Saudi Arabia's Capital Market Authority approved Saudi Aramco's application for an initial public offering on the kingdom's stock exchange as the company said it recorded a $68 billion profit for the first nine months of the year.

The company's prospectus will be published prior to the start of the subscription period, the CMA said on its website on Sunday. The prospectus for the IPO will be released by Aramco on November 9, the company's chief executive Amin Nasser said at a press conference in Dhahran on Sunday. The price at which all subscribers in the offering will purchase shares will be determined at the end of the book-building period, Aramco chairman and governor of the kingdom's Public Investment Fund Yasir Al-Rumayyan said.

Once the book building and share allocation take place over the next several weeks, the company’s shares could start trading in the first half of December, though no date was specified. The offering will be restricted to institutional investors and individual subscribers that include Saudi nationals and any non-Saudi resident of the kingdom or GCC nationals.

The decision by the CMA comes three years after Crown Prince Mohammed bin Salman announced the intention to list as much as 5 per cent of the company with the goal of reaping $100bn from the offering, as the kingdom looks to diversify its economy away from hydrocarbons.

“Today marks a significant milestone in the history of the Company and important progress towards delivering Saudi Vision 2030, the Kingdom’s blueprint for sustained economic diversification and growth," Mr Al Rumayyan said. "The company’s strategy is underpinned by long-term, exclusive access to the kingdom’s unique hydrocarbon resources, which it manages in order to optimise production and maximise long-term value."

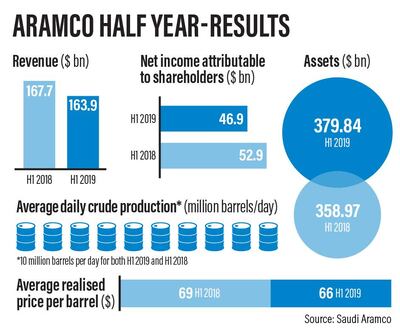

Saudi Aramco, the most the profitable commercial entity in the world, outshining the likes of Apple, Google and Amazon, reported a net profit of $46.9bn in the first half of 2019. In April Aramco issued a debut $10bn bond, which was hugely oversubscribed. Filings for the bond prospectus revealed the sheer size of the company, with a profit touching $111.1bn in 2018 on revenue of $355.9bn. Aramco plans to pay a dividend on $13.4bn for the quarter ending September 30 and will declare an interim dividend of a maximum $9.5bn pending board approval, the company said.

The energy behemoth is the world’s largest integrated oil and gas company producing one in every eight barrels of crude oil globally. In 2018, the company produced 13.6 million barrels per day of oil equivalent, including 10.3 million bpd of crude oil.

The funds from the listing are expected to help Riyadh spend on Vision 2030 realisation projects such as the $500bn futuristic economic free zone Neom and the Red Sea Project, a mega-tourism attraction, as the kingdom opens up its tourism and entertainment sector.

"Our mission is to provide our shareholders with long-term value creation through crude oil price cycles by maintaining our pre-eminence in oil and gas production, capturing additional value across the hydrocarbon value chain and profitably growing our portfolio," said Aramco's chief executive Amin Nasser.

Aramco is reducing the royalty on crude oil and condensate production to 15 per cent from 20 per cent on Brent prices up to $70 per barrel. It increased the marginal royalty rate to 45 per cent from 40 per cent on Brent prices above $70 per barrel up to $100 per barrel; and increased the marginal royalty rate to 80 per cent from 50 per cent on Brent prices above $100 per barrel.

The company is cutting the tax rate on downstream business to 20 per cent from the 50 per cent - 85 per cent multi-tiered structure on the condition that the company consolidate its downstream business under the control of a separate, wholly owned unit before 31 December 2024. The period for which Aramco will not be obligated to pay royalties on condensate production is extended for an additional 10 years after the current five-year period ends on 1 January 2023 and may be further extended for subsequent 10-year periods subject to government approval.

Aramco said it expects 2020 capital expenditure to be between $35bn and $40bn, and 2021 capex to range between $40bn and $45bn.

"The company believes it retains significant flexibility to reduce capital expenditures in a lower oil price environment," it said. In the medium term, Aramco expects to spend 35 per cent on liquids related expenditures, 40 per cent on gas-related expenditures and 25 per cent on downstream related expenditures.

The prospect of being part of the world’s biggest IPO by far has attracted investments bankers from across the globe and all major local and international lenders. Citigroup, Credit Suisse, Goldman Sachs, HSBC, JP Morgan, Merrill Lynch Bank of America, Morgan Stanley, NCB Capital and Samba Capital are joint financial advisers on the forthcoming offering.

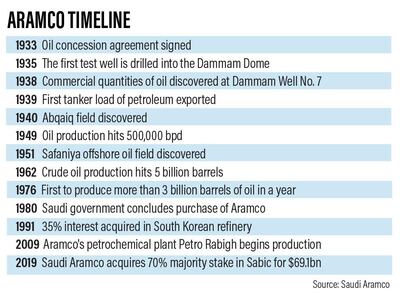

Aramco's move towards a public listing gathered pace this year after the company bought a 70 per cent stake in Saudi Basic Industries Corporation in March as part of the kingdom’s plans to consolidate its oil interests. Aramco took the stake in the biggest petrochemicals producer in the Middle East from state-controlled Public Investment Fund for $69.1bn.

"If it proves anything it proves that the pillars of Vision 2030 are going to be implemented fully," said Abdulla Al Zamil, chief executive of Zamil Industrial and chairman of Gulf International Bank. "A lot of things were announced back in 2016 and 2017 and now we are seeing a lot of the vision pillars being implemented as promised, be they structural reforms or regulatory reforms ... if anyone had any doubts about vision implementation the IPO proves that Mohammad bin Salman is marching ahead."

Ihsan Bu Hulaiga principal consultant at Joatha Consulting Center, said Aramco's IPO will "instigate economic growth so the economy will have a better chance to cater to vision 2030 targets."

The offering also "brings about a new dimension of possibilities to Tadawul and to the financial market in Saudi Arabia," Mr Bu Hulaiga added. "It will, with time, bring in additional appetite from foreign institutional investors and it will also upgrade the dynamics of the Saudi stock market to be on par with the best and most competitive markets."

Aramco has been at the front and centre of the kingdom’s economic reform agenda after the three-year oil price slump that began in 2014 and pushed the crude price below $30 per barrel in the first quarter of 2016. Though the price of oil has since bounced back to above $80 per barrel in the last quarter of 2018 and is currently hovering close to $60, the kingdom is continuing to institute wide-ranging economic and social reforms rather than slow down. The key pillars of the overhaul agenda are to cut Saudi Arabia’s dependence on oil, incubate homegrown industries, develop alternative revenue lines and sell stakes in state-owned entities such as Aramco.

"We do not expect any change in short-term production policy from Saudi Arabia in response to the IPO and that Saudi Arabia’s commitment to the OPEC+ production cuts will remain in place," said Edward Bell a commodity analyst at Emirates NBD.

-With assistance from Deena Kamel