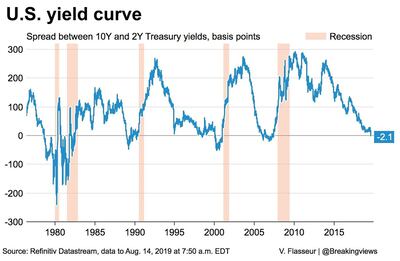

Fears of a looming recession jolted US markets last week with the key benchmark indexes slumping about 3 per cent on Wednesday alone. Investors were spooked by an inverted yield curve, defined as an interest rate scenario where long-term government bonds have a lower yield than short-term debt instruments. Many analysts say it is a precursor to a recession as people start stockpiling money into safer long-term investments.

However, some analysts say investor reaction was overblown and although inverted or negative yield curves have historically preceded periods of subdued economic activity, a recession in the immediate future is unlikely.

So what is a recession, what triggers them and how long do they last?

What is a recession?

Simply put, a recession is a period of contracting economic activity across an entire economy. The economy in question can be a country, a region, multiple regions or the entire globe.

The technical definition of a recession is two consecutive quarters of negative economic growth as measured by an economy's gross domestic product, or the total value of goods and services produced.

What triggers a recession?

There is no single trigger for a recession. It is typically a combination of internal and sometimes external factors. A recession can occur due to extreme policy decisions by monetary authorities or governments, such as dramatic changes to an interest rate regime or structural change in an economy that makes it difficult for businesses and financial institutions to continue growing.

Overextension of credit and financial markets during the up cycle and social and political uncertainty can be among the domestic triggers for a recession.

Externally, conflicts with trading partners such as the US trade war with China or a slowdown in other major global economies can force recessionary conditions.

What happens in a recession?

Businesses fail and sometimes financial institutions that have loaned them money go under. Industrial output slumps, consumer spending declines sharply and elevated unemployment levels prevail.

Recessions have typically been shorter than growth cycles since the onset of the Industrial Revolution. However, they are painful for the population and have a considerable psychological impact.

When was the last recession?

Economies work in cycles and a recession is an integral but much dreaded part of that cycle. The last major recession to hit the world was in 2008.

Governments across continents had to come to the rescue of banks and financial institutions after the collapse of banks Bear Stearns and Lehman Brothers in the US as a subprime mortgage blowout turned into a full-blown financial crisis.

The best-known example of a recession is the Great Depression of the 1930s when US GDP fell more than 10 per cent and the unemployment rate briefly touched 25 per cent, according to Investopedia.

A depression is a deep-rooted and much longer recessionary period.