E-commerce is the great commercial leveller. An entrepreneur can dodge the shackles of a retail outlet with its multi-year leases and provision of full-term postdated cheques, the dishonouring of which can result in a custodial sentence. If the supply chain is efficient enough, even the requirement to hold stock can be minimised, saving on personnel and facility running costs.

The advent of VAT across the GCC in 2018 can, managed properly, give the e-commerce specialists an additional competitive advantage over businesses for whom e-commerce is just another sales channel. This is due to a particular GCC phenomenon where there is a general practice of creating separate legal identities for each physical trading location. Often this is a cynical exercise to avoid legislative requirements that would apply were these individual units combined under a single trade licence.

Peter Whatley, the chief executive of Argent Gulf Consulting, told me: “What is broken up can be brought back together for VAT reporting purposes by choosing a ‘group election’: the splintered businesses can report as if there were just one Trade Licence.

“However, this only applies within a single country. A large diversified group would need to put a separate ‘group election’ in place in each GCC country in which it has multiple trading entities.

“Moreover, large groups are likely to be involved in joint ventures where such a solution might not be possible due to partner requirements. So we awaken amid a myriad of legal entities that were benign in a non-tax world that become administratively toxic.”

To get an idea of how this might work, I spoke with Henrik Baerentsen, CEO of the UAE-based LensesDirect.me FZC, an online start-up supplying contact lenses. They are planning to expand, offering their products across the GCC and I examined how VAT might apply to them.

Substantive legislation is still pending, but the British treatment offers them a path they can prepare for now and amend where necessary. This type of approach by businesses will make the transition easier come V day on the January 1, 2018. Like the EU, the GCC is a customs union.

Let’s walk through a scenario showing what business might be like for LensesDirect.me once VAT arrives.

It is January 2, 2018 and the company ships lenses from the UAE to Oman, to end-user customers who cannot reclaim VAT as they are the final consumer of the product being purchased. The customer receives an invoice with UAE VAT as the tax is charged in the country from where the goods were dispatched. The sale is recorded in the supplier’s UAE VAT return.

Each GCC country has a “distance threshold”. In this scenario, this is the amount at which UAE sales into Oman mean LensesDirect.me must register for VAT in Oman.

Assuming their sales within a trading period to Oman reach the “distance threshold”, now they must register for VAT in Oman. Does this mean they need to set up a legal entity in Oman? We don’t know. The legislation may allow them to use their UAE Trade Licence to register in Oman, but only for VAT purposes.

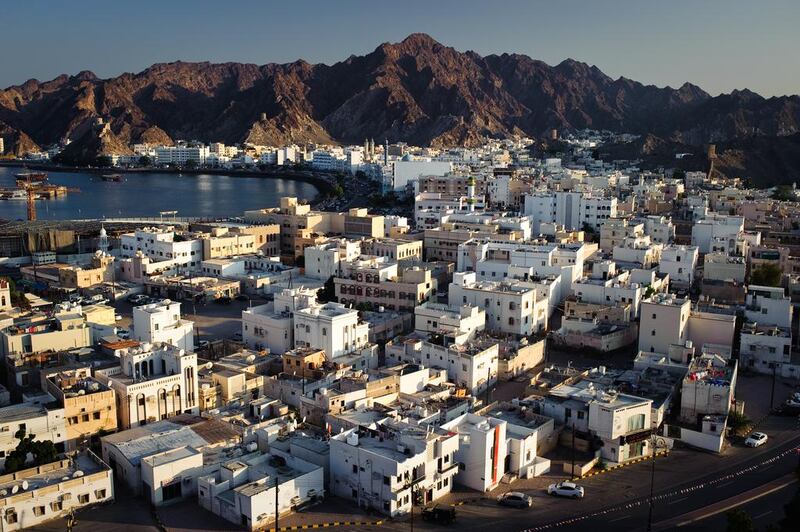

What we can say is that VAT would not be charged twice. Now registered in Oman, UAE VAT would no longer be charged on Omani sales, instead reporting these to the Omani VAT authorities. Where would any Omani VAT inspection be held? Probably Muscat, so businesses like LensesDirect.me will need to be regulatory-mobile.

Say their intra-GCC trading greatly exceeds that in the UAE alone, where all their costs are incurred. In this scenario, the UAE return would involve a refund, which may trigger an automatic VAT audit.

The business is now claiming money from the UAE while paying it in other GCC countries. This is hardly fair to the UAE. Will there be some agreed inter-government mechanism put in place to eliminate this anomaly?

Businesses like LensesDirect.me need to check whether there will be variations in VAT treatment for their products in each GCC market. For example, there is no guarantee the supporting documentation in each country will be the same.

Since VAT is likely to evolve differently by country, all changes need to be factored into standard operating processes to avoid fines and interest.

Does e-commerce offer a threat or opportunity for the VAT man? As long as the process is correctly mapped digitally, it should theoretically pose the fewest issues.

Conventional trading companies have paper-based systems that fail in some manner all too often. A lost invoice here. A smudged unreadable delivery note there.

However, most UAE businesses are not legally required to conduct an audit, so many don’t even bother with this basic bookkeeping.

In an e-commerce environment, record completeness is typically an all-or-nothing affair. An automated environment unemotionally captures all information as programmed.

There have been many articles predicting that automation would bring about the demise of many traditional professions; including mine.

For example, no mildly complex business needs to have a human-delivered payables and receivables accounting function.

Given the lack of working VAT experience among accountants in the GCC, surely to mitigate the risk of substantial fines and interest it is time to look at the automation not just of processes but whole functions.

Winners seek an advantage when something materially changes the market they trade in. When something seismic changes the market for everyone, take the time to review your business and be evolutionary enough to survive the aftermath.

David Daly is a chartered accountant (CIMA) typically serving in chief financial officer or finance director roles.

business@thenational.ae

Follow The National's Business section on Twitter