What was the general market movement in Abu Dhabi in the third quarter?

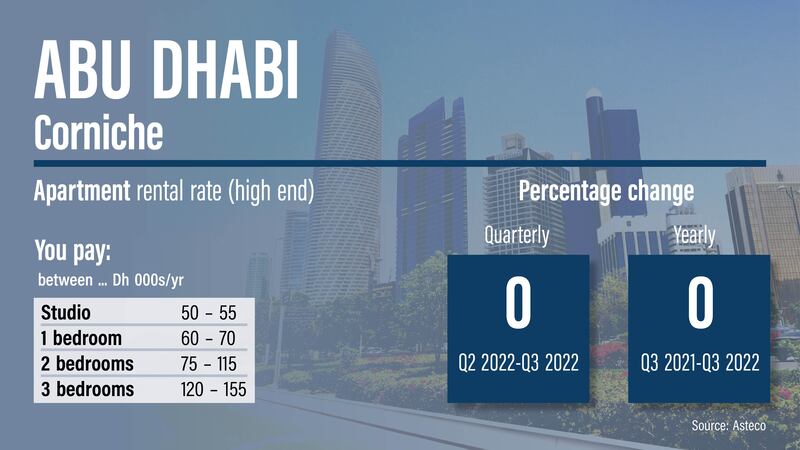

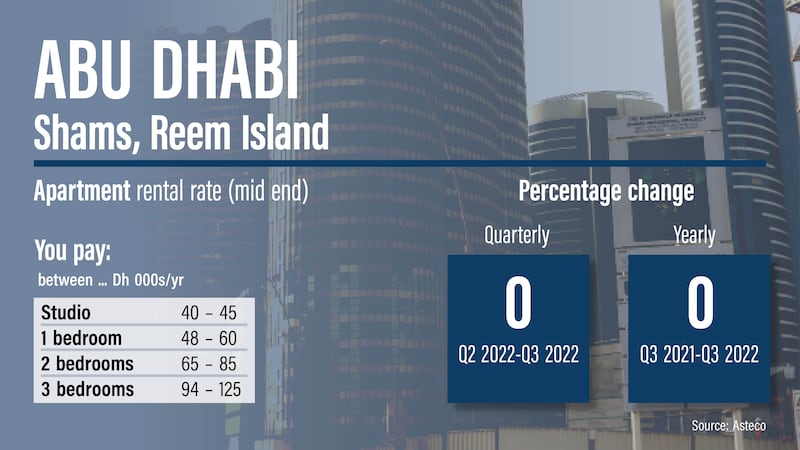

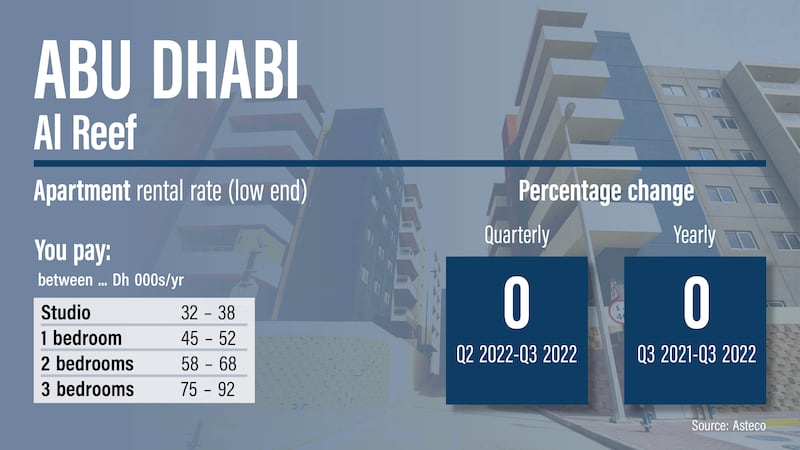

The market was largely stable between July and September, except for some marked rental growth for a selection of prime and high-quality developments, according to property consultancy Asteco.

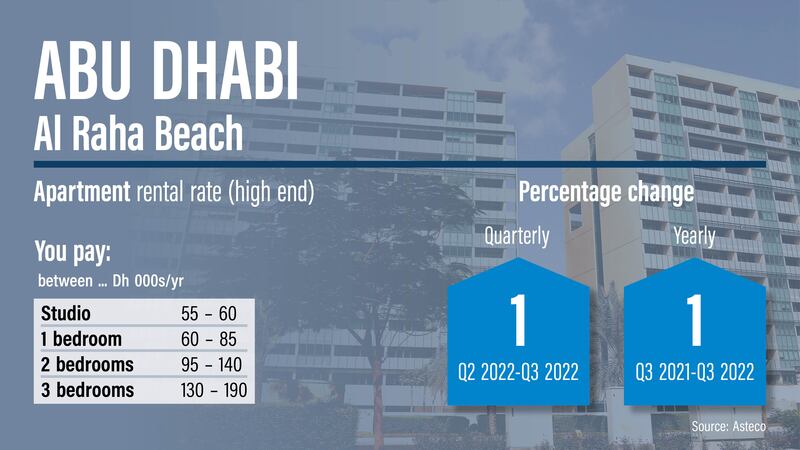

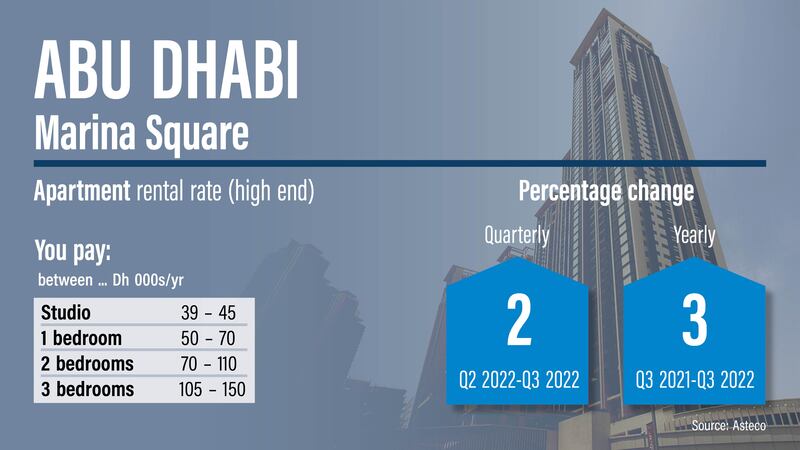

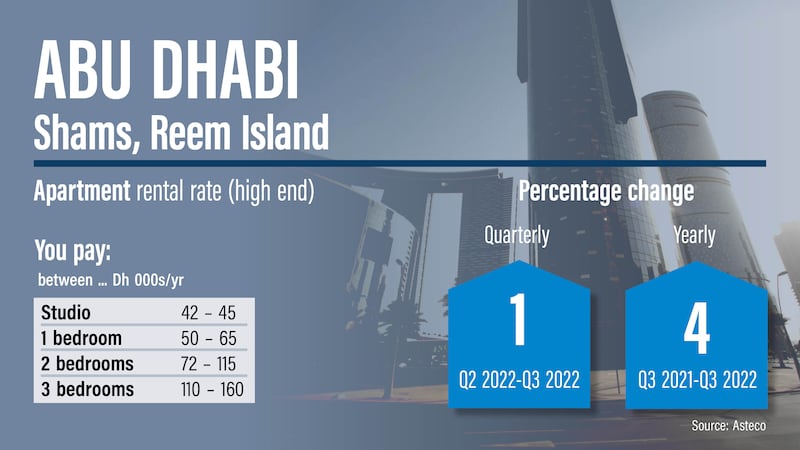

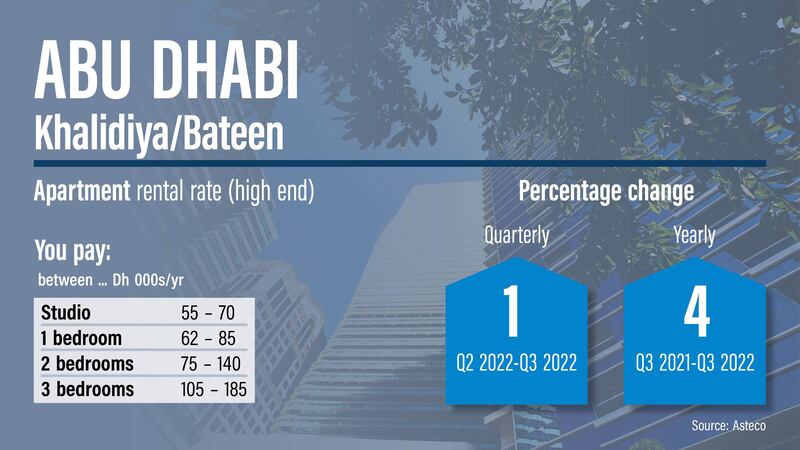

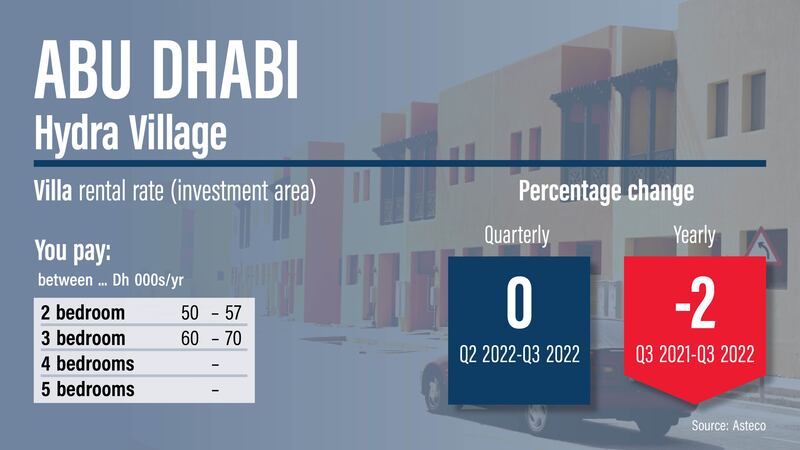

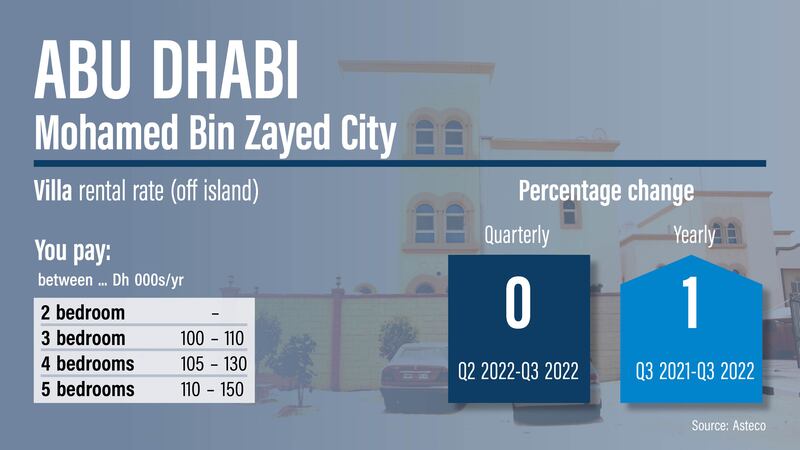

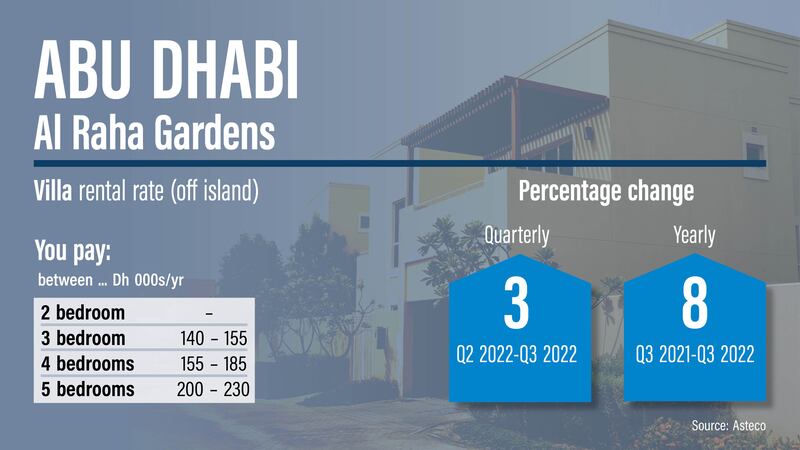

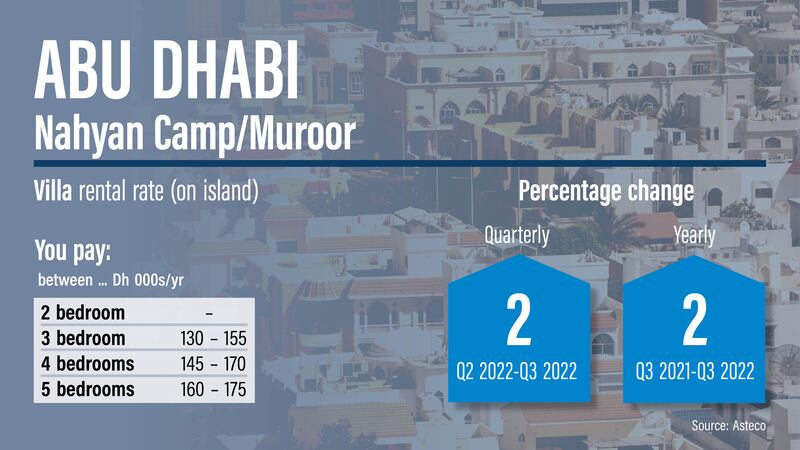

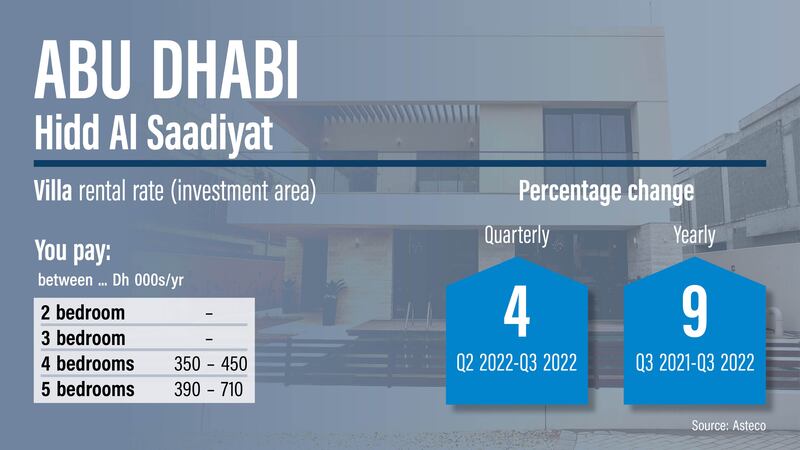

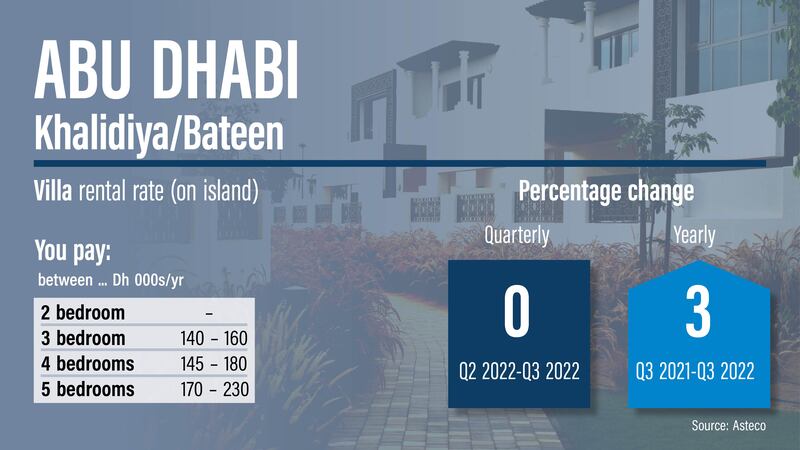

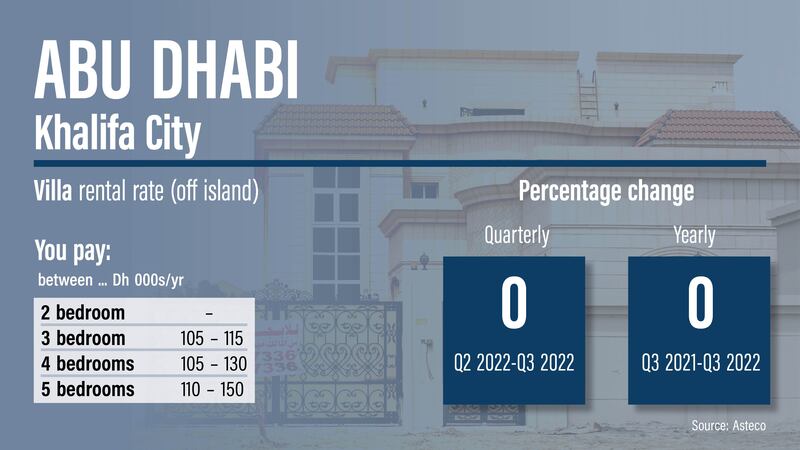

Average villa rates increased by 2 per cent quarter on quarter and 4 per cent year on year, while apartment rates were up 1 per cent quarter on quarter and 1 per cent year on year, it said in its third-quarter report.

This follows stagnant rates in the second quarter.

“There have been marginal rental rate declines for several lower-quality buildings located on the Abu Dhabi main island,” the report said.

“This is predominantly due to the increase in relocations from the city to areas that have seen the delivery and handover of a significant amount of new supply over the years, including Al Reem Island.”

Property agent JLL reported a small annual average rental rise of 2 per cent in the capital, and noted that demand is strong for new developments in investment zones — particularly for town houses and villas.

Bayut and dubizzle, meanwhile, said that average rents were largely stable in the affordable segment, with modest fluctuations of up to 5 per cent annually for certain bed types and 11 per cent for luxury rentals.

The UAE's property market has grown sharply during the past year amid the broader economic recovery from the coronavirus-induced slowdown.

Where were rents rising the most in Abu Dhabi?

The villa segment showed 4 per cent quarterly increases for Al Raha Beach and Hidd Al Saadiyat, according to Asteco. The latter has some of the most expensive properties to rent in the city, with rates upwards of Dh700,000 ($190,605) per year.

Saadiyat Island recorded the biggest quarterly rent increases for apartments, at 3 per cent.

Demand for bigger homes has remained steady since the shift to larger properties during the early part of the pandemic.

“This has pushed the price upwards for rental villas, in particular, within the luxury sector,” said Bayut and dubizzle. “With regard to the affordable sector, landlords priced their properties competitively to make them more appealing to tenants.”

Tenants on a stricter budget preferred areas such as Khalifa City A, Al Khalidiya, Mohamed bin Zayed City and Al Muroor, while Al Reem Island was most sought after for luxury apartments.

What about supply of new units?

JLL said 2,000 units were expected to be delivered in the remainder of 2022, with a total stock of 278,000.

Asteco meanwhile reported delivery of 1,000 units in the third quarter across Al Raha Beach, Al Reem Island and Saadiyat Island.

“The third quarter also recorded a number of noteworthy project launches including Al Jubail Island's Ain Al Maha Village comprising approximately 240 villas, and Yas Park Gate, which will bring about 500 residential units to the market once completed,” Asteco said.

“Several other projects have been launched over the last four to six months, predominantly comprising residential units with ancillary retail. Those are expected to start construction within the next three to six months.”

Asteco said 5,100 apartments were completed in the first half of the year, 1,000 in the third quarter and projected a further 2,350 in the fourth quarter with 100 villas also to be completed before the end of the year.

What other projects are in the pipeline in Abu Dhabi?

There have been quite a few significant ones announced this year.

Aldar last week launched Saadiyat Lagoons, a nature-inspired residential community in one of the most desirable areas of Abu Dhabi.

It will have 207 villas released in its first phase, which will be available exclusively for Emirati buyers on November 3. Prices start from Dh6.1 million.

Aldar also recently launched units at its Grove District on Saadiyat Island, and earlier this year it launched The Louvre Residences.

This will be close to Zayed National Museum, Louvre Abu Dhabi and Guggenheim Abu Dhabi, and will include five residential buildings with 612 units.

Bloom Holding launched the second phase of its Bloom Living project, which on completion will offer more than 4,000 residential units.

On Reem Island, Reem Hills will be an Dh8 billion (Dh2.17bn) gated community covering an area of 1.8 million square metres, and is to be built on a man-made hill — a first for the UAE capital.