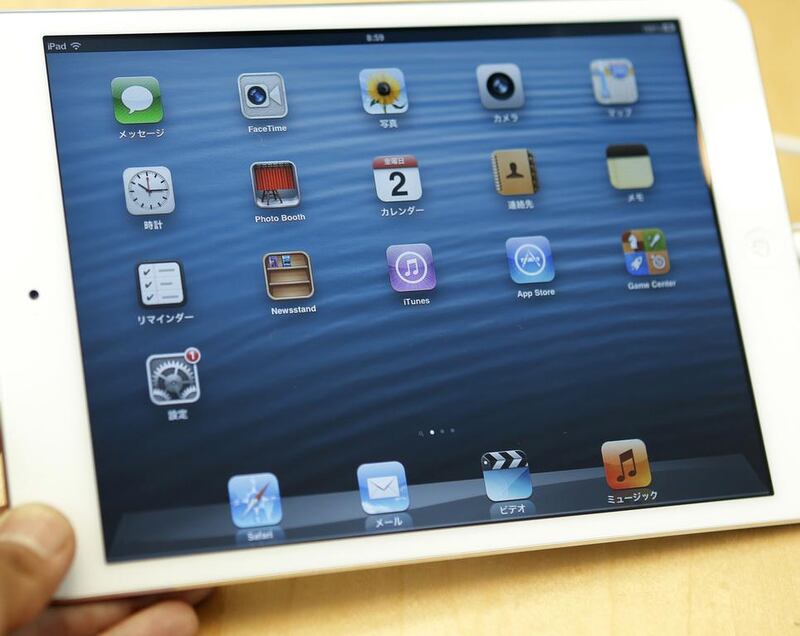

The iPad is losing steam just four years after its release, but an alliance with International Business Machines (IBM) could rejuvenate a flagging product by entering into a largely untapped corporate market.

Apple, which released its fiscal third-quarter results today, said it shipped 13.2 million iPads in the June quarter, 8 per cent fewer than a year earlier and lagging Wall Street's forecast for 14 million or more. Sales of the device, which accounted for 15 per cent of revenue, fell short of Wall Street's expectations for the second quarter in a row.

Apple helped create the tablet market in 2010 with its first iPad. But growth has plummeted from 2012, as larger phones became more popular and people delayed replacing their tablets. And it is ceding market to mostly cheaper Android offerings from Samsung and Chinese manufacturers using Google software.

Apple’s chief executive Tim Cook described iPad sales as “very bifurcated” - they continue to grow at 50 per cent or above in emerging markets such as the Middle East and China, but in developed countries like the United States, the “market is weaker”.

Research firm IDC lowered its forecast for 2014 worldwide tablet demand growth to 12.1 per cent - a fraction of the 51.8 per cent expansion of 2013. The first quarter of this year also saw Apple’s market share slide to 32.5 per cent, from 40 per cent a year earlier.

“The tablet market globally has really hit a wall,” said Cantor Fitzgerald analyst Brian White.

Another threat to iPad sales may come from within. Apple is expected to introduce a larger 5.5-inch iPhone in the fall. At those dimensions, the iPhone would begin closing in on the 7.8-inch iPad mini.

“You have the negative impact of the larger screen iPhone and what that would do to iPad mini,” said Piper Jaffray analyst Gene Munster. “You’re going to get a larger screen iPhone before you’ll get contributions from the IBM partnership.”

Investors hope the partnership with IBM announced this month will help bolster sales in the largest global enterprises, which could provide a boon to US tablet sales.

Mr Cook cited IDC figures showing that iPad penetration among businesses stood at about 20 per cent, versus 60 per cent for notebook computers.

Analysts say the alliance, in which the two companies will work on a suite of secure business apps, may take years to show up in the bottom line. But they see potential in marrying IBM’s business-software expertise with Apple’s hardware and services.

“I do believe Apple can leverage IBM’s channel,” said Mr White.

Growth areas include the retail sector, where employees may increasingly use tablets for inventory management, as well as financial services, and transportation, he said. Other promising sectors included education and health care.

“We see the importance of the customer ... and both feel that mobile and enterprise is just an enormous opportunity,” Mr Cook, a former IBM executive himself, said on a conference call. “And we’re not competing with each other so a partnership in that case is particularly great.”

Overall, Apple’s quarterly results showed a 12 per cent rise in net income to $7.75 billion and a 6 per cent revenue increase to $37.4 billion, with strong iPhone and Mac sales making up for the drop in iPad demand.

In the most recent quarter, iPhone sales rose 13 per cent to 35.2 million and Mac sales increased 18 per cent to 4.4 million. That helped offset a second-straight quarterly decline for the iPad, with sales dropping 9 per cent to 13.3 million as the tablet market becomes more saturated, especially in the US and Western Europe.

The results reinforced the importance of the iPhone, which accounts for more than half of Apple’s revenue and about 70 per cent of total profit, according to ISI Group.

China also continues to be a major focus for Apple. Over the past quarter, the company said iPad sales jumped 51 per cent in the world’s most populous country, while iPhone sales rose 48 per cent, boosted by a partnership to sell the handset through wireless carrier China Mobile. Mac sales also increased 39 per cent in China, Mr Cook said.

Along with China, sales in Brazil, India and Russia also have been strong. IPhone sales in those countries increased a total of 55 per cent last quarter.

International sales accounted for 59 percent of the company’s revenue last quarter.

Apple also boosted its dividend. The company said it would give a dividend of 47 cents a share that will be payable on Aug. 14 to shareholders of record as of Aug. 11. Through dividends and buybacks, Apple has now paid out $74bn as part of a $130bn capital return programme that is authorised for another six quarters.

Apple had $164.5bn in cash and investments at the end of last quarter, with all but $27bn held outside the US.

Looking ahead, the imminent release of new gadgets is crucial for Apple. The company, which hasn’t released a new mobile device since last year, is working on larger-screen iPhones, a potential wearable device and an upgrade to Apple TV, people familiar with the plans have said.

Apple has released new iPhones each September for the past two years.

* Additional reporting by Bloomberg News

business@thenational.ae

Follow The National's Business section on Twitter