Genesis

English rock band Genesis outearned the entertainment world in 2022, proving that for some, age is just a number when it comes to work and income.

The Invisible Touch hit makers earned an estimated $230 million over the course of last year, Forbes magazine reports.

The highlight of their year was the $300 million sale of their music rights to Concord Music Group in September.

The sale included music by individual band members, including Phil Collins’ blockbuster solo albums No Jacket Required and … But Seriously, as well as music by Mike Rutherford’s side-project Mike + The Mechanics.

Not included was music recorded with former members Peter Gabriel and Steve Hackett.

Recorded music royalties and revenue from the European leg of their $100 million The Last Domino? tour rounded off their income for the year.

Collins, 72, has a net worth of $350 million, according to the wealth tracking website Celebrity Net Worth. The seven-time Grammy winner has sold in excess of 100 million albums on his own and with Genesis, which he joined in 1970.

The In The Air Tonight singer reportedly owns property in the US and in his native England.

Rutherford and Tony Banks, both also 72, have a net worth of $120 million and $60 million, respectively.

Other top earners in 2022 include Sting ($210 million, largely from the sale of his musical catalogue), Tyler Perry ($175 million), Brad Pitt ($100 million) and Taylor Swift ($92 million).

Anne Hathaway

Les Misérables actor Anne Hathaway has invested in Every, a food technology start-up that wants to hasten the global transition to animal-free protein, the company said recently.

The size of her investment was not disclosed. It is her first investment in a business-to-business (B2B) company.

“The need to transform our food system has never been clearer or more urgent. An important piece of the puzzle is in nature-equivalent animal proteins, such as Every has been developing. I’m proud to back this vision of a better future,” Hathaway said.

The company uses precision fermentation to turn DNA sequences, yeast and sugar into faux meat proteins that it claims taste and function much in the same way as the originals but have a lighter environmental footprint.

Every creates animal-free pepsin and egg proteins that are vegan-certified.

The company is now scaling up its production line after seven years of research and development. It unveiled three products in the past 12 months.

Investments in precision fermentation platforms totalled $1.7 billion in 2021.

“We are thrilled to partner with visionary investors like Anne to drive forward our plans to reimagine the way we feed and nourish the world,” said Every chief executive Arturo Elizondo.

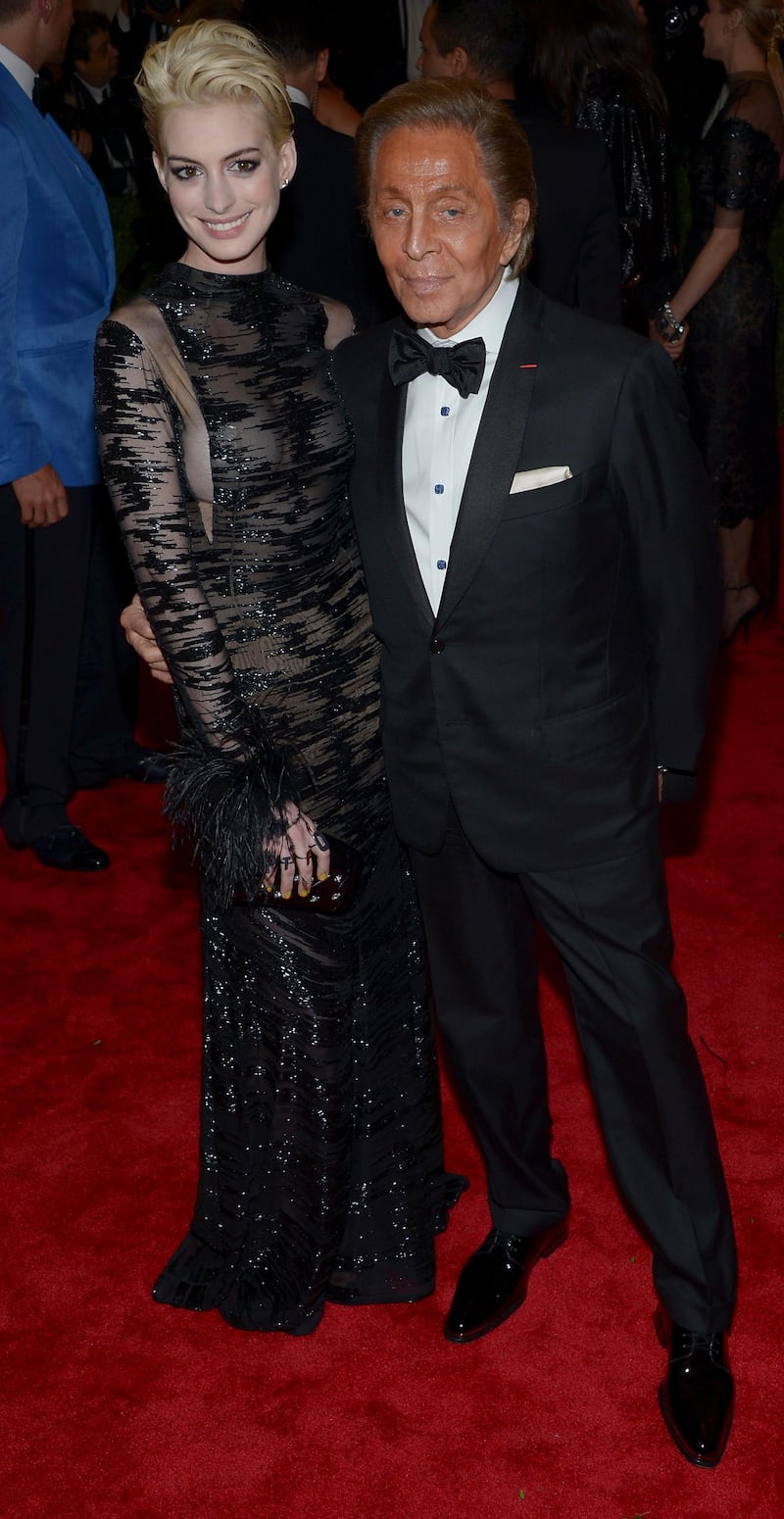

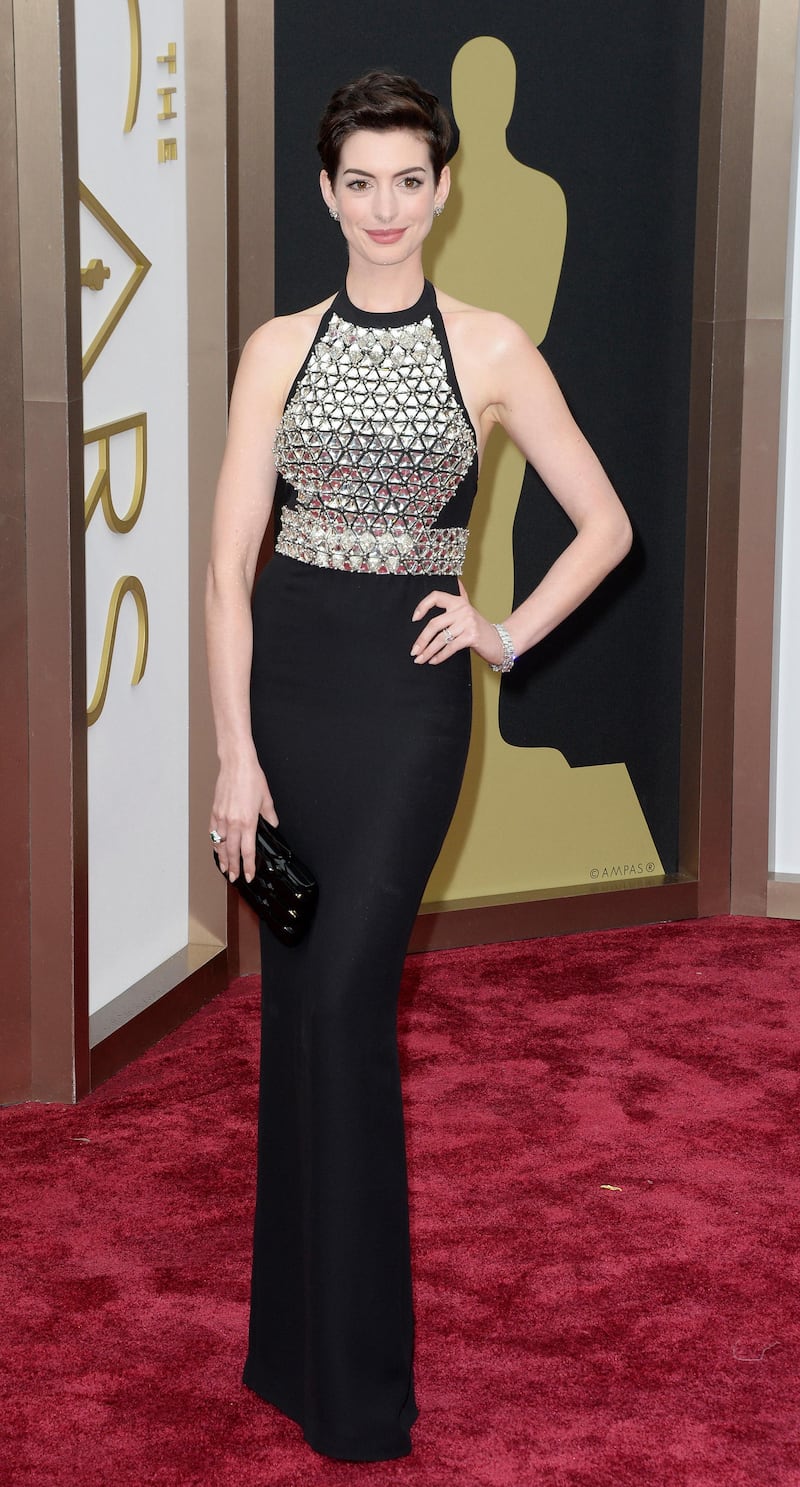

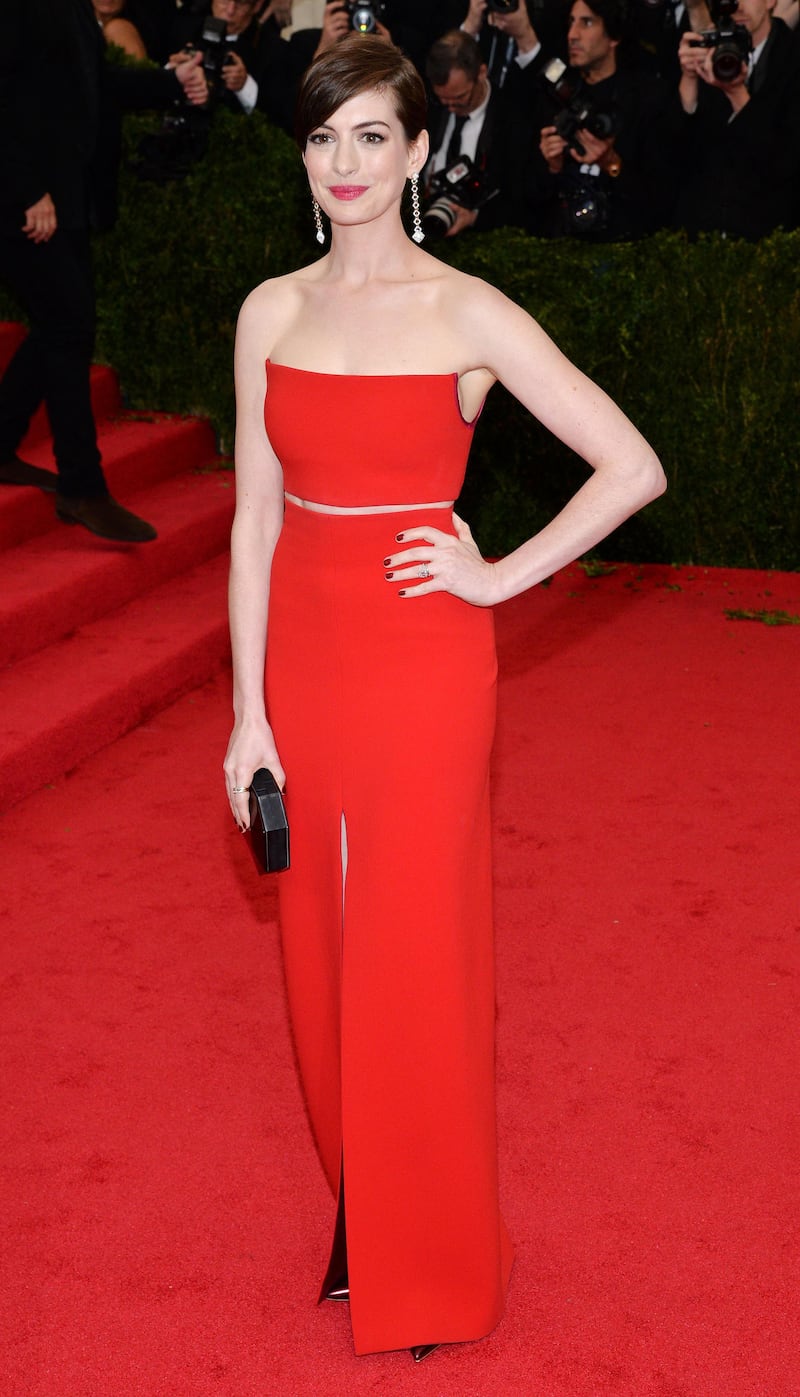

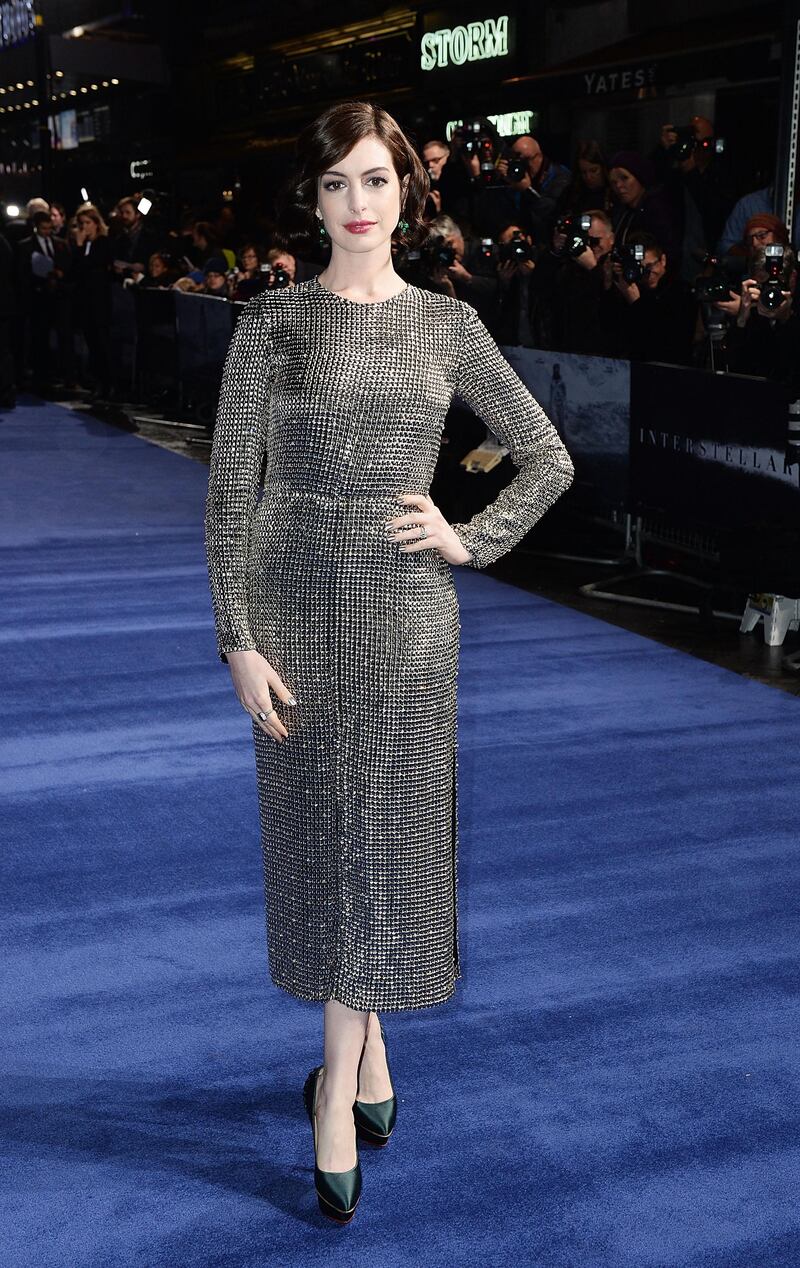

Anne Hathaway's style evolution — in pictures

Other investors in the start-up include Bloom8, McWin Food Systems Fund, Temasek and ZX Ventures, and others who have collectively injected more than $230 million so far.

Hathaway, a UN Woman goodwill ambassador, chose to back Every after making lifestyle adjustments to reduce her consumption of meat and single-use plastics, and to embrace a zero-waste approach.

At 40, the actor has a net worth estimated at $80 million, according to Celebrity Net Worth.

The principal source of her wealth is her film career. One of the highest-paid actresses in Hollywood, she stars in projects that are often both commercially and critically successful.

Hathaway is an emerging impact investor. Her most recent sustainable investments include ZenWTR, which claims to be the world’s first vapour-distilled water brand with bottles made of 100 per cent recycled ocean-bound plastic.

In November, she backed Pact, a London-based seed venture fund that aims to spend £30 million ($35.8 million) on early stage, “mission-driven” start-ups across Europe.

Michael Jackson

The estate of the late Michael Jackson is reportedly selling half of its current interests in the singer’s music catalogue for close to $1 billion, Variety magazine reported.

Record label Sony and a possible financial partner are seeking to acquire 50 per cent of the estate’s interests in Jackson’s publishing, recorded-music revenue, the coming biopic Michael, the MJ: The Musical show and other assets.

The deal would be the biggest to date in the music catalogue market.

Among the biggest transactions so far is the $500 million sale of Bruce Springsteen’s entire catalogue, also to Sony Music.

Despite any eventual sale, creative control of the assets would remain with the Jackson estate, according to the report.

Although the singer’s estate was estimated at $500 million at the time of his death, his continued popularity has taken its value to more than $2 billion, according to Forbes magazine estimates.

Jackson’s albums are among the highest earners in history. Thriller, from 1982, is one of the two biggest sellers of all time. It has been certified 30-times platinum.

Video: Fans adorn Michael Jackson's Hollywood star, five years on

Sony has previously acquired sections of Jackson’s legacy. In 2016, it purchased the Jackson estate’s 50 per cent stake in their joint venture, Sony/ATV Music Publishing.

Two years later, the company said it had acquired the estate’s 25.1 per cent stake in EMI Music Publishing for $287.5 million, when it paid $2.3 billion for the company.

Upon his death, the King of Pop’s will stipulated that 40 per cent of his assets be divided evenly among his three children.

Another 20 per cent was set aside for various children’s charities. The remaining 40 per cent was to be used to support his mother Katherine, with any remainder of that amount also to be split among his children.

Justin Timberlake

Actor Justin Timberlake has joined a $9 million funding round into The Ugly Company, a California-based producer of upcycled dried fruit snacks, the company said.

The series A round was led by fruit grower and distributor Sun Valley Packing. It will help the company expand its production capacity to meet surging demand, while speeding up its expansion across the US.

The company turns misshapen or “ugly” fruit into dried fruit. Last year, the company rescued more than 2.17 million pounds of food waste.

“The millions of pounds of fruit that gets thrown away every day in Central CA is heart-breaking … My dad is a farmer that raised me on the seat of a tractor, but it wasn't until I returned home from the army, and was working as a truck driver, that I looked at this food waste from a new perspective,” said Ben Moore, founder and chief executive of The Ugly Company.

Timberlake's net worth is estimated to be $250 million, according to Celebrity Net Worth.

Last year, the Cry Me A River singer sold the rights to his entire back catalogue to Hipgnosis Song Management for a reported $100 million.

He rose to fame as a member of the 90s boy band NSync and went on to launch a solo music career. He has also starred in several movies, including The Social Network and Friends with Benefits.

Timberlake is also a television and film producer.

Outside entertainment, his business dealings include beverage and clothing lines, and he co-owns a string of restaurants.

As an investor, Timberlake has put money into 17 companies, including Myspace.com, TMRW Sports and 1Password. He earns more than $50 million a year, according to Celebrity Net Worth.

He and his wife, actress Jessica Biel, reportedly own homes in Hollywood, within the exclusive Yellowstone Club in Montana and in Nashville, Tennessee.