Faiz Alam Ansari thinks it is a great time to be a hotelier in India.

He is the complex general manger of the Sheraton Grand Bengaluru Whitefield Hotel in the south Indian city also known as Bangalore. Business is brisk at the property.

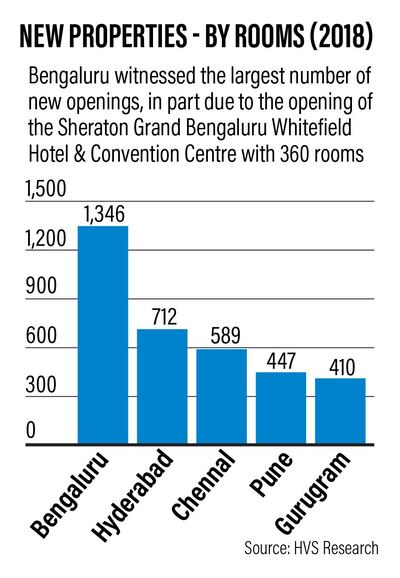

“There is a huge increase in demand and also the limited supply of hotels helps,” says Mr Ansari. The hotel only opened one year ago – the 100th property in India under Marriott International's portfolio of hotel brands, which include Sheraton, Aloft and Le Meridien.

The data for the industry supports Mr Ansari's optimism. Average hotel room rates in 2018 rose by 6.25 per cent over the previous year to 5,950 rupees (Dh315) while occupancy levels increased to 66 per cent last year compared to 64 per cent in 2017, according to a report released this month by the consultancy HVS Anarock. It forecasts that revenue per available room, an indicator that takes both occupancy levels and room rates into account, will grow by 9.5 per cent this year.

"The hotel industry is currently at the cusp of an up-cycle," says Pratik Tholiya, the associate vice president for institutional equity research at Elara Capital, an investment bank based in Mumbai. "The occupancy is at the decade high and the average room rates are the highest since 2012."

A steady flow of foreign tourists, an increase in discretional spending due to a rise in disposable incomes and the country's expanding middle-class population, plus increasing business travel, are all factors driving this trend, he explains.

There are some short-term headwinds, though.

“The ongoing general elections could dampen some of the sector’s otherwise upbeat performance in 2019,” says Mandeep Lamba, president for south Asia at HVS Anarock. During the six weeks of the general election, which runs until May 23, companies are cautious and may hold off on expansion plans that would involve business travel. Also, an increased supply of nearly 8,574 rooms set to open in India this year could have an impact, he adds.

“However, the tide is set to change this year as market sentiments can recover with the aid of a stable government, post-elections, to support the required economic growth,” Mr Lamba adds. “Banking on this important factor and also considering the limited new supply in 2020, the hotel industry can record its highest-ever occupancy.”

While hotels in many countries largely depend on foreign tourists to fill their rooms, in India it is tourists travelling within the country and business travellers who are the main drivers of demand.

Business tourists make up 60 per cent and leisure tourists 40 per cent of guests for India’s hospitality industry, according to Elara Capital, an investment bank.

Of the non-business traveller market, domestic tourists make up 76 per cent of guests, while foreign tourists account for the remaining 24 per cent.

In large part, this is due to the fact that the number of overseas tourists visiting India is relatively small considering the size of the country. India in 2017 attracted just over 10 million foreign tourists, according to the ministry of tourism. By comparison, Dubai received 15.8 million tourists in the same year.

“Most of our guests are business travellers,” says Srijan Vadhera, the general manager of the Conrad Bengaluru, a luxury property operated by Hilton. “However, during the weekends we do get a lot of domestic tourists checking in.”

The number of overseas tourists is rising in India, however, with foreign visitors up 14 per cent in 2017 over the previous year, data from the ministry of tourism shows.

Domestic tourism, meanwhile, is booming. Domestic tourist trips in the same year totalled 1.65 billion, driven by factors including the rise of budget air travel. Fierce competition between India's airlines has driven down fares, which in turn is helping to fill hotel rooms.

Pascal Gauvin, the managing director for the India, Middle East, and Africa region of IHG, one of the world's biggest international hotel chains with brands including InterContinental, Crowne Plaza and Holiday Inn, says that while occupancy rates have been improving significantly in the country, it has not been easy to increase room rates.

“Unbranded economy hotels that add to the lower end of the price range create stiff competition that instigate further rate cuts,” says Mr Gauvin.

IHG’s revenue per available room for India was up 9.8 per cent in 2019 over the previous year, he says. But the company had to work hard to “increase rates incrementally across key markets by maintaining industry-leading revenue practices in our hotels, providing our revenue management teams with proprietary tools and training”, he says.

The chain in India is largely focused on tapping the country's large pool of mid-market travellers, which means that IHG is focusing on expanding its Holiday Inn brand.

“The Indian market is driven by domestic travel and the rising middle class [which is] resulting in an increased demand for hotels in the mid-scale category,” says Mr Gauvin.

The company operates 27 Holiday Inn hotels in India and has a further 33 properties under the brand under development and due to open within the next three years.

Other major hotel companies that are expanding in India include Marriott and Radisson. Marriott says India is the company’s second-fastest growth market in the Asia Pacific region after China, and it has plans to open more than 50 new properties. Marriott says it expects to have more than 30,000 rooms open in India by the end of 2023.

India is a highly price-sensitive market when it comes to domestic leisure travellers who spend their own money rather than using company expenses, says Neelu Singh, the chief executive of Ezeego1, an online travel agency. Therefore, developing good value hotels for this market is key.

“The development of midscale and budget hotels is what is going to fuel the growth in demand from the leisure segment,” says Ms Neelu.

Popular tourist destinations including Goa, Jaipur, Kerala, Shimla are places where there are opportunities for hotel chains to target leisure traveller, says Karan Anand, the head of travel company Cox & Kings in India. “Cities like Mumbai, Bangalore and Delhi host both business and leisure tourists but the share is skewed towards business travellers.”

But building hotels can be a long process in the country, with expansion plans frequently hindered by numerous obstacles.

“Land availability and rising real estate costs are one of the main reasons of low development of budget and mid-market hotels,” says Mr Anand.

Other factors holding back the sector’s expansion include a drawn-out bureaucratic process to secure government approvals and licences to develop hotels in India, he says.

A shortage of skilled employees in the country is another major hurdle for the hotel industry in India.

“The travel and tourism sector is one of the major creators of jobs in India,” says Mr Vadhera at the Conrad Bengaluru. “However, the industry is faced with a challenge to bridge the gap between the supply of trained manpower and the demand in the industry.”

Down the road in Bangalore, Mr Ansari says finding and retaining staff is one of his biggest headaches. Part of the problem is that salaries in the industry are generally quite low in India, while there is fierce competition for the limited pool of skilled employees, he says.

But he remains upbeat about the outlook for his hotel's performance.

“We're expecting double-digit growth numbers in the next year,” he says.