Gold in India is losing its shine, with demand expected in the world's second-largest consumer of the yellow metal to remain subdued this year as Indians look towards other investment options, according to jewellers.

“What we feel in 2018 is that gold will probably retain a similar business to last year,” says ABS Sanjay, the managing director of AVR Swarna Mahal Jewellery, based in the south Indian state of Tamil Nadu. “In the past two to three years the investment has majorly transferred to equities or mutual funds or other investments.”

Last year, there was a substantial drop in gold demand.

Gold demand in India, the second-biggest consumer behind China, is expected to have been between 650 tonnes to 750 tonnes last year, down from 974 tonnes in 2013, according to the World Gold Council.

"Headwinds for demand continue though, following various measures since early 2016 to boost transparency, and therefore we expect full year demand in 2017 to be well below the five-year average," says Somasundaram PR, the managing director, India, for the WGC. It cites the introduction of India's new goods and services tax (GST), as a factor in hurting demand from consumers.

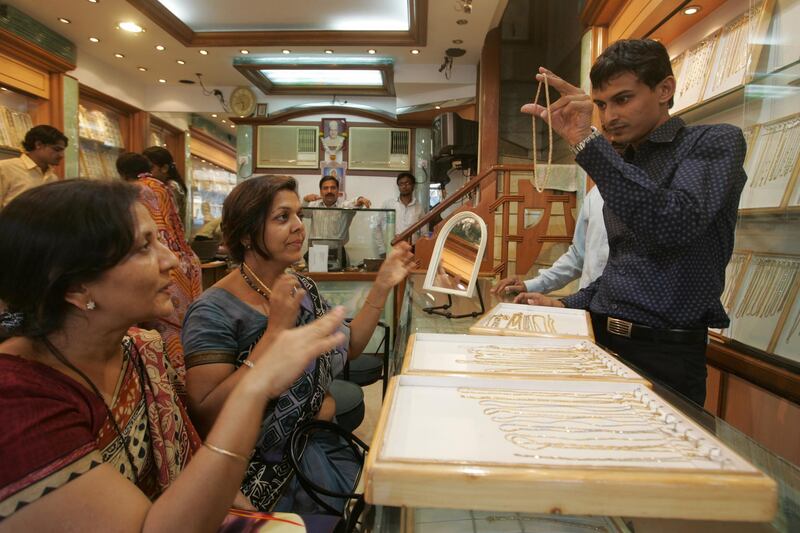

Anil Jain runs a jewellery store in Mumbai's biggest jewellery market Zhaveri Bazaar, a chaotic and grubby area in the south of the city with rickety buildings and shops that are each home to glittering jewellery, gold coins and bars worth millions of dollars.

Business is not as good as it should be, given the fact that the wedding season is in full swing – a peak time for Indians to buy gold, he says.

“Business is not anticipated.”

But it is not as bad as it was a year ago in the immediate wake of demonetisation - a move in which the Indian Prime Minister Narendra Modi in a shock announcement in November 2016, banned the two highest value banknotes, says Mr Jain.

“It was pathetic, pathetic. Post demonetisation, we were really in dire straits, although things got a little better after Diwali, but since the prices are rising, again it will be a dampener for the public to come to buy gold.”

Gold prices in India have risen because of an uptick in prices globally, combined with some weakness in the rupee against the US dollar, making imports more costly and pushing rates in India to a more than one-year high to above 31,000 rupees (Dh1,790) per 10 grams.

Gold plays a highly significant cultural and traditional role in India, and is important during weddings and religious festivals. It has long been widely used as an alternative to the formal banking system, with many households purchasing and storing gold at home rather than putting their savings into banks, particularly in rural areas where it is harder to access banks.

But gold is largely considered an "idle" asset in terms of its role in the economy. Consequently, India in recent years has taken steps to try to reduce imports of gold, including a series of hikes on import duties, because it weighs on the country's current account deficit. The government has made efforts to bring demand for the precious metal into the formal financial system through sovereign gold bonds scheme launched in October last year, for example.

_______________

Read more:

[ Analysts say Modi's foreign investment reforms don't go far enough ]

[ AirAsia considers IPO for selling stake in Indian unit ]

_______________

Demonetisation was designed to try and reduce black money flows in the country to create greater transparency for the its economic activities.

This pushed more Indians towards the banking system and citizens are increasingly looking at keeping money in the formal economy rather than opting to keep their savings in cash and gold, according to Mr Sanjay.

“Traditionally, people used to do a lot of savings in India,” he says. “Whenever they used to buy gold, they just used to look at it as savings. But in recent years, because there was no very big growth in the gold price, they started to look at other investments. More organised currency is in the system now.”

There has been a noticeable reduction in gold purchases being made in cash following demonetisation, Mr Sanjay adds.

Gold has been a big beneficiary of black money flows in India because it was easy to do transactions in gold under the counter, but with the introduction of the goods and services tax (GST) last year, which requires regular filing and more paperwork, sales have become more transparent.

Still, analysts say that illegal activities such as smuggling are likely to persist in India.

High import duties are widely cited as a major factor in encouraging smuggling of gold into India, to avoid paying the levies on the metal and generate profits. The import duty on gold stands at 10 per cent. Up to 120 tonnes of gold was brought into India illegally in 2016, according to the World Gold Council. That is almost a fifth of total gold imports.

Mr Somasundaram says that smuggling remains a major problem and, ultimately, the best way to curb imports would be to reduce the duties on gold to “kill the incentive” for smugglers.

But the World Gold Council is upbeat on the longer term outlook for gold demand in India.

“In India – the second-largest gold market in the world – we believe that after their initial implementation shock, policies such as the demonetisation initiative and GST will start to have a positive effect on the economy,” according to a report by the organisation released this month.

It explains that rising economic growth underpins gold demand

“As incomes rise, demand for gold jewellery and gold-containing technology, such as smartphones and tablets, rises,” its says. “Income growth also spurs savings, helping increase demand for gold bars and coins.”

Meanwhile, the introduction of VAT in the UAE could be of benefit to India, jewellers including Mr Jain say.

“It's less attractive for Indians to buy gold in Dubai now and bring it back to India because of VAT. They won't really save money by doing that.”

There could be more relief on the way for the gold sector in India, with its union budget being presented on Thursday.

“To revive demand for gold in the country and boost exports of jewellery, the union budget is expected to announce reduction in import duty on gold,” says Arun Singh, the lead economist at Dun & Bradstreet in India.

Mr Sanjay is hopeful. If the customs duty comes down, he says this will lead to reduced prices in gold products in India, and will ultimately boost his jewellery sales.

“The duty may come down about 2 to 3 per cent. We've been expecting this to happening in previous budgets and it didn't happen, so we think there's a chance that the duty may come down this time.”