Abu Dhabi's largest industrial zone is seeking the help of banks to lure greater numbers of international companies to the emirate.

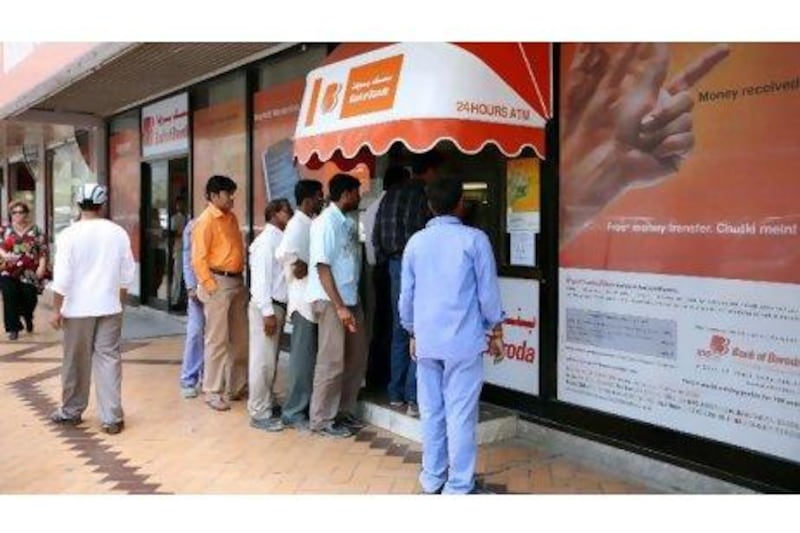

Bank of Baroda has signed an agreement that it is hoped willattract companies from India to the Khalifa Industrial Zone Abu Dhabi.

Video: Industry Insights Forum: Kizad

Tony Douglas, CEO of ADPC on the growth of Abu Dhabi as a new industrial hub in the Gulf.

The free zone, also known as Kizad, is a major part of the emirate's efforts to meet its Vision 2030 diversification targets.

The agreement is expected to help increase the already high level of Indian investment in Abu Dhabi, said Ashok Gupta, the chief executive for GCC operations at Bank of Baroda.

"With this agreement, Bank of Baroda will be able to help in attracting new investments to Kizad, a very prestigious special industrial zone, by supporting industries and attracting investors from India and other parts of the world."

As part of the agreement, Bank of Baroda will offer preferential lending rates to Indian companies seeking to invest in the Emirates, in return for directing them towards establishing operations in Kizad.

A Dh26.5 billion (US$7.21bn) project on the border between the emirates of Dubai and Abu Dhabi, Kizad is planned to occupy an area two-thirds the size of Singapore and allow full ownership of companies by international investors.

Kizad is slated to fully open by the end of next year.

It is expected to contribute $40bn to the local economy and add 100,000 jobs. Bank of Baroda is the latest in a string of banks to have been courted by Abu Dhabi Ports Company, which manages Kizad. This month, National Bank of Abu Dhabi signed a similar agreement, seeking to convince greater numbers of companies to set up shop in the UAE.

"NBAD will leverage its global presence spanning four continents, its strategic relationships with leading banking institutions in key target markets, and its global contacts to promote Kizad as the industrial zone of choice," said Mark Yassin, the senior general manager and head of corporate and investment banking at NBAD.

The tie-up followed deals signed with HSBC and Citibank to identify potential tenants overseas and bring them to Abu Dhabi.

Kizad is already home to a number of companies including Emirates Aluminium, which has been operating there since 2009.

The aluminium smelter and other capital-intensive industries in Abu Dhabi would require a large number of ancillary services and industries, all of which would provide a lucrativesource of lending for banks, said Mark McFarland, an economist at Emirates NBD.

"They're obviously going to do quite a nice little bit of business in trade finance and lending for working capital," he said.