Gemcorp Capital, a global asset management firm specialising in emerging markets, is planning to launch an inaugural investment fund for Saudi Arabia with an initial target of $1 billion.

With the fund, the UK-based company aims to offer an opportunity for both global and domestic investors to invest in key projects aligned with the kingdom’s 2030 vision programme.

The fund is being launched in partnership with the Ministry of Investment Saudi Arabia (Misa).

Gemcorp will commit seed funding, while Misa will support the establishment of the fund and provide access to investment opportunities in Saudi Arabia including credit, equity and hybrid debt, complementing existing sources of funding available in Saudi Arabia, Gemcorp said on Wednesday.

Credit products will comprise structured debt, structured trade finance and convertible debt, while equity products will include common equity, preferred equity and other equity derivatives and hybrids.

“Saudi Arabia has recently become very attractive to global investors and this fund will provide further investment support for key sectors such as energy, infrastructure, and mining and minerals,” Saudi Arabia's Minister of Investment Khalid Al Falih said.

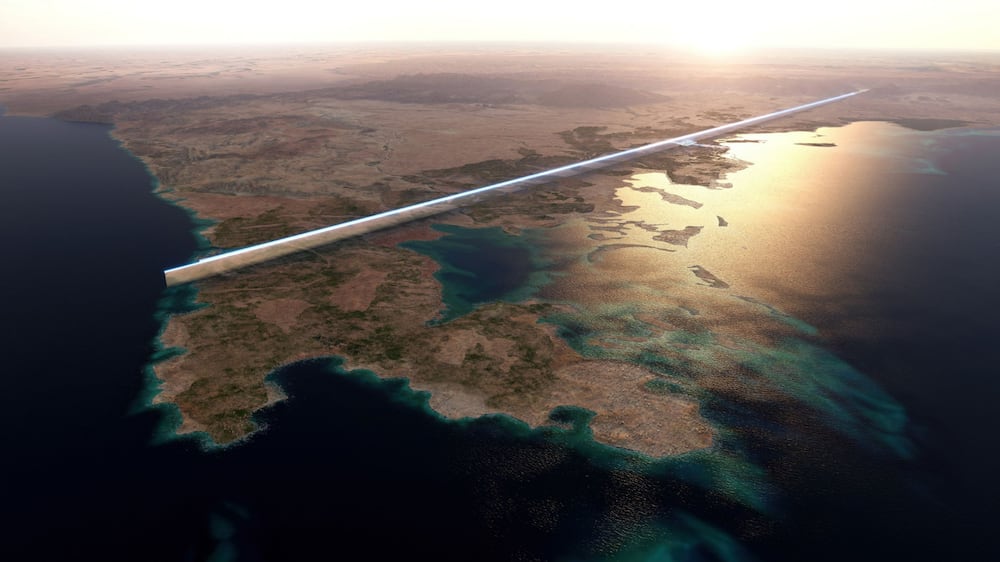

The Arab world's largest economy aims to attract more investment into the country and diversify its economy away from oil. The country has launched a number of new projects in the last few years including a $500 billion futuristic city named Neom along the Red Sea coast.

Earlier this year, Saudi Arabia granted an industrial licence to Ceer, a joint venture between the Public Investment Fund and Taiwan’s Foxconn, to start manufacturing electric vehicles in the kingdom.

Saudi Arabia's Neom to include world's longest skyscraper

The country's sovereign wealth fund, the Public Investment Fund, also joined hands with South Korea’s Hyundai to jointly build a car manufacturing plant in the kingdom, with an estimated investment of more than $500 million, in push to develop its automotive industry.

“Foreign direct investment has been a transformative force in our local economy, fostering job creation and empowering women in the workforce,” Salah Ali Khabti, Deputy Minister of Investment of Saudi Arabia, said.

“Gemcorp’s $1 billion fund will be a pivotal catalyst for our economic growth, poised to invigorate our key priority sectors.”

Gemcorp Capital provides funding to sovereign and corporate borrowers across sectors including technology, infrastructure and energy and structured trade finance. It has completed more than $7 billion of private credit transactions in global emerging markets, from the Middle East to sub-Saharan Africa to South America, South-east Asia, and Eastern Europe.

The firm is looking to invest at least $10 billion in Africa over the next decade, mainly in the form of debt deals in partnership with other institutional investors, alongside private equity investments on a selective basis.

“As the global landscape becomes more dynamic and complex, we are expanding our investment offering across emerging markets,” Atanas Bostandjiev, founder and chief executive of Gemcorp, said.

“Saudi Arabia is a key focus market, offering a favourable investment environment … for public and private stakeholders in our three priority sectors: energy, infrastructure, and minerals and mining. Our aspiration is to make this fund the first of a series of follow-on funds in the kingdom.”