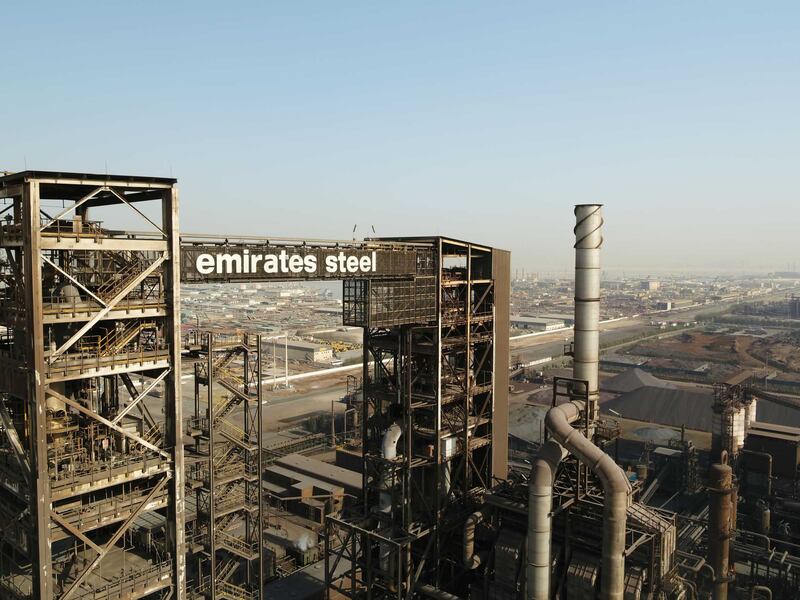

Emirates Steel Arkan, the UAE's largest public steel and building materials business, reported a 4 per cent annual jump in its third-quarter net profit on the back of lower costs and a rise in other income.

Net profit for the three months to the end of September climbed to Dh107.1 million ($29.16 million), the company said in a filing on Wednesday to the Abu Dhabi Securities Exchange, where its shares are traded.

Direct costs declined 21 per cent, year on year, to Dh1.8 billion while finance and other income increased during the period. Revenue for the period slid 18 per cent annually to Dh2 billion.

The company’s nine-month profit rose by more than 1 per cent to Dh387.6 million as direct costs fell more than 10 per cent to Dh5.7 billion.

Revenue for the January-September period stood at Dh6.48 billion, compared with Dh7.1 billion during the same period last year.

“What we see is there are a lot of headwinds in the steel industry [including high-interest rates, as well as geopolitical issues that could reduce demand],” group chief executive Saeed Al Remeithi told The National in an interview.

“However, we are in a good position, from the local market and from the strong balance sheet that we have in the company.”

The demand for steel and building materials continues to be high in the UAE amid a construction boom and the launch of new projects by developers.

Earlier this year, Dubai approved a new master plan for Palm Jebel Ali – a luxury lifestyle project that will occupy an area twice the size of Palm Jumeirah.

The long-planned tourist attraction – spearheaded by leading developer Nakheel – will include 80 hotels and resorts, green spaces and other leisure and retail amenities spanning 13.4 square km.

Other developers are also launching new projects.

“Demand is healthy and is expected to continue throughout next year,” Mr Al Remeithi said.

The company will also seek new acquisitions and joint venture opportunities to grow its business.

“We are looking everywhere … for any opportunity, as long as it fits into our strategy,” he said.

Earlier this year, Emirates Steel Arkan and AD Ports Group, the operator of industrial cities and free zones in Abu Dhabi, signed a non-binding initial agreement with Japanese companies to establish a low-carbon iron supply complex in the emirate.

The company, which supplies manufacturing and construction sectors in the UAE and more than 70 other markets, aims to boost its exports to new markets, including India and North Africa.

“There are some primary markets for us like Europe and the US where we are always there but in some markets, sometimes there is an opportunity [and] we can really go and sell,” he said.

“India is booming and maybe North Africa. Those are the potential markets, where we can be there.”

Formed after the merger of Emirates Steel and Arkan Building Materials in 2021, Emirates Steel Arkan is majority owned by Abu Dhabi holding company ADQ.

The company reduced its net bank debt by 61 per cent to Dh424 million by the end of September, from Dh1.1 billion at the beginning of the year.