It is deeply therapeutic and satisfying to do something where you see immediate results – isn’t it? But it could be at our peril.

Last weekend I got busy clearing out and cleaning kitchen cupboards. The aim: to experiment with colour and paint them. Having spent a few hours on this, I then took a big step back – and realised I’m going to dismantle and chuck the lot instead. The right thing to do is redesign the space from scratch and not be constrained by what already exists.

I was the victim of “busywork” instead of productive work. I felt I would be serving my best interest by getting the elbow grease going. Not figuring out the bigger picture first and making sure that my busywork serves that purpose means that my efforts were wasted.

It reminds me of the time a young man proudly showed me the app he had been using to track his daily spending – every single money transaction for three years.

You’d think he had his financial life sorted, feeding the information into his bigger picture life plan. But no. He’d done the busywork of collecting a data trove and done nothing with it. Nothing. Lots of busywork, but zero productive work.

What a waste!

The other thing I fell victim to is being hemmed in by existing structure. By “the way it is”. Each of our lives is unique. My kitchen will reflect how I live and what I want, eg to be able to face my children while I cook instead of them seeing the back of me.

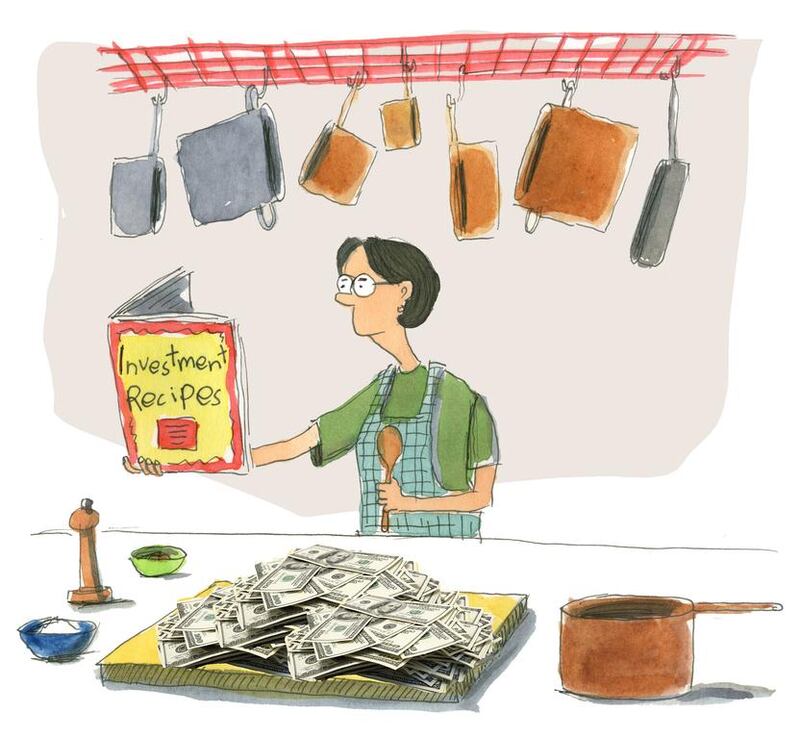

The same goes for financial planning, or should I say strategising. You see we often think we are being good and planning our financial future, when in fact we are delving into investment options. There is a vast difference.

Here are two thoughts: let us stop using the word plan.

A financial strategy is what we need. Why? Because we appear to confuse “planning” with the busywork side of our personal finances and don’t look at the whole of our life. Plus I think this will help free us from the existing constraints of what’s traditionally on offer.

Managing an investment portfolio is not financial planning or strategising. It is managing your investments.

Misleadingly named financial planning firms are happy that you haven’t woken up to this. This is why they are putting out calls for more recruits to take your money. A quick web search for financial adviser jobs on offer in the UAE shows that there are quite a few available – one online overseas recruiter boasts salaries starting at £70,000 (Dh312,749) – with more than double achievable for the right sort of candidate. The fees you pay for the privilege of squirrelling money with them, while you pat yourself on the back thinking you are doing the right thing, is what’s funding this.

What we need is strategic planning. Smart decisions that are relevant to the unique you and me. And we need help figuring them out. This is why talking to people is a good thing. We are complex beings, and what’s right for you might be wrong for many others. Liken your financial strategy to your fingerprint. There’s only one person – you – with your print. Same goes for how your life has played out and where you want to head.

Talking to financial advisers – not financial salespeople – will help us to figure these things out. If you can find them.

I think the right kind of adviser would offer a fee-based structure. The existing system is conflicted – with earnings linked to products (plans) bought into. Having said this, I thought I’d found the “right sort” and duly paid a flat annual fee, only to realise – always in retrospect – that it was rubbish, because their approach was traditional, as were their offerings: non-performing so called savings policies for children’s education, ditto for my retirement. I got out of them – at a huge loss.

What I did with my kitchen only cost me half a day of my life. Yes I wish I could get that time back, but at least it’s not the kind of damage that accrues when we don’t think about what our strategy is when it comes to our life and our finances.

Take a step back, do not be restricted by what convention dictates. What is your strategy? What are you doing about it?

Nima Abu Wardeh describes herself using three words: Person. Parent. Pupil. Each day she works out which one gets priority, sharing her journey on finding-nima.com.

pf@thenational.ae

Follow us on Twitter @TheNationalPF