Global ports operator DP World said it will delist from Nasdaq Dubai, after the company concluded the disadvantages of staying listed on the stock exchange outweigh the benefits.

After its return to private ownership is accepted, DP World will become 100 per cent owned by its parent company Port and Free Zone World, which is a wholly-owned unit of Dubai World, DP World said in a regulatory filing to the bourse on Monday. The move will enable DP World to focus on its medium-to-long-term strategy of transforming from a global port operator to an infrastructure-led end-to-end logistics provider, it said.

"Delisting from Nasdaq Dubai is in the best interest of the company, enabling it to execute its medium to long-term strategy," said Yuvraj Narayan, group chief financial, strategy and business officer of DP World. "DP World is focused on the transformation of the group and takes a long-term view of investment returns and value creation. In contrast, public markets typically hold a short-term view. As a result of this gap, the DP World strategy is not fully appreciated by the equity markets, and consequently is not reflected in the company's share price performance."

PFZW offered to acquire 19.55 per cent of DP World's shares traded on the Nasdaq Dubai, returning the company to private ownership. Each DP World share will be acquired at $16.75 (Dh61.51), representing a 29 per cent premium on the market closing price of $13 on Sunday, DP World said. Shares of DP World rose 10 per cent after the delisiting announcement to $14.30 at the end of trading on Monday.

"Returning to private ownership will free DP World from the demands of the public market for short-term returns which are incompatible with this industry, and enable the company to focus on implementing our mid-to-long-term strategy to build the world's leading logistics provider," said Sultan bin Sulayem, chairman and chief executive of DP World.

The company will focus on integrating its acquisitions with its global network of interconnected ports, logistics businesses and economic zones, he said.

"PFZW is highly supportive of the DP World Board's strategy and believes it is critical that DP World does not lose momentum in positioning itself as a leading global supply chain solutions provider," it DP World said on Monday.

PFZW will pay Dubai World $5.15 billion to help "in discharging outstanding obligations to banks", so that DP World can "implement its strategy without any restrictions from Dubai World’s creditors", the company said.

Proceeds of the agreement will also be used to settle other outstanding payments and transaction-related expenses to allow DP World to fund potential redemption of its convertible bonds.

PFZW will fund the deal through a new debt facility, arranged by Citibank and Deutsche Bank.

The deal was "definitely unexpected" otherwise there would be much higher volumes of DP World's shares trading on the market than recorded, said Marie Salem, head of institutions at Daman Securities.

"Returning to private ownership would not change the structure or performance of the company – it will go on with its normal business cycle," Ms Salem said. "After all the company announced its intent to acquire a 51 per cent stake in the Ukrainian TIS Container Terminal, indicating the company is still expanding and working on its long-term projects."

Investors who hold shares are expected to benefit from DP World's offer to buy-back shares at a 29 per cent premium.

"Who would not be keen on buying the stock at 10 per cent higher from the previous close and make a good 20 per cent return on investment?" she said.

Rothschild & Co, who advised DP World Independent Directors on the financial terms of the offer, said the terms are "fair and reasonable" as far as voting shareholders are concerned.

The cash offer, expected to be completed in the third quarter of 2020, is subject to shareholder and regulatory approvals, the company said.

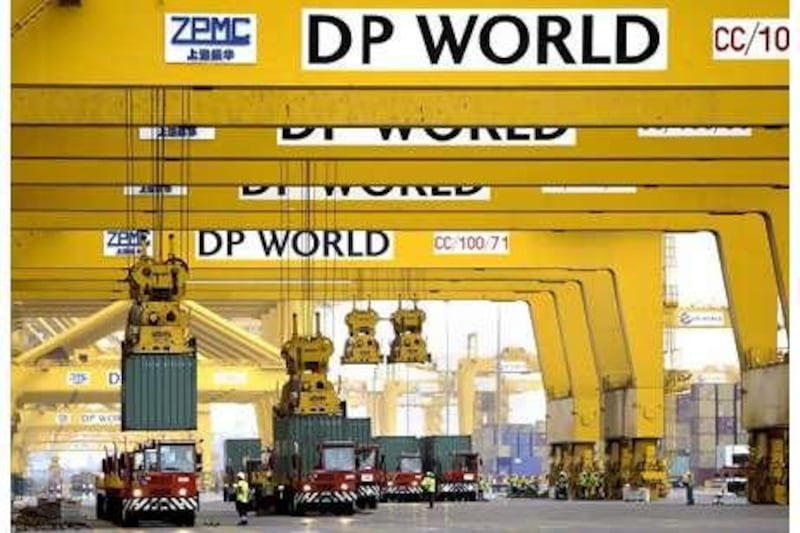

DP World reported flat growth in its shipping container volumes in 2019 amid market uncertainty from trade wars and geopolitical tensions.

The ports operator handled 71.2 million twenty-foot equivalent units (TEUs) across its global portfolio of container terminals last year, with gross container volumes flat year-on-year on a reported basis and up 1 per cent on a like-for-like basis.

DP World shares were listed on the Dubai International Financial Exchange on November 26, 2007, in what was then the Middle East's largest initial public offering that raised about $5bn. DIFX was rebranded to Nasdaq Dubai in November 2008. A dual listing on the London Stock Exchange followed in June 2011. However, due to weak trading volumes on the LSE, DP World delisted the shares from the index in January 2015 after shareholder approval.