Bilateral trade between UAE and China increased 16.2 per cent to $11.2 billion (Dh41bn) in the first quarter of the year compared with the same period a year earlier, the Chinese ambassador to the UAE said.

"China-UAE trade is expected to maintain the momentum of rapid growth throughout 2019 and beyond," Ni Jian told the state news agency Wam.

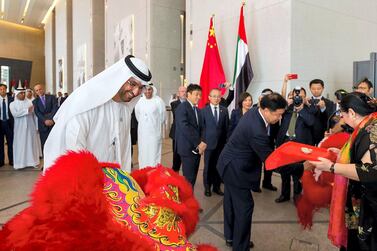

The comments come as Sheikh Mohamed bin Zayed, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, is on a visit to China this week to boost trade and economic relations between the two countries.

In the first five months of this year, bilateral trade amounted to $19bn, a 11.3 percent increase from the same period last year, Mr Ni added.

Chinese exports to the UAE as well as imports from the UAE into China in 2018 also accelerated. China’s exports to the UAE grew 3.2 per cent to $29.66bn and China’s imports from the UAE went up 32.8 per cent to $16.26bn.

Investments from China in the UAE reached $9.1bn with Chinese foreign direct investment in the UAE touching $620 million in 2017, the ambassador said.

Speaking on the Belt and Road initiative of the Chinese government, Mr Ni said China and the UAE have made “solid co-operation and yielded remarkable achievements".

“Our co-operation in commodities trade is optimising, with the UAE maintaining its status as China’s second largest trading partner and top export market in the Middle East and North Africa region.

"In general, Chinese companies in the UAE have been growing by leaps and bounds, especially at a time when our bilateral relations are thriving and the UAE has become an important partner in the Belt and Road co-operation," he said.

Chinese engineering contracting companies accrued $3.61bn in revenue from projects in the emirates, a 53 per cent increase on their 2018 top lines.

There are as many as 6,000 Chinese companies operating in the UAE, mostly based in Dubai, he said.

Co-operation in the financial sector is also deepening with the central banks of the two countries signing a currency swap agreement as well as setting up a Renminbi (Chinese yuan) Clearing Centre and branches of all Big-Four Chinese state-owned banks in the UAE.

Large energy companies such as China National Offshore Oil Corporation, Zhenhua Oil and a state-owned investment company, CITIC, have all set up offices in Abu Dhabi since 2018, while China Machinery Engineering Corporation, CMEC, opened an office in Dubai.

China Railway Construction Corporation, China Railway Construction Engineering Group, Power China and China Energy Engineering Corporation are also sending more employees to the UAE market due to new projects, the envoy said.

China-UAE co-operation in the energy sector is also expanding from upstream exploration to downstream refinery to service-contracting.

Chinese energy companies have steadily increased their participation in concessions operated by Adnoc. President Xi Jinping led a delegation to the UAE in July last year, as the world's second-largest oil consumer is looking to diversify its import of Middle East crude.

Adnoc also awarded a Dh5.8bn seismic survey agreement to BGP, a unit of China National Petroleum Corporation (CNPC), during the president's visit. The governments signed a partnership agreement to collaborate on polymers, technology and market access.

Last year, Adnoc awarded China Petroleum Engineering & Construction Corporation, a CNPC subsidiary, an engineering, procurement and construction contract to expand production capacity at the onshore Bab field to 450,000 barrels per day from its present capacity of 420,000 bpd.

CNPC also won a 40-year rights agreements worth Dh4.3bn for concessions offshore Abu Dhabi. The Chinese state oil company company also has a 40 per cent stake in Adnoc subsidiary Al Yasat Company for Petroleum Operations, from whose concession the first batch of crude, a 50,000 bpd shipment, was loaded and shipped to China in June.

CNPC has taken an 8 per cent stake in Adnoc onshore, making China one of the largest foreign investors in the Abu Dhabi oil and gas sector.