The US dollar wobbled further yesterday, but a strengthening outlook in the second half of the year bodes well for Gulf investors.

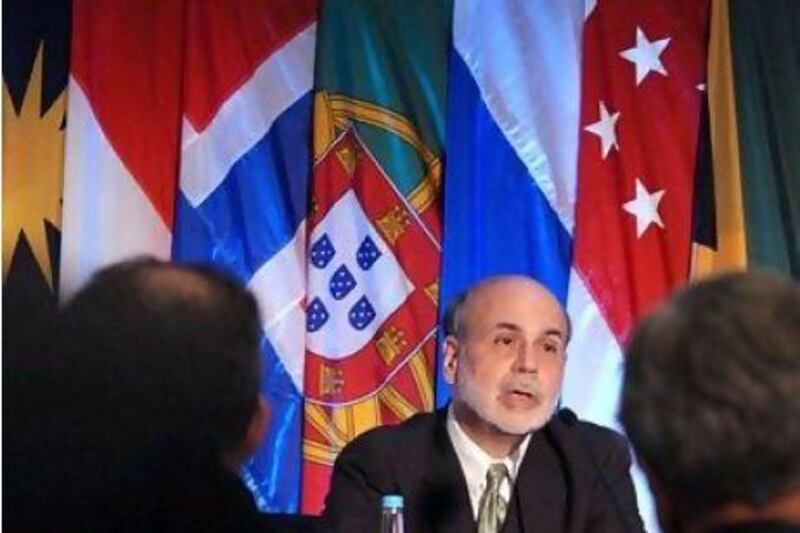

The greenback weakened to its lowest level in a month against the Japanese yen after a speech by Ben Bernanke, the chairman of the Federal Reserve, failed to impress investors.

Acknowledging the US economy had slowed, Mr Bernanke's comments added to speculation that US interest rates would remain low to help kick-start growth.

Lower interest rates mean slimmer returns for investors with assets in the currency.

But Mr Bernanke tipped the economy to pick up over the coming months and appeared to show his faith in the US recovery, giving no signal of plans for fresh monetary stimulus in the form of a third round of quantitative easing.

"Our forecast is for the dollar to perform better in the second half of the year," said Tim Fox, the chief economist and head of research at Emirates NBD. "Things will get better, as oil prices are off their peaks and jobs growth will improve modestly."

Nearly two thirds of global reserves, including much of the GCC's oil revenues, are denominated in dollars.

Most Gulf economies also peg their currencies to the dollar.

Regional dollar investments have performed poorly, as the currency has stayed weak in recent months.

Last month it reached a record low since the post-Bretton Woods era began in the early 1970s, according to the Federal Reserve's broad trade-weighted index.

Recent weakness in the labour market and a political standstill surrounding attempts to cut US public debt have also sapped the dollar's strength. At the same time, anticipation of earlier interest rate increases in other economies have pulled investors away from the dollar.

But Mr Bernanke said the dollar's weakness was not a cause for worry. The Fed's pursuit of employment generation and price stability would help to support the currency's value, he said.

At the same time, the outlook for the dollar's rivals is hardly positive.

"The big uncertainty revolves around the euro zone and its debt problems, and markets are still relatively sanguine about that," Mr Fox said. "I wouldn't be surprised if the euro weakens a bit as the US picks up steam."

The euro had risen against the dollar in recent weeks after growing expectations that interest rates would be increased again by the European Central Bank next month. But the euro fell from close to a four-week high against the dollar yesterday as a further twist emerged in the euro zone's sovereign debt drama.

Investors were unnerved after the IMF said a €26 billion (Dh140.04bn) loan to Portugal entailed "important risks" and the German finance minister Wolfgang Schaeuble said bondholders would have to contribute a "substantial" share of a second aid package for Greece.