An antitrust advocacy group called on all 27 members of Facebook’s cryptocurrency effort – which include Spotify, Mastercard, Visa and Uber – to withdraw from the project immediately amid a hearing before the US Senate to examine the digital currency known as Libra and mounting criticism of the project.

“Today’s hearing confirmed that there are clear privacy risks, monetary risks, regulatory questions and monopolistic questions that are far from being answered,” said Matt Stoller, senior fellow at the Open Markets Institute. He said David Marcus, the head of Facebook’s Calibra, which is overseeing the Libra initiative, had not addressed privacy issues in his testimony on Tuesday.

With Libra’s regulatory hurdles in the spotlight, cryptocurrency markets have been reeling. Bitcoin dropped below $10,000 (Dh36,725) three weeks after surging above it for the first time in more than a year as US policymakers aired concerns about the viability of digital currencies.

The largest digital coin by market capitalisation fell as much as 12 per cent on Tuesday, down 25 per cent from its June high of $12,733. Ethereum and Litecoin both declined 13 per cent, Bloomberg reported.

Criticism from both Republican and Democratic legislators included money laundering, sanctions enforcement and Facebook’s recurring missteps in protecting user privacy.

Senator Sherrod Brown, the top Democrat on the Senate banking committee, compared Facebook to a toddler playing with matches.

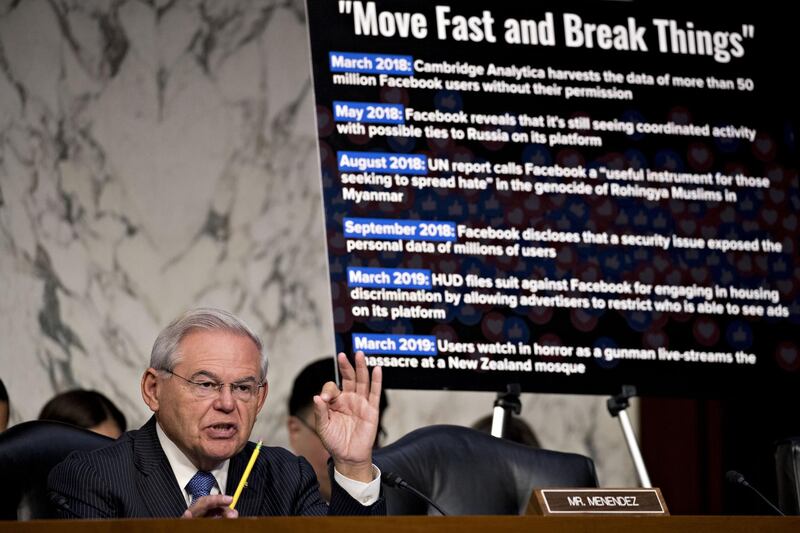

“Their motto has been move fast and break things,” Mr Brown said in his opening statement. “They certainly have. We’d be crazy to let them experiment with people’s bank accounts.”

Earlier this week, Federal Reserve chairman Jerome Powell also raised concerns about the project. In Europe, French finance minister Bruno Le Maire told Italian newspaper Corriere della Sera that the G7 would examine the Libra proposition at the meeting of finance ministers this week.

“The red line for us is that Libra must not transform into a sovereign currency,” he said.

Katharina Pistor, a professor at Columbia Law School and expert on global finance law, will testify on Wednesday before the US Senate Committee on Financial Services that Libra "has accelerated a debate that has long been coming: a debate about how to harness the opportunities and meet the challenges associated with fast-moving innovations in technology, including crypto technology".

Professor Pistor supports a draft bill titled "Keep Big Tech Out of Finance Act" that aims to prevent big tech firms – defined as those generating more than $25 billion in annual revenue – from becoming financial institutions but called the proposed law a "game slower" not a "game stopper".

Mr Marcus said Facebook won’t launch Libra until regulators’ concerns are fully addressed.