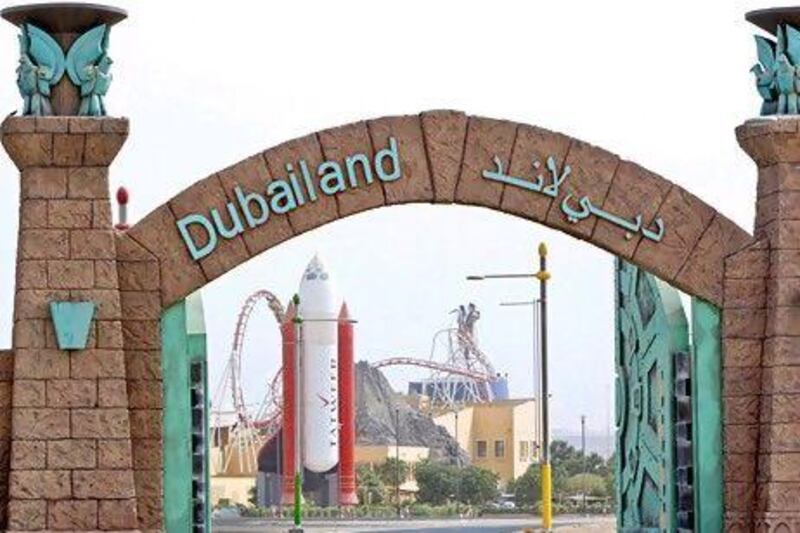

It once planned to build roller coasters in Dubai and energy cities in Doha and Mumbai.

Finance:

Industry Insights Exclusives you can bank on from The National's premium content. Learn More

But in the wake of the financial crisis, Gulf Finance House, the Bahraini investment bank, has been forced to ditch its grand plans, sell assets and claw back funds wherever it can.

The bank had high hopes for amusement parks, including the Arabian Legends Theme Park resort in Dubailand, initially planned as a US$1.5 billion (Dh5.51bn) investment due for completion in 2013. The bank took a $300 million provision against its Dubailand exposure in 2009 after the financial crisis hit.

It was among a number of commercial developments planned before the crisis, including Bahrain Financial Harbour, until Gulf Finance House was forced to change tack.

Three years on it remains mired in a fight for survival after debts that mounted during the boom years turned sour and forced a debt rescheduling in December 2009.

Yesterday the investment bank returned to the black with a profit of $3.4m for the third quarter, up from a loss of $115.1m during the same period last year. It has reported losses in 10 out of the past 12 quarters.

The return to profits showed that the bank's asset sales programme was working, said Mohammed Al Nusuf, the deputy chief executive of Gulf Finance House.

"The increase in net profit to $3.4m is a testament to the bank's diligent and professional management as well as its revised investment strategy," he said.

But the bank's auditors warned that a fall in capital ratios below the regulatory minimum and its $297.93m of accumulated losses "may cast significant doubt" on Gulf Finance House's ability to absorb further losses and "continue as a going concern".

At the end of September, the bank's contractual obligations exceeded its liquid assets, auditors from KPMG wrote.

"As a result, the ability of the group to meet its obligations when due depends on its ability to achieve a timely disposal of assets." The bank's Dubai-listed shares fell 1.7 per cent to 50 fils each in trading yesterday after the release of the financial statements.

Gulf Finance House's investment banking business made a total income of $27,000 during the third quarter, while the bulk of the bank's operating income came from foreign exchange gains of $7.5m.

The bank has sought a number of asset sales, making a $6.25m profit on sales of land during the third quarter. The bank's shares, which are also listed on London and Kuwait markets, were frozen for almost eight months after a proposed capital raising failed to materialise. Since it resumed trading in June the stock has lost three quarters of its value.

Gulf Finance House's business model relied upon cheap access to credit and the soaring property market of the boom years.

"It was a business model which relied on a lot of transaction activity taking place in a booming market," said Mike Williams, the senior director of research and consultancy at CB Richard Ellis.

Gulf Finance House had made a number of deals that involved repackaged plots of land, acquired cheaply during the boom years, and then sold to sub-developers as part of master-planned communities, he said. But this was likely to have left the bank with a number of non-performing assets in the wake of the property market plunge that hit the Middle East in the wake of the global financial crisis.

"This model hasn't worked for years, since the financial crisis in 2008. At the moment, they're just trying to manage their position," Mr Williams said.

Gulf Finance House could not be reached for comment.