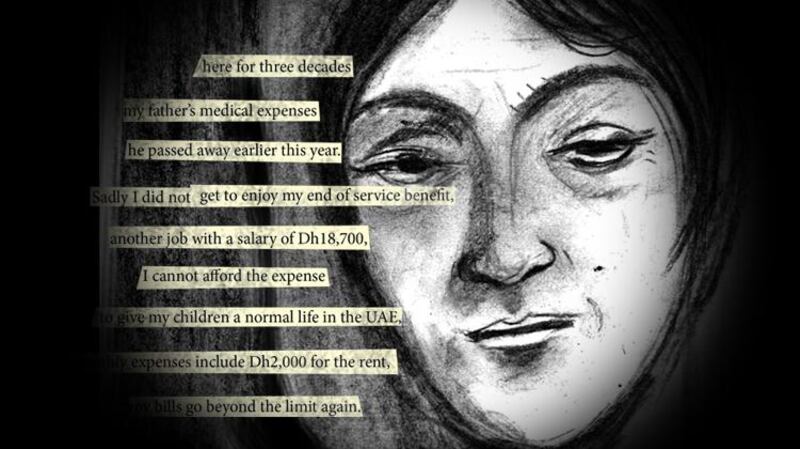

I have been working in the UAE for 30 years and was employed by the same company as an executive secretary from 1991 to 2014, when I was made redundant. Sadly, I did not get to enjoy my end of service benefit, because my bank used it against an outstanding personal loan. I later approached another bank for a buyout loan to pay off the remaining balance. I now have another job with a salary of Dh18,700, with 50 per cent of that going towards the loan and the rest spread across my five credit cards. The debts are:

Salary transfer loan: Dh274,890

Credit Card 1: Dh51,724

Credit card 2: Dh25,900

Credit card 3: Dh17,800

Credit card 4: Dh51,000

Credit card 5: Dh4,000

Total: Dh425,314

I built up these debts because I paid for my father’s medical expenses back home, until he passed away earlier this year. However, two of the credit card debts have been with me for 20 years and my finances worsened when I was made redundant in 2014.

I am also a single mother supporting my two children. Although my son is working, earning about Dh5,000, and contributes towards the household expenses, my daughter is still in secondary school. Their father stopped giving me financial support as he is now retired. My monthly expenses include Dh2,000 for the rent, Dh1,000 for bills, Dh2,000 for food, Dh2,000 for education and Dh1,000 for other expenses.

I would like to consolidate all of my liabilities, so that my monthly payment is lower. The interest on the cards in particular is very high, which is causing the amount due to shoot up. Every time the charges are applied, my bills go beyond the limit again. I have spoken to the banks about consolidation, but they say they cannot do it. I want to give my children a normal life in the UAE, which to me is home. I have been living here for three decades and my children have grown up here. It's just unfortunate that I cannot afford the expense of living here now, unlike the past. DB, Dubai

Debt Panellist 1: Philip King, head of retail banking at Abu Dhabi Islamic Bank

With liabilities of over 22 times your month salary, and over 50 per cent of the Dh18,700 you earn each month already going towards loan repayments, it is not surprising that banks are reluctant to accept your application for debt consolidation.

To find a way out of debt you have to start making all your card payments on time as this is where the highest rates can be found. If you continue to miss repayments then fees will begin to pile up, putting your finances under further stress. The fact that you have been in debt on two credits cards for 20 years demonstrates a need for better financial management. You will have to live to a strict budget going forward, closely monitoring all incomings and outgoings.

If you have family outside of your son who can also support you by providing an interest-free loan or are able to sell assets to raise funds, this should be a priority. Reducing your debt burden will place you in a stronger position to speak to your banks regarding a consolidation loan, which represents a more sustainable way to reduce your debt. Once you have agreed a compromise with your banks, make sure you stick to your repayment schedule, using any extra funds to help pay down your debt and diligently managing your household budget.

___________

Read more:

[ 'I paid back my missed payments, so why does the bank not recognise this?' ]

[ 'I have a new job in Saudi Arabia — can I repay my UAE loans from there?' ]

[ 'After two redundancies, 70% of my Dh22,000 salary goes to the banks' ]

[ 'I signed up for three credit cards because my income did not match my expenses' ]

[ Single mother earning Dh5,500 owes Dh155,000 to banks and private money lenders ]

____________

Debt panellist 2: Ambareen Musa, founder and chief executive of Souqalmal.com

The UAE is a great place to live in, but the living expenses can put an enormous strain on your finances, especially if you're grappling with debt. Add high-interest credit card debt to the mix, and you have yourself a recipe for financial trouble. Unfortunately, your case is one of high credit card dependency.

You mention that your monthly expenses amount to Dh8,000. You're also spending half of your Dh18,700 salary on the loan instalments with barely anything left to cover your credit card payments. With average credit card interest rates close to 40 per cent per annum, you won't be able to repay your outstanding balance if it's left on the back-burner. And because a significant portion of your credit card debt has been lingering around and multiplying for over two decades, you must focus on getting rid of this first.

You should approach your credit card providers and request your outstanding balances are restructured into a fixed-interest loan. This will help put a stop on the exorbitant interest you accumulate every month you go without paying off your dues in full.

Based on your calculations, you're only left with about Dh1,300 to put towards your credit cards. But because your household income is supplemented by your son's Dh5,000 salary too, you can use these extra funds to start repaying and closing your credit card accounts one by one. You should also go over your expenses once more and make sure you're sticking to a strict budget.

Once you have some financial wiggle room, decide how to go about settling your credit card debts. Choose a repayment strategy that motivates you. You could either pay off the smallest credit card balance first (that's the 'Debt Snowball' strategy) or pay off the credit card debt with the highest interest rate first (that's 'Debt Stacking'). Then there's also the 'Debt Snowflake' method that can help you shave months off your repayment term by putting every little amount saved here and there towards your credit card repayment.

___________

Read more:

Start-up will help UAE residents borrow money they can afford to repay

The Debt Panel: Single mother of four is being hounded by debt collectors over Dh43,000

A nine-step guide to help you renegotiate bank debts in the UAE

How an Abu Dhabi resident took three UAE banks to court and cleared Dh700,000 debt

It is possible to restructure debt directly with UAE banks, a Sharjah resident reveals how

__________

Debt panellist 3: Rasheda Khatun Khan, a wealth and wellness planner and founder of Design Your Life

Accumulated debt over a long period is like a house of cards waiting for that one card to be taken out before it falls down. It is easy to get consumed by a cycle of layering credit cards over loans, but it all leads to a downward spiral into unmanageable debt. Living above your means every month, juggling your expenses and debt repayments, become a normal way of life. At some point this system will no longer work and it is usually only then you realise the extent of this issue.

Rising living costs are a part of life and many of us are not able to keep our income levels rising at the same rate. The only thing to focus on is reducing expenses. There is no magic formula that works; you must simply live within your means. At your stage of debt accumulation I recommend considering three options:

1. Debt consolidation companies. These act as an intermediary between you and the bank or financial house to negotiate more affordable terms for your cash flow. They are sometimes able to get a consolidation loan placed or restructured. These companies are fee-based so ensure you fully understand the charging structure before you decide to go ahead.

Also, check with your credit card provider to see if they can convert your card on to a loan. As the debt is already with the bank, they may be able to consider this.

2. Raising capital. Is there anything you can sell, such as property, land or other assets? Now is the time to do that.

3. Focus on ways to increase your income. Ask for a pay review at work or look outside your main line of employment – are there any side projects you can take on? I also recommend confiding in a friend. Two heads are always better than one.

The Debt Panel is a weekly column to help readers tackle their debts more effectively. If you have a question for the panel, write to pf@thenational.ae