Saudi Arabia’s National Commercial Bank, the kingdom's biggest lender, entered into a framework agreement with Samba Financial Group, to explore a merger of the two lenders that could create the third-biggest banking entity in the Arab world by assets.

A framework agreement signed on June 25 will pave the way for the start of a reciprocal due diligence process and provides an outline for the two lenders to negotiate definitive and binding terms for a potential tie-up, NCB and Samba said in separate statements to the Tadawul stock exchange, where their shares trade.

The principal terms agreed will see Samba shareholders receive between 0.736 and 0.787 newly-issued shares of NCB in exchange for each Samba share they hold.

Based on the exchange ratio range, at a closing share price of 37.25 Saudi riyals (Dh36.48) per NCB share on June 24, the proposed deal would value Samba Financial Group share at between 27.42-29.32 riyals, a premium of 19.2 to 27.5 per cent above its closing price as of June 24, according to the NCB regulatory filing. This indicates NCB could pay between $14.62bn-$15.63bn to buy its rival.

If the two sides agree terms, NCB will be the merging bank and Samba Financial Group being the merged bank. Both banks intend to conclude the reciprocal due diligence process and sign the definitive agreements in relation to the merger within a period of four months from today.

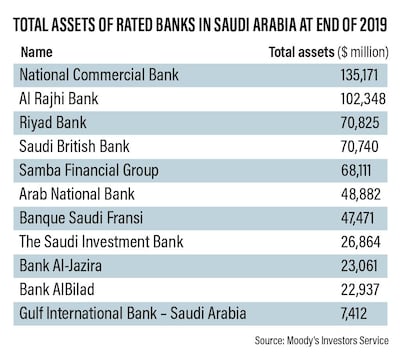

The merged entity would be the third-largest lender in the Arab world with more than $213 billion (Dh781bn) in assets as of the end of March 2020, about 5 per cent higher since the end of 2019. The lenders had a combined 29 per cent market share as of the end of last year, based on total deposits held.

Both banks have government entities as significant shareholders. Saudi Arabia's sovereign wealth fund, the Public Investment Fund, holds a 44.29 per cent stake in NCB, and a 22.91 per cent share of Samba Financial Group, according to stockmarket data. The Public Pension Agency also owns 5.36 per cent of NCB and 11.54 per cent of Samba, while the General Organisation for Social Insurance has a 5.18 per cent stake in NCB and 7.09 per cent of Samba.

NCB had previously been in talks with competitor Riyad Bank about a potential merger, but those talks were ended last year.

"I am not so surprised," Tarek Fadlallah, chief executive of Nomura Asset Management Middle East, told The National.

"We knew that there was appetite for further consolidation in Saudi Arabia’s banking sector. For the banks themselves it makes sense: it's economies of scale, savings in IT and headcount costs," he added. "Does Covid make the merger more logical now? Yes. Was it because of Covid? No, absolutely not, if you consider the talks between NCB and Riyad bank last year."

The new entity means a bigger bank for the main shareholder, the kingdom's sovereign wealth fund, and provide the latitude to do bigger deals.

In a research note, Al Rajhi Capital said that Samba Financial is "a more strategic fit" for NCB than its abandoned deal with Riyad Bank and could offer good cost synergies.

The potential tie-up is the latest in a series of banking mergers being undertaken across the Gulf as lenders build scale and attempt to achieve greater efficiencies. In the kingdom, Saudi British Bank completed a merger last year with Alawwal Bank last year creating a lender with $68.7bn worth of assets.

In the UAE, a three-way tie-up between Abu Dhabi Commercial Bank, Union National Bank and Al Hilal Bank was completed last year and Dubai Islamic Bank completed its acquisition of smaller rival Noor Bank earlier this year, creating an entity with assets of more than Dh275bn ($78bn).

And in Kuwait, merger talks are continuing between Kuwait Finance House and Ahli United Bank to create an Islamic banking with about $96.7bn of assets.

Both NCB and Samba said they do not expect the proposed merger to result in involuntary redundancies of employees. NCB has appointed JP Morgan as its financial adviser, and law firm Abuhimed Alsheikh & Alhagbani as its legal advisor. Samba appointed Morgan Stanley as its financial adviser, and Khoshaim & Associates as its legal advisor.