Adnoc Gas, the integrated gas processing unit of Adnoc, plans to invest more than $13 billion until 2029 to pursue domestic and international growth opportunities as it aims to expand its liquefied natural gas (LNG) production capacity.

The company aims to more than double its LNG output capacity by 2028 through the strategic acquisition of the new Ruwais LNG plant from parent company Adnoc and potentially target assets in Europe, India, China and South-East Asia, Adnoc Gas said in a statement on Monday.

Adnoc Gas, which approved a dividend of $3.25 billion for the full year 2023, intends to “progressively” increase the dividend it pays shareholders by 5 per cent year-on-year over the next four years.

“Adnoc Gas recorded robust financial and operational results in 2023, has delivered on its dividend promise to shareholders, and is progressing several significant projects that will accelerate its future growth,” said Dr Sultan Al Jaber, the group managing director and chief executive of Adnoc.

“Between 2024 and 2029, we plan to invest over $13 billion in domestic and international growth opportunities … in addition, we are looking to increase our LNG export volumes in a growing global market,” said Dr Al Jaber, who is also the chairman of the Adnoc subsidiary.

LNG is produced when natural gas is cooled, which shrinks the volume of the gas, making it easier and safer to store and transport over long distances.

State-run energy companies in the Middle East are betting big on the commodity, seen as a low-carbon alternative to crude oil and coal.

Emerging economies in Asia are aiming to increase the share of natural gas to reduce dependency on highly polluting coal amid an expected surge in power demand.

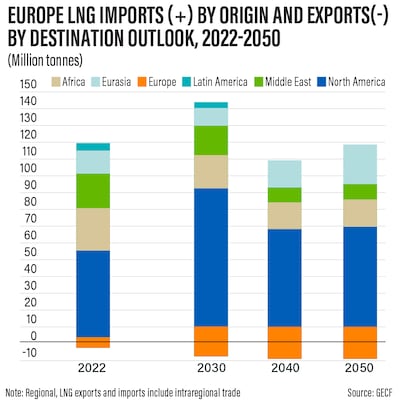

Meanwhile, Europe is seeking to replace Russian gas supplies with LNG shipments from the US and the Middle East.

Last month, Adnoc signed a 15-year agreement with a subsidiary of the German energy company Sefe (Securing Energy for Europe) for the delivery of one million metric tonnes per annum (mmtpa) of LNG.

The LNG will primarily be sourced from the Ruwais LNG plant, which is currently under development in Al Ruwais Industrial City. Adnoc plans to take a final investment decision on the 9.6-mmtpa project this year.

In January, Adnoc Gas signed a 10-year agreement to supply 500,000 tonnes per annum of LNG to Gail India.

The company, which has access to 95 per cent of the UAE's natural gas reserves, signed LNG export agreements worth up to $12 billion in 2023.

Last year, it also awarded contracts worth $4.9 billion to expand its processing capacity.

“In 2024, the company will focus on processing and delivering increased volumes of gas to its customers and enhancing its product mix to meet the growing global demand for lower-carbon solutions,” said Ahmed Alebri, chief executive of Adnoc Gas.

“Through two of its ongoing strategic projects, the company will continue to expand its natural gas pipeline network and develop infrastructure to boost gas supply for its petrochemicals growth in Ruwais."

Last year, Adnoc raised about Dh9.1 billion ($2.5 billion) from the sale of a 5 per cent stake in Adnoc Gas in one of the largest initial public offerings of 2023. Adnoc continues to own 90 per cent of the gas subsidiary.

Adnoc Gas reported a 24 per cent jump in its fourth-quarter profit as the company sold larger volumes of natural gas and other commodities amid higher prices.

The company’s net income rose to $1.35 billion in the three months that ended in December. Revenue rose to $6.3 billion in the fourth quarter from $5.89 billion in the same period a year earlier.