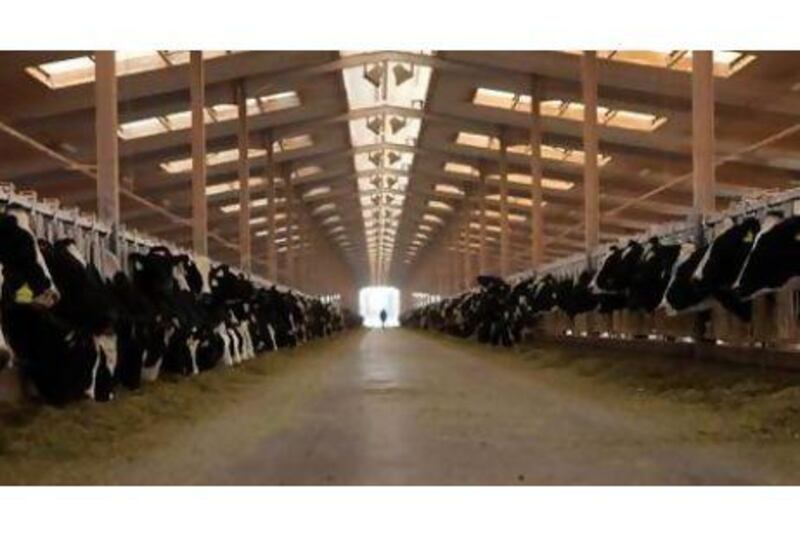

Saudi Arabia’s Almarai reported an 11.9 per cent decline in its second-quarter net income on the back of a rise in expenses and financing costs while revenue rose as the biggest dairy producer in the Middle East reshuffles its top management.

Net profit after zakat and taxes for the period ending 30 June fell to 582.5 million Saudi riyals (Dh570m), the company said on Sunday in a statement to the Saudi stock exchange, where its shares trade. That missed the 604.5m riyals income estimates by two analysts for the second quarter, according to the Bloomberg data. The company shares traded 2.3 per cent lower at 2.16pm UAE time.

Operational profit dipped to 738.5m riyals, down 3.4 per cent year-on-year. Revenue for the three-month period, however, climbed 2.6 per cent to 3.76 billion riyals, led by poultry followed by fresh dairy, while a general weakness in the juice market continued in 2019.

The company attributed the slide in net income to higher operational and financing costs. Its selling and distribution expenses increased by 28.2m riyals, a 5.1 per cent rise, due to “higher general marketing expenses and trade support … other expenses: increased by 11.4m riyals, mainly due to higher losses from sale of dairy herd,” it said.

Funding costs, climbed by 41.2m riyals on the back of “higher interest-bearing debt after repayment of perpetual sukuk last year, higher interest rate due to higher Sibor and lower capitalisation of funding cost for qualified capital projects,” Almarai said in the bourse statement.

The company, which has seen a continued decline in profitability over the recent quarters, as contributions to overall income from various business lines shrunk, has brought back employee veterans to steer it back to profit growth.

Almarai on Sunday said its chief executive Alois Hofbauer, who took the role in April, resigned due to personal reasons. Georges Schorderet will replace Mr Hofbauer. Mr Schorderet, who has previously served as the company's chief executive and chief financial officer, was appointed adviser to the Almarai board after he opted to retire earlier this year, the company added.

The Almarai board also appointed Majed Mazen Rasheed Nofal as the deputy chief executive, and promoted Paul Gay as the chief financial officer, it added.

“The board believes these changes in Almarai 's leadership executive management positions will ensure continuity while paving the way for its future strategy,” it said.

The board in May also approved a new five-year business plan with 7.1bn riyals in capital investments as it looked to cut costs and return to profit growth.

“Given the persistent challenging economic conditions across the region, the focus on efficiency and cost optimisation measures will continue throughout the plan period to ensure continuous competitive advantage," it said at the time.

The latest plan, the company said, is “in line with the long-term investment cycle of the company, calling for less expansionary investments and a focus towards more efficiency and sustainability”.

The board plans to fund the investments over five years, mainly through operating cash flow. Almarai will focus on replacing existing assets; adopting a greener energy footprint; improving production capacities and capabilities in farms and manufacturing facilities; enhancing innovation and product development and its distribution and transportation methods, it said.