E-commerce is forecast to grow 14 per cent globally over the next five years, giving breathing space to the air cargo industry that is witnessing its worst year in a decade because of the US-China tariff war.

The global e-commerce industry, which makes up 16 per cent of total air cargo business, is projected to more than double from $2 trillion (Dh7.34tn) worth of goods in 2019 to $4.4tn by 2025, according to the International Air Travel Association (Iata), the trade body with more than 290 member airlines.

"Huge increase in internet penetration allows customers to compare prices around the world of different commodities they'd like to purchase and they become accessible through a number of technologies across cross-border shipping, logistics and payments," Brendan Sullivan, head of e-commerce and cargo operations at Iata, told reporters in Geneva.

Some global carriers are working to gain a bigger share of the door-to-door delivery market that has been dominated by online shopping giants such as Amazon, Alibaba and JD.com. Dubai-based Emirates has launched Emirates Delivers, Lufthansa has Heyday and British Airways parent IAG has Zenda.

The air cargo industry is well-positioned to capitalise on the growth in e-commerce, according to Iata.

"Air cargo is built to handle e-commerce, approximately 80 per cent of business-to-consumer cross-border e-commerce is transported by air," Mr Sullivan said.

China and the US are the biggest e-commerce markets globally because of their large population size, total gross domestic product, manufacturing capabilities and high internet penetration.

The size of China's e-commerce market is valued at $723 billion in 2019, which is projected to grow 51 per cent by 2023, according to Iata.

"China is a huge purchaser as well as a large exporter and has a significant size of online shopping market," Mr Sullivan said.

The US e-commerce market is worth $365bn and forecast to grow 55 per cent to $566bn over the next five years.

"This creates a huge opportunity for cross-border e-commerce as well as stimulating domestic e-commerce," he said.

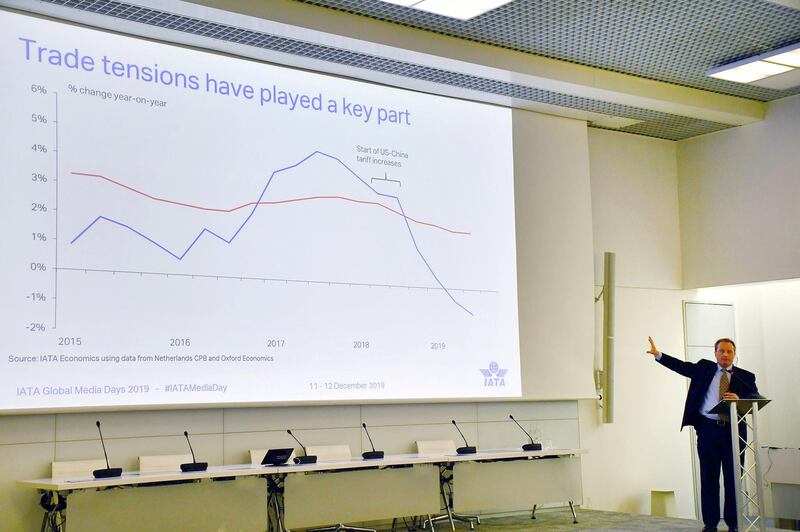

However the growth in US and China's e-commerce markets will depend on a truce in the trade war between the world's two biggest economies.

"If the trade issues resolve favourably, you can see this will have a huge impact because much of the goods will move around to these two huge e-commerce markets," Mr Sullivan said.

On December 16, Washington and Beijing agreed on the terms of a so-called "phase one" trade deal that will see the US reducing some tariffs on Chinese imports in exchange for China increasing its purchases of American agricultural, manufactured and energy products.

While the US and China are the biggest e-commerce markets, the distribution of e-commerce growth across regions is uneven, with some countries capitalizing on it more than others.

"Emerging markets can also pose an opportunity for cross border e-commerce growth in the next decade," Mr Sullivan said.

From a consumer point of view, the most popular goods sold through online shopping are clothing, shoes, and consumer electronics.

The most popular items that are sold online and moved by air transport for its speed and reliability are consumer electronics, cosmetics and body care and higher-value food and drinks.

"Air cargo is the preferred way of shipment for electronics due to relatively small volume or tonnage in comparison to high value," Mr Brendan said. "It is also suitable even for higher value food and drink products."

In China, beauty and cosmetic products are the most popular goods for cross-border e-commerce purchases.

While consumer demand for online shopping remains robust, consumers are also increasingly conscious of their impact on the environment.

About 50 per cent of respondents in a customer survey would opt or "greener" shipping to reduce their carbon emissions, Mr Sullivan said. About 61 per cent said they'd pay a small, 0.10 euros, fee for carbon-neutral parcel delivery.