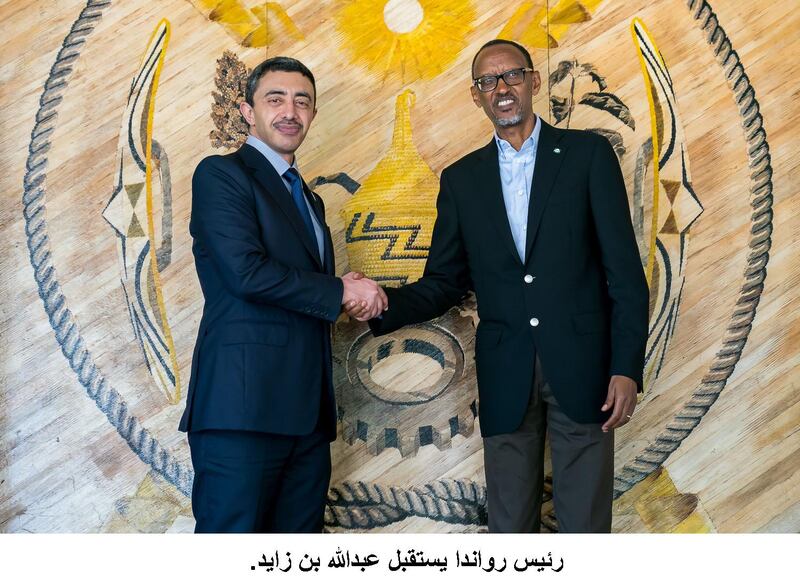

Every year Abu Dhabi's Ataya exhibition – a medley of food, clothing and jewellery shops – raises funds for domestic and international aid organisations. Managed by the Emirates Red Crescent charity, it is part of the extensive efforts that have helped make the UAE the world's 10th largest aid donor. This year, Ataya revenues will fund a series of health and education initiatives in Mauritania, shining a much-needed spotlight on the UAE's growing aid and investment interests in Africa. It coincides this month with a visit to the continent by the UAE's Minister of Foreign Affairs and International Cooperation. Sheikh Abdullah bin Zayed met officials from Ethiopia, Mali, Rwanda and Senegal, inaugurating embassies in the latter two and discussing bilateral relations in the fields of education, security and investment.

Although China dominates investment in Africa – and therefore the headlines – the UAE's presence is not new. In terms of capital expenditure, the country was the world's second largest investor in Africa in 2016, to the tune of $11 billion. (That year overall Middle Eastern investment was $15.6bn.) Since 2002, Dubai's non-oil trade with the continent has grown by 700 per cent. As The National reported this week, the Abu Dhabi Fund for Development has allocated Dh64.2 million towards renewable energy projects in the Seychelles, bringing total investment in the East African island nation to Dh399m. India and the UAE are planning to investigate joint export opportunities on the continent, while this country is contributing to a West African force to battle Islamic militants in the troubled Sahel region. From investment in African aviation and manufacturing to humanitarian assistance, the UAE is ahead of much of the world.

And with good reason. Africa is changing fast; in the last few months, entrenched leaders have fallen in Zimbabwe, South Africa, Angola and Ethiopia. And as change sweeps the continent, huge growth will inevitably accompany it. The continent’s hungry young population and underdeveloped infrastructure make it an attractive proposition. Poor governance and rampant corruption – which have consistently spooked investors – are increasingly a thing of the past. What begins with aid will ultimately feed into huge business opportunities on the continent. As it transitions away from oil dependence in the coming decades, the UAE is positioning itself to participate in the African growth story. The opportunities for mutual benefit are immense.