Applications for US unemployment benefits gradually eased last week despite a stream of business reopenings, underscoring the longer-term labour market challenges caused by the coronavirus pandemic.

Initial jobless claims for regular state programmes totalled 1.54 million in the week ending June 6, down from 1.9 million in the prior week, Labour Department figures showed on Thursday. Applications for unemployment insurance have fallen consistently each week since peaking at the end of March, but the volume of weekly filings is still more than double the worst week during the Great Recession.

The median estimate in a Bloomberg survey of economists called for 1.55 million initial claims in the latest week.

Continuing claims – the total number of Americans claiming ongoing unemployment benefits in state programmes – decreased by less than estimated to 20.9 million in the week ending May 30. Those figures are reported with a one-week lag. The four-week average of continuing claims declined for a second week, to 22 million.

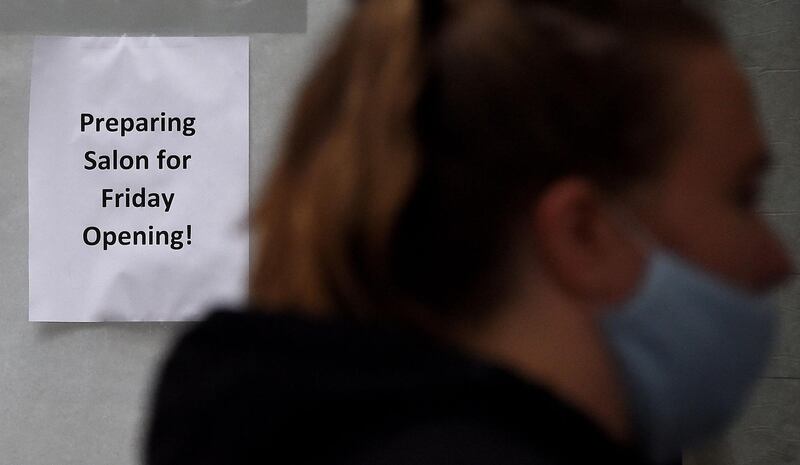

When paired with the May employment report out last week, which showed employers added 2.5 million workers to payrolls in the month, Thursday’s data underscores the degree of churn in today’s labour market. Millions of Americans are returning to work, businesses are reopening and many restaurants are once again serving dine-in customers.

At the same time, companies continue to face diminished demand and are laying off workers as a result of the financial strain. The worst of the coronavirus-related layoffs is likely to be over, but the secondary effects of what may ultimately be the deepest recession in almost a century could persist for much longer.

Federal Reserve chair Jerome Powell expressed concern on Wednesday about longer-term unemployment challenges after the pandemic. “My assumption is that there will be a significant chunk, well, well into the millions of people who don’t get to go back to their old jobs and there may not be a job in that industry for them for some time," he said. "It could be some years before we get back to those people finding jobs.”

Yields on 10-year Treasuries extended their decline following the report, while US stock futures remained sharply lower amid concern about the virus and the speed of the economic recovery.

While many states saw declines in continuing claims, several saw significant increases including California, Florida and Oregon – potentially reflecting the processing of a backlog of claims. Florida saw an increase of about 306,000 from the prior week.

Given the unprecedented surge of claims in recent months, many economists look to the non-seasonally adjusted figures for a more accurate read on claims. Unadjusted initial claims fell by about 83,000 last week, compared with the seasonally adjusted decline of 355,000.

Many states recorded increases in initial claims, including California with about 29,000, Massachusetts at about 17,000 and New York with about 12,000. Florida recorded the largest decrease, at about 97,000.

In the week ending June 6, states reported 705,676 initial claims for Pandemic Unemployment Assistance, the federal programme that extends unemployment benefits to those not typically eligible like the self-employed. The total number of unadjusted continuing claims in all programmes fell slightly to 29.5 million in the week ending May 23.