

"5G smartphones in a few years will probably take over the entire world," Mr Miyachu said.

Operating profit reached ¥191.6 billion (Dh6.39bn) in October-December, SoftBank said in a stock exchange filing.

The results cover turbulent three months, during which SoftBank suffered a network outage, fielded ongoing government calls for lower prices, and faced scrutiny over ties to Huawei Technologies – the Chinese company whose telecoms equipment Western powers fear could be used for espionage.

Pressure is set to continue from October as e-commerce company Rakuten becomes the fourth major wireless carrier offering low prices.

The quarter also saw SoftBank conduct Japan's largest IPO. However, the stock dropped 15 per cent on its December 19 debut from its ¥1,500 IPO price, stinging its overwhelmingly domestic retail investors and cooling broader investor sentiment, finance executives said.

The stock closed flat on Tuesday ahead of the earnings report, trading about 20 per cent below the ¥1,600 average target price of 13 analysts compiled by Refinitiv.

Seven analysts recommend buying the stock, whereas six suggest holding or selling.

Nomura Securities analyst Daisaku Masuno wrote in a report that SoftBank should be able to grow as market uncertainty fades by appealing to heavy users through its industry-leading 50 gigabyte data plan, while offering low prices through its Y!mobile brand.

SoftBank maintained its forecast for operating profit to rise 10 per cent to ¥700bn for the year through March, versus the ¥691bn average of 13 analyst estimates.