It was instructive to hear this week that Prince Alwaleed bin Talal's Kingdom Holding has dispensed with the need for advisers.

"We do the origination ourselves," Ahmed Halawani, the company's head of private equity and international investments, told Bloomberg. "We do not wait for an investment bank to come and say 'this is a group of companies and we think that potentially they will fit your strategic objectives.'"

This news was relevant to me not because I am a billionaire or a Saudi royal - I am of course neither, sadly for my wife - but for the fact that when it comes to seeking advice on financial matters, context is everything.

For Kingdom Holding, a sophisticated, world-class organisation with the equivalent of a fiscal army on its payroll, independent advisers are at best a luxury and at worst a pain in the neck.

However, at my stage of pecuniary evolution, I could do with all the professional advice I can get. This has not of course stopped me from going through some very persistent periods of denial that I actually need help with my finances.

But there is very little room for delusion once the children arrive, and now that I have such a blessing in my life I can see how it becomes more than a duty, almost my highest responsibility, to ensure that they are as well taken care of as can be.

This I have discovered involves thinking about wills, life insurance policies, investment plans, trusts, offshore bank accounts and more - basically the whole gamut of the financial industry - which will result in a mild panic attack if my experience is anything to go by.

And that is really the issue when it comes to my personal finances. Can I be courageous enough to first, be honest, and second, to accept help? I'm trying on both fronts and it isn't easy.

Despite talking a good game - and having been a business journalist for much of my career - I am not very good with money. There it is, the truth. I am a spender not a saver. The quick fix of blowing my hard-earned cash on a holiday or a lavish meal will always outweigh the quiet satisfaction of squirrelling away a portion of my salary every month.

It is just the way I am wired. I am hoping that as my financial education gathers pace that it may result in some real behavioural changes for the better but so far it's baby steps.

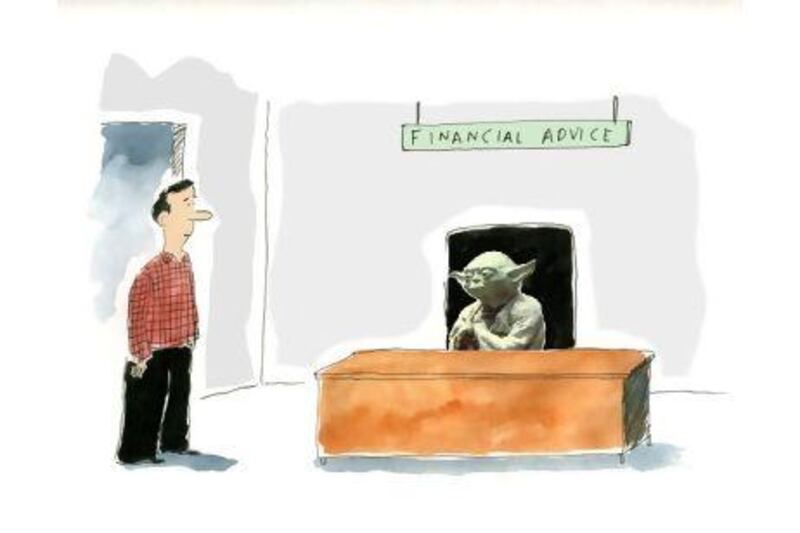

Now, the second part of this journey is almost the hardest bit - finding the humility to seek out a wisened councillor, a mentor in money, a Yoda of the wallet, and then actually listen to what is being said and finally, do as I am told.

It has been a long, torturous process going back almost three years. The first independent financial adviser I sat with taught me very little. Not his fault, as annoying a person as he was. I spent most of our two meetings and subsequent email exchange telling him how clever I was, how much more I knew than he did and that he could only help me on certain conditions that were quite frankly ridiculous.

I guess it was all about control. Needing to pretend I knew what I was doing when deep down I didn't. But I just could not let this person, whose time and effort I had asked for, see how ignorant and helpless I really was. Still I made a start.

The second adviser I liked a lot. He didn't last long but at least I got going on the life insurance process. The third guy was gone even faster. Is it me? I began to wonder.

Still, he showed me that it is never too late to save, no matter how much money I have seen go down the drain over the years.

Now I am on my fourth and I can say that I have changed. I am ready to be taught, to learn, to do the necessary to put an investment plan into place even if it means not spending. Maybe this time, he will be the one? Who knows?

I do know now, however, that if you haven't learnt the good habits - saving and investing rather than spending for example - young, like any skill, it is much harder to learn it later in life.

Even though my baby son is only a year old I am already thinking about the lessons we can teach him while he is still a child - the most important being that actions are louder than words.

My parents always told me to save half my money but I could easily see them doing the exact opposite - no prizes for guessing which path I followed.

To be able to properly pass on any wisdom I am finally getting when it comes to financial matters I will have to be able to teach by example.

Today I have hope that it might be possible - thanks to the patience of those advisers.

pf@thenational.ae

With finances you can be your own worst enemy

On the money: Having children brings exposure to the whole gamut of the financial industry - which may result in a mild panic attack.

Editor's picks

More from the national