Britain is being urged to lure back big spenders to its luxury shopping sector by restoring a tax break for tourists.

The National has been told that visitors from the Gulf are among those to have been “deterred” since a tax-free scheme was dropped in 2021.

Retailers are campaigning for Chancellor of the Exchequer Jeremy Hunt to restore it in a pre-election budget next month.

A group of Conservative MPs have also gone public to warn the so-called tourist tax has had “significant repercussions” on tourism.

Under the old rules, non-EU visitors could claim back tax on goods they took home with them from Britain.

It was scrapped after Brexit with ministers calling it a costly £2.5 billion ($3.16 billion) a year relief that only benefited certain areas such as London.

Mr Hunt kept the door open to a U-turn in his autumn statement, telling MPs that officials were “looking again at the numbers” and studying how rival luxury markets in Paris and Milan have fared.

However, he warned this week that there may be limited scope for tax cuts in the March budget, with Mr Hunt under pressure from the Tory benches to offer a pre-election giveaway to voters.

Bringing back VAT-free shopping was part of the tax-cutting plans of Liz Truss’s government in 2022, but the package was a political flop and was shelved as her premiership imploded.

In a submission to Mr Hunt, the Association of International Retail said he should revisit those plans in the budget to stem a “growing diversion of spending by non-EU visitors away from Britain to continental Europe”.

The group has handed figures to the Treasury showing that spending by non-EU tourists had risen above pre-pandemic levels in mainland Europe but fallen in the UK. It warned this trend could “continue to get worse in 2024”.

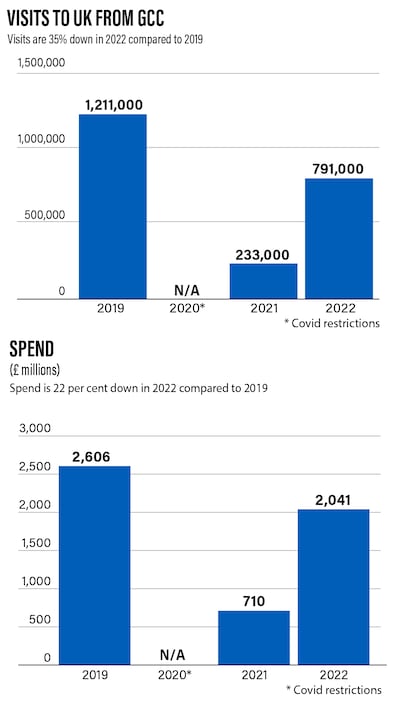

Sam Miley, an economist at the Centre for Economics and Business Research, told The National that tourists from the Gulf and East Asia were the main markets that appeared to have stayed away since the tax change.

Figures from various retail sources, such as providers of high-end goods, suggest “high-spending individuals are being deterred from visiting the UK”, Mr Miley said.

Gulf visitors will benefit from new UK visa rules coming into force on Thursday, meaning they can make unlimited visits to Britain for two years with an Electronic Travel Authorisation.

The scheme is open to citizens from the UAE, Qatar, Bahrain, Oman, Kuwait, Saudi Arabia and Jordan, with Gulf travellers expressing hope of a surge in arrivals and investment.

However, a letter signed by 38 Conservative MPs warns tourism and associated sectors such as leisure, retail and hospitality in the UK are being held back by the shopping tax. High-end fashion houses Mulberry and Burberry are among those who have blamed the tax change for a hit to their earnings.

The letter argues that introducing a “new, internationally competitive tax-free shopping scheme would help UK businesses rebuild the economy”, the Daily Telegraph reported.

“By positioning the UK as a world-renowned shopping destination, the scheme can foster inward investment and growth across the visitor economy – strengthening our supply chains and driving economic activity in all regions and businesses throughout the UK,” it said.

The opposition Labour Party, which is widely predicted to come to power at this year’s election, has said it is not calling for the return of VAT-free shopping.

Labour does not believe that “reinstating tax-free shopping for international visitors should be a priority for the use of billions of pounds of public money,” shadow treasury minister Tanmanjeet Singh Dhesi said last year.

However, modelling suggests the lost revenue could be offset by people spending money on accommodation and other goods on trips they would not otherwise have made, said Mr Miley of the CEBR. Its analysis says Britain’s GDP could have taken an £11.1 billion ($14.05 billion) hit because of the tax.

To regard a tax break as merely benefiting the wealthy retail sector in London would be “oversimplifying the economic impact of this activity,” he said.