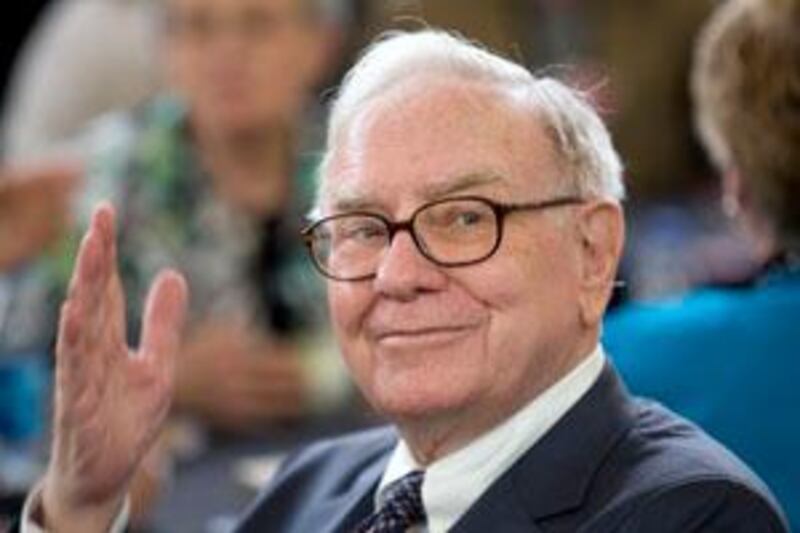

Legendary investor Warren Buffett is fond of this saying: "It is only when the tide goes out that you find out who has been swimming naked." The ongoing volatility in global stock markets means the tide has gone out, and it seems that some fund advisers and managers have been caught having a dip without their swimming costumes. Bernard Madoff and Alan Stanford may have captured the headlines of late, but they are far from the only individuals being investigated by financial authorities across the globe.

Last month, the UK's Financial Services Authority (FSA) took out a court injunction to freeze the assets of a firm called Upton & Co Accountants, which it believes had been peddling an investment scheme it called the "Currency Plan" to unsuspecting investors. The court order also stops Upton & Co from selling any further products. In addition, the authority went so far as to keep secret the details of Upton's scheme, fearing that it would be duplicated by other firms or individuals.

UK authorities also arrested three men over an alleged £50 million (Dh293m) investment scam last month, while in the US a British man was arrested in Los Angeles in late May in a separate alleged scam that netted US$7m (Dh25.7m) from unsuspecting investors. Back in the UK, the FSA has also issued a consumer alert against UK Expatriates Independent Financial Advisory Services (UEIFAS), which operates from Middlesbrough and Wrexham.

An FSA spokesman told The National that the alert was basically a fishing expedition, the beginning stages of gathering evidence. In short, the UK regulator suspects the firm may not have invested its client's money as it was supposed to have done, and is asking customers of the firm to make sure that any money they have invested through UEIFAS is where it is supposed to be. The frequency of such warnings from the FSA is on the increase. In the whole of last year it issued seven warnings; in the first three months of this year it had already issued four.

While it is relatively straightforward for investors to check that their money is held in the fund or product it is supposed to be in, it can be more difficult, if not impossible, for them to check what is going on with the fund itself. This is either because the investment products held in the fund were complex or actual fraud was involved, or in some cases both. As it happens, UK expats in the Gulf could be particularly susceptible to fraudulent advisers simply because they are significantly better off than average expatriate.

According to research by Banco Santander published in Nov 2008, the 500,000 or so British citizens living in the Gulf account for one quarter of all UK expatriate wealth. On average they have tucked away £125,000 in savings, compared to the £43,000 stashed away by UK expatriates based in Australia, or the £39,000 amassed by those living in mainland Europe. The FSA keeps a list of all the companies it has banned or warned against on its consumer information website, www.moneymadeclear.fsa.gov.uk. There are more than 100 firms listed.

It is also possible for consumers to verify that their adviser is authorised by the FSA. Many of the investors who lost money in the Madoff's alleged Ponzi scheme are now suing the advisers who put them into the fund, on the grounds that they did not do proper and rigorous checks on what Madoff was up to. With a seemingly increasing number of frauds coming to light, it appears likely that more deceived investors will opt to try to recoup their lost savings by going after careless or devious advisers.

Keren Bobker, a senior consultant at Holborn Assets, based in Dubai, believes it is vital that investors check out their adviser properly. "The best course of action is to ensure that the IFA (independent financial adviser) they deal with has a good reputation and that an adviser is properly qualified and has experience," Ms Bobker says. Kevin M LaCroix, a lawyer and partner at OakBridge Insurance Services in Ohio, is the author of the liability blog the "D&O Diary".

Mr LaCroix has compiled a list of all the legal action filed in the Madoff case, which includes the household banking names such as Banco Santander, HSBC, Standard Chartered International and UBS, all of whom had put clients' money into Madoff's US$5 billion scheme. Union Bancaire Privee and Santandar have already said they will reimburse clients, a move Mr LaCroix believes may force other big banks to do the same.

"I think it certainly puts pressure on other banks," he says. "However, other banks may not be as well positioned financially as Santander and therefore simply may be unable to make the same offer. "Other banks may feel that they have legal defences on which they can rely, and are prepared to take their chances in court." But Mr LaCroix thinks that those who invested in Madoff through banks with "deep pockets" may turn out to be the lucky ones when it comes getting their money back.

It is not only those seeking high returns who have found their money was not invested as advertised. The UK's Standard Life, an insurance and pensions group, last month agreed to compensate about 100,000 investors in its Sterling Fund after it was revealed that some assets in the fund had been invested in asset-backed securities, which investors felt did not accord with the fund's marketing literature.

If Standard Life, UBP and Santander had not decided to compensate investors, the investors would have been able to lodge a complaint with the financial services ombudsman in the jurisdiction through which they invested. "Most IFAs use plans and products from insurance and investment providers based in an offshore jurisdiction, mostly the Isle of Man, which has its own depositor protection and investment compensation schemes in place, as well as a financial services ombudsman," Ms Bobker says.

If the ombudsman finds in a customer's favour, he will order the fund manager to compensate the individual. And if it turns out that the fund manager has no assets, investors will be eligible for a payout from the compensation scheme. Compensation schemes have different payout limits, so again, it is important to check before investing. The maximum compensation available for investments made through the Isle of Man is £48,000, while Jersey and Luxembourg have no compensation scheme.

Ms Bobker believes that one positive outcome of the Madoff and Stanford affairs would be that investors start taking much more responsibility for where and with whom they place their money. "It amazes me that the public rarely ask about these issues, when they are vitally important," she says. So the message is clear. If investors do not want to find themselves swimming with someone who is not wearing a costume, and losing money in the process, they should make sure they know as much as they can about the people they swim with.