The GCC consulting market is set to expand 11 per cent and exceed $6 billion in revenue this year, as economic diversification strategies and giga projects boost demand for its services, a report released Wednesday has found.

The industry’s growth is also likely to lead to increased hiring in the region, in contrast to the worldwide trend, where major consultancies have been trimming their workforce, according to Source Global Research.

The regional market’s projected expansion comes after revenue last year rose 13.2 per cent to hit $5.4 billion, compared to slowing growth in other global markets – France’s market grew by 5.4 per cent last year, while in the UK it rose by 4.7 per cent, the latest annual report by Source found.

Saudi Arabia’s consulting market – the GCC’s largest – expanded faster than the overall market in 2023 at 18.2 per cent, as revenue reached a record $3.2 billion.

The UAE’s market also rose by 15.2 per cent to reach $1.1 billion, while Kuwait’s grew 8.9 per cent to $315 million and Bahrain’s expanded 7.2 per cent to $146 million.

Qatar’s market, meanwhile, fell sharply by 9.8 per cent annually to $445 million – after swelling sharply in 2022 due to the Fifa World Cup – while Oman’s dipped slightly by 0.3 per cent to $156 million.

“What we’re really seeing is the GCC bucking the trend when it comes to macroeconomic gloom,” Dane Albertelli, senior research analyst from Source, told The National.

“Central governments are continuing to pump large amounts of funds into giga projects and economic diversification initiatives, which is only going to benefit the consulting market as a whole.”

While regional tensions due to the continuing war in Gaza have affected the wider Mena region, the GCC’s economies have not felt any major impact so far.

"Barring any large-scale escalation in regional conflict, what we’re seeing is the GCC consulting market being generally unaffected," Mr Albertelli said.

Investment from the public sector remains strong as vast megaprojects reach the implementation stage, while companies in the region are looking to expand into new growth areas created by diversification initiatives, the report said.

The governmental push across the Gulf to “create better, more vibrant and thriving countries” is the main driver behind the growth of the consulting market in the region, agrees Varun Malik, managing director of Konsalidon, a digital platform that connects companies with consulting firms.

In Saudi Arabia, for example, the consulting sector's growth has been driven primarily by the kingdom’s Vision 2030 economic diversification agenda, which seeks to reduce its reliance on oil and tap into other high-growth industries such as manufacturing, technology and tourism.

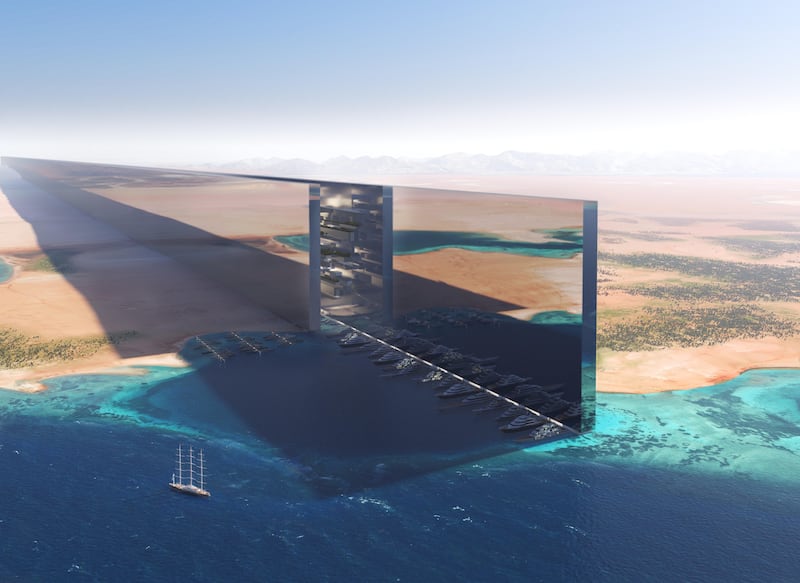

Saudi Arabia’s sovereign investment arm, the Public Investment Fund, is backing several projects in the kingdom including the $500 billion futuristic city Neom, and multibillion-dollar developments on the Red Sea coast, as well as in Riyadh.

“Expo 2030, as well as World Cup 2034, are set to be held in Saudi Arabia and the derivative excitement created by these events is driving growth in the private sector,” Mr Malik told The National.

Across the GCC last year, the public sector (up 12.6 per cent to $1.35 billion) and financial services (up 12 per cent to $1.5 billion) performed strongly, “despite their already well-developed market size, reflecting the health of the GCC market and the scale of investment that central governments are pouring into consulting use”, the Source report said.

While all industry sectors posted double-digit growth, health care (up 16 per cent) and pharma (up 17 per cent) recorded the fastest revenue increase, it added.

Up to 56 per cent of organisations also said they have seen significantly increased competition between GCC members.

“As countries in the GCC look to further develop their economies away from their reliance on fossil fuels … the battle for external expertise is only set to increase,” Mr Albertelli said in the report.

“This new form of interstate competition demonstrates a clear opportunity for consulting firms operating in the region to engage with organisations and provide them with new services and insights, such as innovative ways to make the most of fast-growing areas of the economy, like tourism and retail.”

Hiring or firing?

Globally, several consultancies have slashed their workforce in recent years, especially in markets such as the US, amid global economic uncertainty.

Last March, global consultancy Accenture revealed plans to cut 19,000 jobs, or about 2.5 per cent of its workforce, over the next 18 months to reduce costs.

Last month, Accenture also cut its revenue forecast due to the “uncertain macro environment”, while Deloitte announced a significant reorganisation in a bid to “modernise and simplify” its strategy.

Last week, McKinsey, which cut 1,400 jobs in 2023, also reportedly offered some of its staff in the UK and the US nine months of pay to leave the company.

“Consulting teams are nice to have [but] not always mission-critical,” said Mr Malik.

“During Covid, and right after, demand for consulting services was sky-high as organisations everywhere were looking to understand how to navigate the pandemic, pivot their business models and stay afloat during an uncertain time."

This led to a lot of consulting firms “getting excited and hiring way more people than they needed in the long term”.

But demand has since cooled, forcing consulting firms to reassess their structures.

According to Mr Albertelli, consultancies in the GCC are bucking the global trend for now.

“Lots of the large consulting firms are really ramping up their operations in the region, opening more offices and making all of their service lines available to businesses in the GCC, with technology expertise in particular demand,” he said.

“As well as hiring local talent, they are also bringing in specialists from their global networks.”

However, if regional geopolitical tensions escalate and global economic conditions worsen, the outlook might change, according to Mr Malik.

“Consulting is discretionary spend – unlike audits, for example – and so as budgets tighten, consulting services will be viewed as non-essential,” he said.

"This will lead to more people being let go and workforces being slashed at consulting firms in the region – otherwise regional consulting firms will just bleed money if they have a lot of people ‘on the bench’ and they won't be able to sustain their businesses."

Tech push

Looking ahead, organisations in the GCC said their already heavy use of consultants will only increase in the coming year as diversification initiatives continue, Source said.

Productivity improvements as well as cutting costs are now the most-discussed topics at senior levels in the GCC, as organisations want to be more efficient but are also seeking to build resilience amid the volatile macroeconomic situation, it added.

The advent of ChatGPT and other artificial intelligence software, and wider technology discussions are also high on the agenda as companies adopt digital transformation strategies.

“Along with tight deadlines and the need to stay ahead of rivals, organisations are also in the midst of transforming their technology infrastructure," Mr Albertelli said.

"This ultimately means that consultants will be in demand for a whole host of reasons and firms with the greatest breadth of expertise are the most likely to be the most wanted."

According to Mr Malik, while entities across the region, especially the public sector in Saudi Arabia and the UAE, traditionally relied solely on the brand name consulting firms, there has been a "very clear move away from the larger firms towards smaller firms".

"Clients have begun to understand that boutique firms can deliver significant value – often more value – than the traditional large firms."

Despite the growing adoption of AI, he does not believe there is any immediate threat to consulting roles.

"In the short to mid-term, I personally think consultants are safe. Current AI is more of a solution for administrative tasks, and for repeatable processes. I don't think we have AI in place yet that can truly replace a consultant, though AI will certainly augment the work of consultants. One of my consultant jokes that he has two analysts on his team – ChatGPT and Gemini," he said.

However, in the long term, there will be a gradual shift towards more AI usage in business.

This will enable AI to offer "thoughtful responses to complex challenges and situations, present several strategic choices to management, and even offer guidance on how an organisation should proceed", Mr Malik said.

"I do believe that at some point AI and other technology will certainly replace the work of consultants but I don't think we're there yet."