The Middle East unit of China State Construction Engineering Corporation (CSCEC) expects to secure more work in the region by tapping resources from Chinese banks and credit agencies as the company targets up to US$1 billion in revenue this year, according to its chairman.

The company has existing relationships with bodies such as Chinese export credit agency C-Exim, credit insurance firm Sinosure and the China National Development Bank that it can rely on to help fund even the biggest projects in the region, said Yu Tao, the chairman of CSCEC Middle East.

“With the lower oil price, probably the government will be even more open to this kind of approach,” said Mr Yu. “We are capable to construct and furthermore we are confident that we can bring in very efficient project finance.”

He said the company is “looking forward to participating more in government projects” including Al Maktoum International Airport and Expo 2020.

CSCEC is ranked as the biggest contractor in the world by trade title Engineering News Record. Its full-year accounts for 2015, the last for which figures are available, show a 10 per cent increase in revenue generated of 880.6bn yuan (Dh471.2bn) and a 20 per cent increase in net profit to 25.1bn yuan.

“We are focusing a lot on infrastructure,” said Mr Yu. “The newly established Asian Development Bank’s focus is on infrastructure.

“I think Dubai and Abu Dhabi are still short of a lot of infrastructure, including Etihad Rail. All of those projects are interesting to China State.”

Mr Yu has said that he expects CSCEC Middle East to achieve revenues of between $800 million and $1bn this year as it wins more contracts.

“The contracts signed and started last year are around Dh4bn across the region,” said Mr Yu.

“The contracts we have already won [and are] waiting to start is around another Dh5bn. So overall last year I think we signed contracts worth Dh8bn to Dh9bn in the region.”

Despite this, he said that the Middle East represents less than 1 per cent of its group activities.

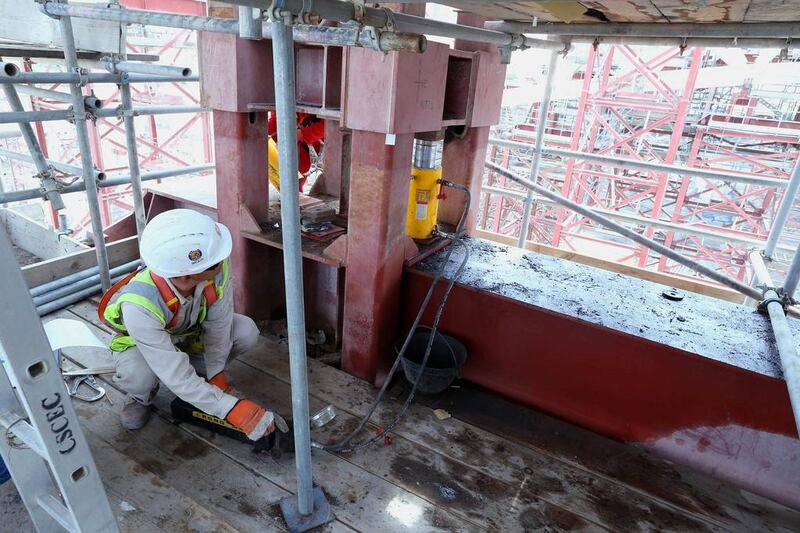

Last year, the company completed a package of works on the Dubai Canal and it delivered a Dh246 million roads infrastructure package for Dubai’s Roads & Transport Authority (RTA) outside Dubai Parks and Resorts. It is also completing infrastructure, steelworks and mechanical, electrical and plumbing packages at Abu Dhabi’s new Midfield Terminal Building.

Within the past few days, the company has landed more than Dh900m of other infrastructure work, including a Dh800m contract to build parallel roads for the RTA between Sheikh Zayed Road and Mohammed bin Zayed Road in the Al Furjan area, and a Dh117.5m contract for infrastructure works to build 1,449 villas at Damac’s Akoya Oxygen project.

A recent report published by BMI Research said that Chinese state-owned enterprises “will increasingly compete with traditional heavyweights in the Mena infrastructure space” as Chinese companies dedicate more resources into a region in which they have traditionally underinvested.

It said there are $92.8bn worth of projects supported by Chinese equity in the Middle East, compared with $158.8bn in Latin America and $235bn in Sub-Saharan Africa.

“Given the prevailing fiscal weakness across Mena in a low-oil-price environment, we expect China to assume a more assertive role in financing infrastructure projects,” it said.

However, the picture is different in Europe and North America, according to a study published on Monday by law firm Baker McKenzie using data from analyst Rhodium Group into Chinese foreign direct investment (FDI).

The study stated that there is increasing evidence of Chinese deals in Europe and North America falling through as Chinese buyers found that proposed deals fell foul of regulatory hurdles and capital controls.

A record $94.2bn worth of Chinese FDI was spent last year, 70 per cent of which came from private companies, but Baker McKenzie said the outlook for this year remains “mixed” given that 30 deals worth a total of $74bn were cancelled last year.

“A short-term slowdown in new deals is likely in 2017, driven both by China’s temporary measures to slow capital outflows and tougher screening of inbound deals in the US and Europe,” said Michael DeFranco, the law firm’s global head of mergers and acquisitions.

mfahy@thenational.ae

Follow The National's Business section on Twitter