Aldar Properties is selling some of its prized assets to the Abu Dhabi Government for Dh16.8 billion (US$4.57bn) in a deal that includes Central Market and hundreds of homes on Al Raha Beach.

Location, location, location:

Industry Insights What's hot and what's not in the world of property. Learn More

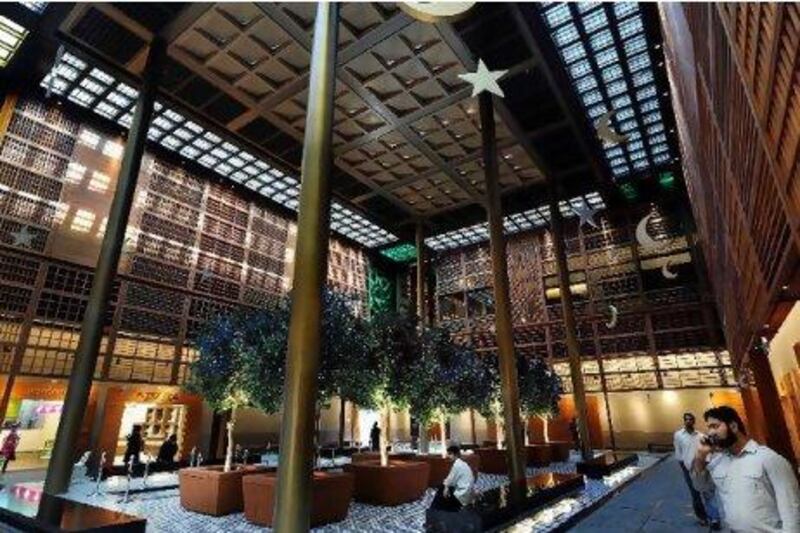

The Government will pay Dh5.7bn for Central Market, the Norman Foster-designed souq in the city centre, and assume the estimated completion cost of Dh2.6bn. Aldar will continue to supervise construction of the project and manage the facility.

The sale also includes 760 residential units in the developments Al Zeina, Al Bandar and Al Muneeraon Al Raha Beach, where the Government will take over Dh5bn worth of infrastructure assets.

The transactions are "designed to create the solid financial foundation needed to drive returns to shareholders", said Ali Eid AlMheiri, the chairman of Aldar. "Moreover, we have realigned our organisational structure, reduced headcount and refined our business strategy."

Aldar is to receive Dh4.5bn from the Government in the next two months, with remaining payments spread over the next four years.

The developer behind Ferrari World and the Yas Island complex was hit particularly hard by the slowdown in the property market.

In January, the company announced a funding plan under which the Abu Dhabi Government would buy Dh10.9bn of the company's Yas Island infrastructure assets, including the Ferrari World theme park, as well as Dh5.5bn of residential units and land.

The company also issued a Dh2.8bn convertible bond to Mubadala Development, a strategic investment company owned by the Abu Dhabi Government.

Since then, the company has been reordering its priorities. In October, it laid off 105 employees, about 25 per cent of the staff, as part of its restructuring.

The company said it would focus on property and asset management rather than new developments, and on increasing the "value of existing development projects and investment properties". New projects would be launched only when there was "demonstrable" demand, the company said.

Yesterday's announcement was the culmination of a "comprehensive review of Aldar's business model, finances and operations", the company said.

"With a substantial land bank across Abu Dhabi, Aldar is well placed to capitalise on future development opportunities based on demonstrable market demand," Mr AlMheiri said. "Aldar will also benefit from sustainable recurring revenues from our office, retail, hotel and education assets, as well as development management fees from large-scale third-party projects."

The announcement capped a tumultuous week for the company.

Last week, after Mubadala converted $2.1bn of bonds into shares, Aldar's stock plummeted to new lows amid concerns the company would delist. The additional shares increased Mubadala's stake to 49 per cent.

The share price rebounded 2.4 per cent on Monday after the company denied that it planned to delist, only to hit a new low of 81 fils on Tuesday after the company announced plans to consider an asset sale.

Yesterday, the shares recovered 3.7 per cent to 84 fils before the sale announcement.

Aldar is carrying more Dh13bn of debt, with more than Dh6bn due by the end of 2013, according to Bloomberg data.

The deal will reduce the company's debt by Dh5bn. Aldar has repaid Dh14.2bn of debt this year, the company said.

It generated Dh4.6bn of revenue in the first nine months of this year as it continued to hand over more than 3,000 homes on Al Raha Beach and completed construction of three schools.

Aldar posted a net profit for the third quarter of Dh144 million compared with a loss of Dh731.1m in the same period last year.

Revenue for the third quarter included a Dh2.7bn sale of land to the Government.

twitter: Follow our breaking business news and retweet to your followers. Follow us