Jibran Munaf, a communications executive in Dubai, has spent the past 10 months saving up for his dream holiday to Bogota in Colombia.

Mr Munaf, 24, slightly tweaked the 50/30/20 method to prioritise his finances to save for the holiday in July.

He dedicated 50 per cent of his income to essentials, 30 per cent to wants and the remaining 20 per cent to a travel fund for his summer holiday.

This allowed him to save with a clear purpose and ensured that he had sufficient funds to cover his travel expenses.

“Years ago, I had signed up for air miles and frequent flyer programmes using travel rewards cards. Over the years, I generated enough points to offer me a sizeable discount on my flight,” Mr Munaf says.

“To ensure I found the most wallet-friendly flight deals, I not only checked for a flight to and from Bogota but also to the neighbouring city, Chia, from where I could travel by a local coach.

“However, after calculating the fare for the round trips, flying directly to Bogota was more feasible. I always check if there is a neighbouring airport that has a cheaper flight available and also account for travel to the intended destination from that airport.”

Half of Americans said they will take a holiday this summer, up from 46 per cent in 2022, according to a survey of 3,583 adults by global consultancy Deloitte between March 31 and April 6.

Among those who plan to spend more than in 2022, nearly three in 10 (28 per cent) said they are making up for missed travel while 32 per cent said they are taking a bucket-list trip.

The share of people who intend to take an international flight climbed more than 1.5 times to 22 per cent this year, from 14 per cent in 2022.

However, concerns persist, with 50 per cent of non-travellers saying they will stay home due to financial worries, the survey found.

Mr Munaf booked his return flights to Colombia at least six months in advance to secure the best airfare.

Alternatively, you can also jump on low-budget flights that allow for better value, especially when it comes to changing dates and flexibility, he says.

Consider travelling during the off-peak season. By opting for dates just before or after the peak tourist period, you can often enjoy lower prices and fewer crowds, he says.

“I have booked an accommodation close to the city centre in Bogota. While a little more expensive than properties away from the city, this allows me easy access to public transport, deterring the need of a taxi,” he says.

“I also intend to bike around the city. By planning ahead, you can take advantage of early bird discounts and promotions on any local events.”

He also recommends that people use comparison websites to find the best prices and sign up for newsletters or travel alerts to stay updated on the latest offers.

“Eating local food not only allows you to experience the authentic flavours of the destination, but also tends to be more budget-friendly,” Mr Munaf says.

“Explore local markets, street food stalls and affordable eateries where you can savour delicious meals without breaking the bank.”

With a little bit of planning, research and creativity, it is possible to make your summer travel dreams a reality without straining your wallet, he says.

We asked personal finance experts to share tips on how to save for a summer holiday and keep your money safe while travelling.

Plan your trip in advance and reserve bookings

Last-minute travel plans can be very expensive, especially during holiday times as demand is very high. Hence, planning in advance and reserving free cancellation bookings can save you a lot of money, says Vijay Valecha, chief investment officer at Century Financial.

“It costs you nothing to make an advance hotel booking as most websites offer a free cancellation window as short as one week ahead of travel,” he says.

“Set a reminder to cancel all your bookings if you do not plan to travel.”

When booking accommodation, compare prices from different retailers or websites, he says.

The same goes for air travel as ticket prices rocket during the peak season.

Booking your air tickets in advance could help you save about 50 per cent of the ticket costs, which can be expensive if you are a big family travelling together, Mr Valecha says.

Being flexible with your travel dates can also help you to find better rates, he adds.

“Before booking any travel arrangements, carefully review the terms and conditions, including cancellation policies. Unforeseen circumstances can disrupt holiday plans, and having travel insurance can provide financial protection in case of trip cancellations, delays or emergencies,” he says.

Look for travel deals and discounts by airlines, hotels and travel agencies, according to Purvi Munot, co-founder and chief executive of UAE-based money management app Sav.

Consider alternative accommodations such as holiday rentals or homestays, which can be more cost-effective and provide a unique local experience, she says.

Budget for holiday expenses

It is wise to make a list of all holiday-related expenses for the trip. Be as specific as you can since extra expenses can add on a significant layer of cost, says Rupert Connor, partner of Abacus Financial Services.

“Decide how much money you can afford to spend in total, and then divide it up by every item, flight, accommodation, food and other holiday-related activities,” he says.

“Most importantly, stick to the plan as the holiday progresses as it is easy to be swept up in excitement or caught off guard with last-minute purchases and expenses.

“Setting a budget in advance will help you figure out how much money you can devote to each category of expenses, including gifts, food, entertainment and other holiday treats.”

Save for the holiday in advance

Putting away small, affordable amounts can take the edge off when it comes to saving for your holiday, experts say.

Start saving for your holiday by setting aside a portion of your income each month for holiday expenses, Ms Munot says.

This will help you to avoid relying on credit cards or accumulating debt during the holidays.

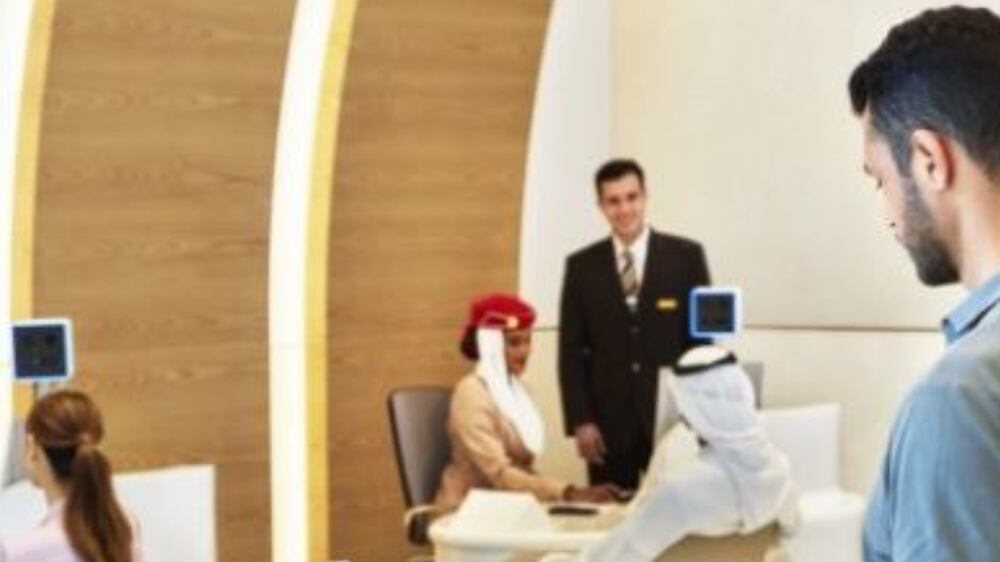

Emirates opens check-in facility in Downtown Dubai

“Identify areas where you can reduce unnecessary spending, such as dining out or entertainment costs, and redirect those savings towards your holiday fund,” she says.

Mr Connor says find an easy way to set aside an amount, whether it is monthly, semi-monthly or weekly, and make sure that cash goes directly into a separate savings account.

“For example, if you save Dh25 per day, that is Dh175 per week or Dh9,100 over the course of a year, which you can use to fully fund holiday spending,” he says.

“Once you get used to saving Dh175 each week, try upping that to Dh200 and then Dh250.”

Avoid funding your holiday with debt

It is very easy to obtain a credit card in the UAE. However, interest rates are higher than in most other places globally, according to Sophia Bhatti, chief executive of Dubai-based Wimbledon Wealth.

She recommends setting up a savings account you do not have access to on your phone and saving small amounts often to make sure you hit the goal.

Save the credit card for emergencies, Ms Bhatti says.

Be cautious while using credit cards for online shopping and ensure the website is secure and reputable, Mr Valecha says.

“It’s wise to use cash for smaller transactions whenever possible. This minimises the risk of identity theft or fraudulent charges,” he says.

“Monitor your accounts regularly for any suspicious activity.”

It is always best not to carry a lot of cash when on holiday and to use your credit rather than your debit card, Mr Connor says.

If a wallet gets stolen, debit cards offer less protection. However, dealing with fraudulent charges is less of a hassle on your credit card.

If you need to withdraw cash, use your debit card since credit cards have high fees, but try to be vigilant and check your statements on the road and when you return to ensure there are no unaccounted charges, he says.

Mr Valecha advises those planning to travel during the holidays to notify their bank and credit card companies about their itinerary.

“This ensures they don’t flag your transactions as suspicious activity, potentially freezing your accounts. It’s also advisable to have emergency contact numbers readily available in case of lost or stolen cards.”

Track foreign exchange rates

If you are travelling internationally, keep an eye on foreign exchange rates.

Consider exchanging currency in advance or using a reputable currency exchange service to secure the best rates, according to Mr Valecha.

Avoid exchanging money at airports or tourist areas as they often have unfavourable rates, he says.

Avoid public Wi-Fi

Ms Munot says travellers should avoid using public Wi-Fi for financial transactions and activities.

Be cautious of fraud and never share sensitive information with unknown sources, she says.

Mr Valecha advises travellers to use secure and private internet connections, such as your home network or a trusted mobile plan, when attempting to gain access to your financial accounts or make online transactions.

Miscellaneous tips

On a holiday, travellers can stick out like a sore thumb and can easily become the victims of fraudsters or criminals, Ms Bhatti warns.

“When leaving the hotel or wherever you are staying, carry small amounts of cash where possible, and avoid taking cards. Instead, use Apple, Samsung or Google Pay and stay in 'touristy' areas when travelling in more dangerous countries,” she says.

“Digital scams are also on the rise. Change your online banking password every 90 days and activate two-factor authentication.”

Be vigilant against phishing attempts during the holiday season, Mr Valecha says.

Avoid opening suspicious links or providing personal and financial information to unsolicited emails, messages or phone calls, he says.

Verify the legitimacy of requests by contacting the organisation directly, he says.

Only shop from reputable websites with secure payment gateways and use apps with daily limits and card-freezing features, Ms Munot says.