After his first year in Dubai, Soufiane Yaaqoubi had saved Dh10,000 and doubled his salary. Two years later, in a dramatic turnaround, he was made redundant, had Dh75,000 in debt and moved to Sharjah to reduce his expenses. "I did think about running away, especially when I heard all those stories of people abandoning cars," says Mr Yaaqoubi, who arrived in the UAE from Morocco in 2005. "I was tempted to do the same. But then I decided against it. I thought I'd face up to the problem and fix it."

His mistake, the 28-year-old says, was becoming "consumed by consumerism" once he tasted success. Mr Yaaqoubi graduated with a degree in marketing and communication from the International Institute of Higher Education in Morocco, but struggled to find a job in his homeland. A cousin was living in Dubai, so he decided to move to the UAE, "a land of opportunity", and stay with his relative as he searched for employment.

In the beginning, Mr Yaaqoubi was in great demand, and he interviewed with potential employers about four times a week. With three languages at his command - Arabic, English and French - it didn't take long for him to land a position. "I started out in sales with a video games distribution company," he says. Earning a monthly salary of Dh4,000, Mr Yaaqoubi worked with French hypermarkets Carrefour and Geant in a bid to increase his company's outreach in the market. He was also paid an annual bonus of 15 per cent, which was subject to his performance in sales and attendance at work.

"My salary was enough for me to start with," he remembers. "I didn't know anyone in town other than my cousin, so my socialising expenses were minimal." Mr Yaaqoubi continued to live with his cousin in Deira, and the company he worked for provided him with a car and driver. He considered his first year in Dubai a success, as he ended it with Dh10,000 in his savings account. But after working at the video-game company for 18 months, Mr Yaaqoubi started applying for a higher-paying job. He didn't have to look for long. Mr Yaaqoubi was soon employed as a business development executive with a runway lighting company at more than double his initial salary, with an added 3 per cent commission per sale.

By this time, Mr Yaaqoubi had "discovered Dubai". "I had more friends," he explains. "I was going out more. I knew all the fun places to hang out. I had been consumed by consumerism." He moved out of his cousin's apartment in Deira, and into a two-bedroom flat in Jumeirah Lake Towers. Although he split the rent with his best friend, it was a hefty expense for the young executive, as his share was Dh5,000 per month. His days of saving were rapidly becoming a thing of the past.

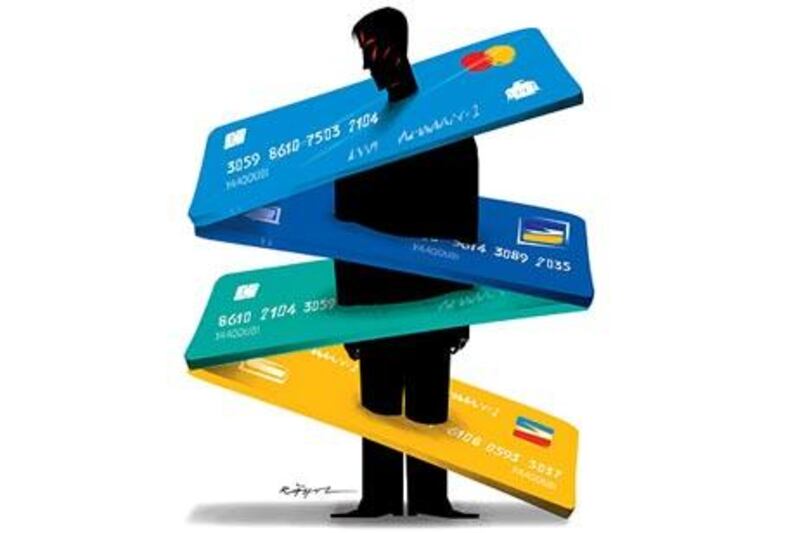

In 2007, two years after arriving in Dubai, he applied for three new credit cards, on top of the one he received when he first opened his bank account two years earlier. By this time his social life had become expensive. He would think nothing of spending Dh700 each night on food and drink. "I didn't have a single main source of expense. I just really enjoyed the good life," he says. "That was the cause of all my troubles."

As his expenses increased, Mr Yaaqoubi started withdrawing money on his credit cards. He says he racked up Dh45,000 in two years to pay for his entertainment and leisure outlays. The comfort of having a regular salary created a false sense of confidence that he could repay his debts, and encouraged him to apply for a personal loan of Dh30,000. "I used that money to pay for a diploma in PR from the EMDI Institute of Media and Communication. My undergrad programme was quite broad in study and I wanted to upgrade in a more niche area," he says.

However, soon after he had amassed Dh75,000 in debt, in November 2008, Mr Yaaqoubi was made redundant. He found a job three months later, but shortly thereafter again joined the ranks of the unemployed as the recession set in. In September 2009 he found work as a business development manager and is earning Dh12,000 a month. He is now sitting on Dh90,000 in debt, though he says he's determined to clear his accounts. To save on costs, he has relocated to Sharjah, and reduced his rent to Dh2,000. "It's easier to not spend in Sharjah," he says. "I mostly go out on weekends only now, so it's easier on the spending."

Mr Yaaqoubi started tackling his debts three months ago. He is paying Dh3,500 a month to his various creditors, and hopes to be free and clear in four years. "My expenses, including food, don't amount to more Dh40 a day, as I cab to work, which is five minutes away from my new home, and my entertainment expenses never exceed Dh150 each time I go out." In hindsight, Mr Yaaqoubi says not putting any money aside as a safety net, and straying from his saving ways, made his bouts with unemployment even more difficult.

Most financial advisers tell clients to put aside three months of salary to tide them over in the event of a sudden loss of work. But Mr Yaaqoubi's strongest piece of advice is to separate your needs from your wants. He says he overspent and lived far beyond his means once he started earning more money. Success, it seems, created a false sense of security. "I thought I needed a lot of what I actually just wanted," he says.

"Taking out a loan and withdrawing money on credit cards to pay for luxuries or a lifestyle was plain stupid on my end. I don't regret anything, though, as it's been an important lesson in life. I'm quite certain I won't repeat it again."