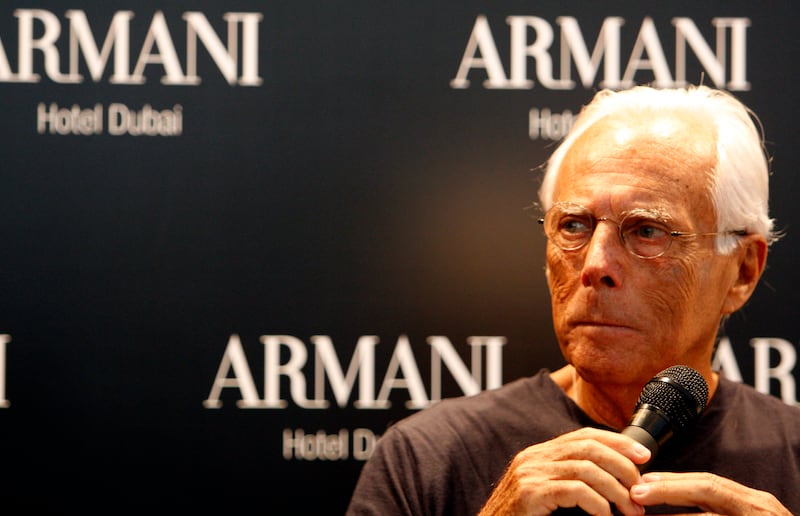

Three months before his 90th birthday, Giorgio Armani is hinting at the possibility of big changes at his Italian fashion empire once he’s no longer in charge.

After fighting for years to keep Giorgio Armani independent as mergers and acquisitions reshaped the luxury sector, the billionaire designer now says he won’t rule out his company someday combining with a bigger rival or listing on a stock exchange.

“Independence from large groups could still be a driving value for the Armani Group in the future, but I don’t feel I can rule anything out,” Mr Armani said in a written interview.

“What has always characterised the success of my work is an ability to adapt to changing times.”

It’s a striking shift in tone for Mr Armani, who rose from Milan window dresser to creator of one of the world’s most prominent luxury houses, keeping tight control along the way and dropping few hints about what would happen once he left the scene.

The plans of Mr Armani, who rarely gives interviews and has to date been reticent about discussing succession, have long been a hot topic in the industry.

But the designer now appears more open to ideas for the future, although it will be up to his heirs to evaluate them, he said.

Giorgio Armani's 'One Night Only' show dazzles crowd in Dubai

“I don’t currently envisage a takeover by a large luxury conglomerate,” Mr Armani wrote in a series of responses to questions from Bloomberg.

“But as I said, I don’t want to exclude anything a priori because that would be an ‘unentrepreneurial’ course of action.”

Mr Armani, who controls virtually all of Giorgio Armani and has a net worth of $6.6 billion according to the Bloomberg Billionaires Index, is also now leaving the door open to an initial public offering.

“Listing is something we have not yet discussed, but it is an option that may be considered, hopefully in the distant future,” Mr Armani said.

Uncertainty about the future is common in the Italian luxury industry, where many companies are still independent and family-controlled – including Salvatore Ferragamo, Prada, Moncler and Ermenegildo Zegna – and all lack the scale of powerful, acquisitive French rivals LVMH Moet Hennessy Louis Vuitton and Kering.

Over the past 20 years, a handful of Italian luxury companies have opted to sell to the French.

Mr Armani pointedly warned about larger luxury groups who “increasingly have the historic brands in their sights”.

That could deliver growth on one hand, he said, “but on the other it entails an inevitable shift in values and substantial upheaval, style included”.

Mr Armani confirmed that he would like to leave his company in the hands of a group of confidantes.

The designer has no children, although several relatives serve on the company’s board, and he has long suggested that an extended family of advisers would steer the group.

“When it comes to succession, I think the best solution would be a pool of trusted people close to me and chosen by me,” Mr Armani said, pointing to the leadership of his company’s foundation, particularly Leo Dell’Orco, who has supported the designer in managing the company for years, and his nieces Silvana and Roberta Armani and nephew Andrea Camerana.

“The foundation will decide and govern the future of the Armani group,” the founder said, “because the people closest to me are at the helm.”

Mr Armani also said he does not envisage any single individual taking his place at the head of the company.

“I started out alone with a small company and have transformed it, piece by piece, into a group of international relevance,” Mr Armani said.

But today’s fashion industry is “very different to when I started, so I imagine multiple co-ordinated functions for those who come after me”.

Daniel Kretinsky

The owner of Britain’s Royal Mail said it rejected a £3.1 billion ($3.9 billion) bid from the Czech entrepreneur Daniel Kretinsky because it “significantly undervalues” the company.

International Distributions Services said it turned down the cash offer, worth 320p a share, on April 11.

“The board believes the timing of the proposal is opportunistic,” IDS said in a statement.

“It does not reflect the growth potential and prospects of the company under a new management team, a significant modernisation programme under way at Royal Mail” and the potential for regulatory easing.

Mr Kretinsky’s EP Group, which holds a 27.5 per cent stake, had said earlier in the day that it is considering its options and wants to “engage constructively” with IDS.

Royal Mail is attracting takeover interest from one of Europe’s most acquisitive billionaires after weathering a protracted labour dispute.

EP Group said private investment was crucial for the company, which has struggled to cope with changing trends in the delivery sector.

“Weak financial performance, poor service delivery and a slow transformation, in the face of a market going through structural change, have put the business under unsustainable pressure,” the Czech company said.

Under the UK’s takeover rules, EP Group has until 5pm on May 15 to either announce a firm intention to make an offer for IDS or walk away.

A bid for the formerly state-owned business could face opposition from some UK politicians who have previously voiced their concerns about the stake that Mr Kretinsky already owns.

In recent years, he has quickly built up a portfolio of assets across Europe. In the UK, he also has stakes in the grocer J Sainsbury and the Premier League football club West Ham United.

In France, Mr Kretinsky’s consortium has taken control of the grocer Casino Guichard Perrachon, alongside media investments.

Royal Mail is grappling with a decline in letter-writing and a rise in parcel deliveries due to e-commerce.

Members of the Communication Workers Union voted to accept a new pay deal last year after months of strikes.

Analysts have previously said Mr Kretinsky could look to break up IDS, which also includes the more profitable Amsterdam-based GLS logistics business.

Royal Mail was privatised in 2013. The government sold its remaining stake in 2015.

Pavel Durov

The Telegram messaging app is likely to pass one billion active monthly users within a year as it spreads like a “forest fire”, its billionaire founder Pavel Durov said.

Telegram, which is based in Dubai, was founded by the Russia-born Mr Durov, who left Russia in 2014.

“We’ll probably cross one billion monthly active users within a year,” Mr Durov, who fully owns Telegram, told the US journalist Tucker Carlson in a video interview posted to Mr Carlson’s account on the X social media platform.

“Telegram is spreading like forest fire.”

Mr Durov, who is estimated by Forbes to have a fortune of $15.5 billion, said some governments had sought to pressure him but that the app, which currently has 900 million active users, should remain a “neutral platform” and not a “player in geopolitics”.

One of Telegram's main rivals, Meta Platforms’ WhatsApp, has more than two billion monthly active users.

The Financial Times reported in March that Telegram would probably aim for a US listing once the company had reached profitability.

He said he had opted for the UAE as it was a “neutral country” that wants to be friends with everyone, so he felt it was the best place for a “neutral platform”.

He said that, beyond money and Bitcoin he has no major property such as real estate, jets or yachts as he wants to be free.

Gina Rinehart

Gina Rinehart has amassed an almost 6 per cent stake in Lynas Rare Earths, adding to the iron ore billionaire’s portfolio of stakes in critical mineral producers vital to the energy transition.

Through her private company Hancock Prospecting, Ms Rinehart added 6.6 million shares in the Sydney-listed company for more than A$40 million ($25.7 million), according to a Lynas filing.

The private company has been regularly purchasing the company’s stock last December.

Lynas is one of the only rare earths producers outside China – which dominates the supply chain – with a mine and processing plant in Western Australia and a refinery in Malaysia.

Ms Rinehart’s bet on the green transition made headlines last year as she waded into lithium takeover deals and took stakes in a handful of companies with large footprints across Australia, including Arafura Rare Earths, Liontown Resources and Vulcan Energy Resources.

She joined forces with Sociedad Química y Minera de Chile, the world’s No 2 lithium producer, for the takeover of Azure Minerals, which was approved by shareholders this month.

According to filings associated with the Azure deal, Hancock Prospecting has cash and cash equivalents of A$19.5 billion.

With input from Bloomberg, Reuters and AFP