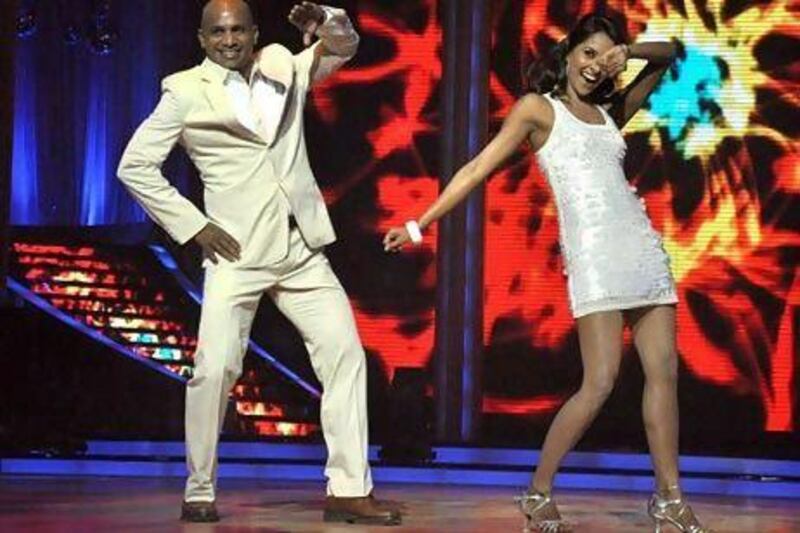

Jhalak Dikhhla Jaa, the Indian version of the BBC's Strictly Come Dancing, has all the right ingredients for a reality TV extravaganza - tears, tantrums and plenty of Bollywood va-va voom.

It is hugely popular programme across the country, featuring the usual assortment of sports stars, TV presenters and, of course, the nation's much-loved movie stars who compete against each other with variety of dance performances.

The fifth season of the hit series has just kicked off and this yearthe show has more interactive elements than before as its makers have introduced several new ways for the programme to keep in contact with its fans - including several mobile-based applications.

The Jhalak Dikhhla Jaa mobile application allows users to download videos, watch popular episodes, visit behind the scenes of the show and follow all Tweets and Facebook updates as well as vote for their favourite contestants.

It may well be sequins at dawn for the contestants but the company behind the app, InTime Media based in Ireland, says India offers huge opportunities in the sector.

"We are the very first entrant into the market with specific sectoral experience. We hope to use this to enable broadcasters to start generating significantly more money both directly from their audiences and from sponsors, from which we hope to make a significant return ourselves," says Julian Ellison, the chief operating officer at InTime Media.

It is easy to see the cause of Mr Ellison's enthusiasm. In India, an estimated 100 million apps are downloaded every month. According to research by Informa Telecoms & Media consultancy house, revenues from mobile data and value-added service in India will grow from the current US$4 billion (Dh14.69bn) to $15.9bn by 2016.

Other companies are also cashing in. "I think there is a tremendous opportunity for international players to succeed in this market," says Abhijit Jayapal, the founder and chief executive of Synqua Games, a gaming software company.

Those building high-quality products and meeting a user need, is bound to succeed and there is a huge gap to be exploited here. Unlike China, India is a more level playing field for international players."

India's user base is huge and its people are hungry for information and entertainment.

"The first and foremost growth driver is the mobile subscriber base of India - currently estimated at 900 million," says Faisal Kawoosa, an analyst of telecommunications practice at CyberMedia Research.

"It enables delivery of content, services to a huge proportion of the population who are otherwise not connected to any other media. Affordable handsets and low mobile services tariffs are two further drivers."

Another big pull for companies is that the Indian market is largely untapped, particularly in rural areas where most people use their mobile phones just for voice calls.

"Most rural people work as farmers and often lack information about prices and growing conditions," says Mariam Dholkawala, the chief executive of iGame-studios, an application development company.

"Services and apps that can help them in these sectors are more successful. Similarly with rural women, there are several welfare programmes to help them be financial contributors to their families."

Almost 90 per cent of the Indian app economy is based on the demand for social networking, instant messaging and games, according to Informa Telecoms. Most of this is fuelled by the urban user.

"The demand for rich content with social networking will probably be the need for the urban users. The urban users prefer entertainment, utility and social networking apps," says Ms Dholkawala.

The urban Indian app buyer is often young and very tech savvy.

"The emergence of smartphones as the fastest-growing segment in the mobile handset market in India has really kick-started the apps space and the dominant use of smartphones is the Generation Y [the Indian audience of 13 to 30-year-olds] who are the prime users," says Parveen Ahluwalia, the director of strategic initiatives at Market Pulse, a market research company.

India, of course, has very distinct regional differences, with hundreds of different languages. Because of this, the apps market can offer its developers a variety of opportunities.

"India is a multicultural and socio-economically diverse nation, which in turn creates opportunities for the mobile apps market," says Mr Kawoosa. "For apps developers in the areas of financial services, entertainment, news and information, gaming, health care and governance are the areas where we see huge potential."

The handset market can also play a major role in deciding which app becomes a hit because the phones that work in India are different from those elsewhere in the world.

Two of the largest makers in India are Nokia and Samsung which have brought so called feature-phones to the market place.

"Basically the lower-end phones have a larger user base than the smart phones. This is not really a challenge for large developer companies, but smaller companies with lesser resources will only be able to focus on a niche user base and may find it difficult to break into the Indian mass market," says Ms Dholkawala.

Getting the right developers on board and finding well-trained staff is an issue for content companies.

"To put it bluntly, while there are huge number of mobile developers who can build basic apps, the talent base of developers to build exceptional products with a high degree of complexity is very scarce," says Mr Jaypal.

Despite the fact that the country's market offers vast opportunities, its size can also be an issue.

"The scale of India can be a challenge. No other TV market offers the potential for so many people to be using our apps concurrently, and this presents interesting challenges for the way the apps are structured, and the back-end systems that support them," says Mr Ellison.

Network coverage, mainly 3G, is still lacking in some parts of the country and that can hamper app developers.

"The 3G services over the months will prove to be instrumental in stimulating growth and bridging the urban-rural divide, but until then it is enjoyed by a smaller segment of the Indian mobile subscribers," says Ms Dholkawala.