It's not often I can boast a victory, but after three years, I can honestly say that I finally feel like a winner this week. And it's been a long time coming.

Not that I ever felt like a loser, mind you, but I'm sure you get my drift when I mention the word "rent". And yearly, at that.

You know that feeling? A year or two ago, many of you probably walked away from exasperating negotiations with your landlord knowing that you were paying way too much for a sub-standard home that failed to offer anything of real value. Why? Because demand for rental properties in the capital far outstripped supply thanks to a massive influx of expats who arrived here for work three to four years ago.

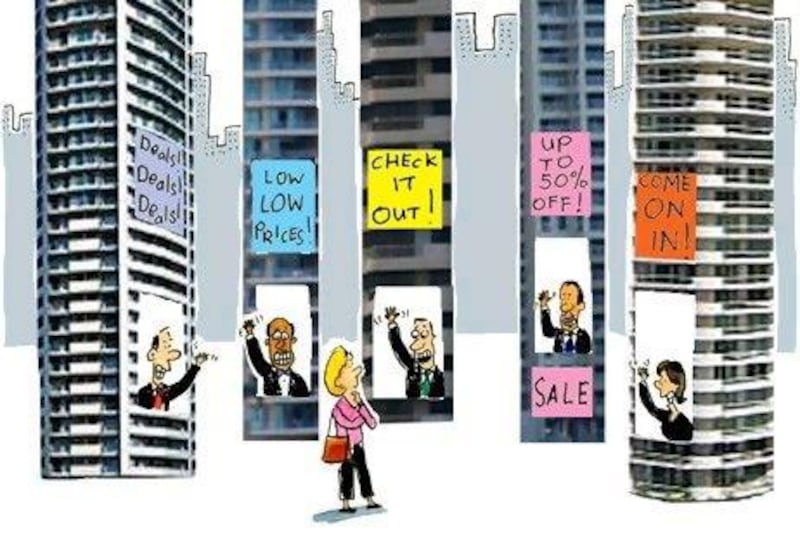

Frustrating, I know, but fast-forward 12 to 18 months and suddenly the landscape has changed. The shoe is on the other foot and we - the renters - have discovered a newfound strength: choice.

The word "choice" may have an unfamiliar ring to it, but suddenly choice is what we have. With more than 5,000 apartments expected to be handed over in the next six months or so - and a steady stream after that - we can finally choose where we want to live and have more say on how much we pay for that privilege.

Even better, the new rental properties will boast decent amenities, such as swimming pools, gyms, playgrounds and quality finishings.

Best of all, there is something for all budgets - from Al Reef near the airport, which started its handover last year and offers residents a quality lifestyle on a budget, to Al Bandar, the new, seriously upmarket waterfront offering from Aldar that started welcoming residents last month.

But what began as possibly déja vu moments with our landlords a few months or even weeks ago when it came to negotiating our rents, many of us are now walking away with some impressive reductions in our yearly housing costs. This leaves us with some serious cash to spare for the first time since we arrived in a city that was bursting at the seams only a few years ago.

In my view, that makes everybody a winner - even me.

After reading countless headlines saying that rents had taken a tumble in Abu Dhabi over the past few months, I have to admit that I was feeling a little sceptical of the whole thing, especially knowing that what I was paying here could have afforded me a decent-sized villa with private pool in Dubai.

And who would blame me? After moving to Abu Dhabi from Hong Kong - one of the world's most expensive property markets - I found myself paying more than twice as much for a tiny apartment with no views and no amenities.

My old place in Hong Kong overlooked the beach and, eventually, Disneyland (although those nightly fireworks displays quickly lost their shine), had wonderful mountain views at the back, offered open-plan living, three bedrooms, two bathrooms and three balconies. It was a five-minute walk to our club and even boasted a playground downstairs, all for the princely sum of HK$10,000 (Dh4,712) a month.

When we moved to the UAE, our flat was, to say the least, a major disappointment - especially because we were paying Dh10,000 a month to live in a neighbourhood with no playground, no decent view in sight and the occasional sharing of a tiny balcony with a family of rats. But that's another story.

It took two years, but we did find a wonderful ground-floor apartment complete with a garden in Abu Dhabi, thanks to friends who had decided to move out to save money. While we are forever grateful to them (Maggie and Al, take a bow), it was quite expensive at the time. But it didn't matter. I would have paid anything to move my family into a decent neighbourhood.

And so, thanks to the domino effect of knowing them, we have found our perfect place. And now it is considered a bargain.

Although a report in The National in January said rents in Abu Dhabi fell by up to 16 per cent in the final three months of last year, I am willing to bet that figure is now much more. Mine, for instance, fell by almost 20 per cent.

Rather than face my yearly rent negotiations with dread, I now look forward to them, not to mention that much-welcome fillip to my savings account.