The topics dominating the headlines — Brexit, the US-China trade war and the possible impeachment of US President Donald Trump — all have an effect on the global economy. But sometimes it is challenging for investors to make sense of it all.

The price of gold and stock markets have seen record highs and the US dollar is strong. At the same time, the US Federal Reserve and European Central Bank (ECB) have been cutting interest rates, yields on $17 trillion (Dh62.4tn) of bonds have turned negative and global economic growth has slowed.

The International Monetary Fund revised down its projections of global economic growth for the fifth time last month with the world’s economy expanding 3 per cent this year, its slowest expansion since the 2008 global financial crisis.

Davis Hall, global head of foreign exchange and precious metals advisory at Indosuez Wealth Management, which has €130 million (Dh527m) in assets under management and offices in Abu Dhabi, Dubai and Beirut, says we are in a "market that's completely upside down".

While Mr Hall, who was in Dubai recently for the bank’s Middle East Investment conference may “not have a crystal ball to look into the future”, here he offers his take on where to invest now and next year.

Why are governments intentionally weakening their currencies?

Everyone is trying to counteract Trump’s proactive disruption by weakening their currencies to offset the tariffs to maintain volume of exports. You’ve got Switzerland with negative interest rates. You’ve got now the ECB that went even more negative. And you have QE (quantitative easing). Now the Fed has announced another organic QE programme. So all of this is that everybody wants to race their currency to the bottom.

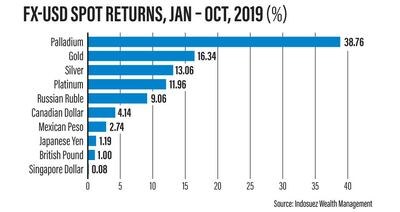

What’s really interesting is if you look at the year-to-date returns on currencies and precious metals, the top four vis-à-vis the US dollar are palladium, gold, silver and platinum. Non-yielding physical assets are outperforming the paper fiat currencies, which are essentially IOUs. For the second year running, we’re seeing a severe outperformance as governments and central banks intentionally weaken their currencies to try to create demand and export-driven support.

Now, that’s really, really dangerous. Because this game is a lose-lose for everyone. Even the Bundesbank [Germany’s central bank], for the first time in 51 years, has started to covertly buy more gold. So … there is a lot of head scratching and people need the support and comfort of something in their portfolio that will safeguard them as a shock absorber.

Is now the right time to buy gold?

We’ve been very, very positive on gold. And this summer it sort of had a supernova explosion. [But] is it too late to jump in? The more you look into the supply and demand, the more the underlying factors are exceptionally supportive. If you look at the demand story, central banks are buying gold more than ever. They bought the most in 49 years last year and the first half buying of central banks collectively this year has been even higher than last year.

There are only 192,000 tonnes of gold in 6,400 years of life that’s been extracted from the earth. The World Gold Council estimates there’s only another 53,000 tonnes under the ground, because more and more mining companies are looking for rare metals that go into iPhones or car batteries instead of gold. The cost of creating mines is somewhere between $3 billion and $5bn with a lead time of two or three years and you have to do it in less and less stable countries. So there are barriers to entry and there aren’t many mines expected to come online in the coming years. If you take the annual production and extraction of gold it’s 3,400 tonnes per year, which means there are only 16 years of current production left.

What does this mean for investors?

Even though gold has reached an all-time high against something like 18 currencies — not the US dollar, yet — I’m convinced over the coming years it will continue and has a chance to move back towards where it was. Why? Because of balance sheet expansion and runaway deficits, which are unchecked, especially in the US. It costs $861,000 a minute to service the existing debt load of the US government [which stands at $23tn]. We’re reaching a point of exponential growth in this deficit and yet interest rates are super, super low.

I’m actually bullish medium to long-term on gold, but short-term, gold is losing a little bit of its momentum. Provided we stay above $1,380, we think we can move above $1,600 next year.

What are the effects of QE policies?

They’re just printing money. Gold at the time when [former US Federal Reserve chairman] Ben Bernanke started this QE policy, under [former US President] Barack Obama, was at $900 an ounce — and we doubled. And it seems like when you shake the toolbox of the central banks, there’s no noise any more. They’ve ... used up all the tools at their disposal and we still are not hitting our inflation targets. We have growth that’s not sufficient to pay back the debt levels that are already high. We’re so much higher in outstanding debt than we were at the Lehman moment [when Lehman Brothers filed for bankruptcy in September 2008]. So have we learnt anything?

Pension fund managers, for example in Switzerland or Europe, have to try to give their pensioners — who are living longer — a return on their portfolios and their funds. The issue is they’ve bought bonds that have done super well for the portfolio, but these bonds are expiring. And then they have cash to reinvest. They’re not going to buy bonds with negative yields and they can’t keep cash, because their banks are going to charge them for holding cash. So what do they do? They continue to buy equities and take more beta risk on the portfolios than a pension fund should traditionally embrace. And this, I think, is going to be one of the big, big issues when the bond market turns.

What is your outlook on the dollar?

We are at the beginning of the end of US dollar dominance. We’ve had the first stage of the currency war, which was the provocation "Make US great again", tariffs and sanctions. Then you had the second phase, which was retaliation by the trading partners, where everyone said "we’re going to weaken our currencies". Now we’re moving towards the third phase, where Trump is like, "OK, how do I respond? I need to weaken the dollar, I need a trade deal and I need to make sure that growth stays strong and the stock market doesn’t fall".

But when you think about all that — they’re cutting interest rates, the fundamentals are terrible, the economy is slowing, they’re printing money and he might be impeached — this is enough to scare people from blindly keeping US dollars. As we move into the first quarter of next year, the US dollar is very, very vulnerable.

What is your outlook on the euro?

In Germany, with [ECB President Christine] Lagarde’s push, we might start to see some fiscal relaxation and stimulus for the first time in decades. They’re running a significant budget surplus. Imagine if they started to change this. This would create foreign direct investment into European assets, which are cheap on a relative basis. So we’re also, strangely enough, starting to suggest and prepare our clients for a recovery in the euro. Everyone has been bashing Europe and the euro for so long, but the fundamentals in Europe are actually not that bad.

How about the British pound?

There’s no more certainty than three years ago because it looks like [Brexit Party leader Nigel] Farage and the Tories — and this is election posturing — are not willing to work together. So we’re going to have another hung parliament, because I don’t think Labour will be in a position to reap a majority. Even though a hung parliament isn’t necessarily good, it also means that the worst-case hard Brexit will not happen.

As we no longer have that tail risk, I think the pound has more support than before, even though the economy is slowing. But if we get another referendum or we finally get clarity and we have another government that moves forward and delivers Brexit with a deal, that’s also less negative than the greatest fear that we all had before.

A lot of Saudi customers have been hedging and selling pounds, because they were afraid of the worst-case scenario. But I just tell them, it’s too late to panic and there’s no need to panic any longer. Because the pound probably has more upside than downside. I think that’s important for people here because they do have sterling exposure through their real estate.

We forecast a gradual move back in the pound towards the mid-1.30s … Moving into next year, we might get back down to 1.25, we don’t think we’re going to go back towards 1.20.

What's your key message?

Anybody who’s holding 50 per cent in equities and going towards riskier, non- investment-grade bonds because they need yields, should have between 5 and 8 per cent gold in their portfolio.

We have a market that’s completely upside down, only because pension funds have to find yields. We obviously want to protect our clients’ wealth, so we’re actually getting a little bit cautious. You can stay in equities, but you have to have an eye on the rear-view mirror.