Aviation executives are set to descend on Dubai for the emirate's biennial air show, which kicks off on Sunday.

While smaller in scale than trade fairs held in Paris and Farnborough, England, the event has acquired a unique allure since it began in 1986, hosting a series of industry-shaking jet orders as Middle East carriers expanded. Here’s a summary of the likely talking points at this year’s event:

* A380’s last chance: can Emirates save the super jumbo?

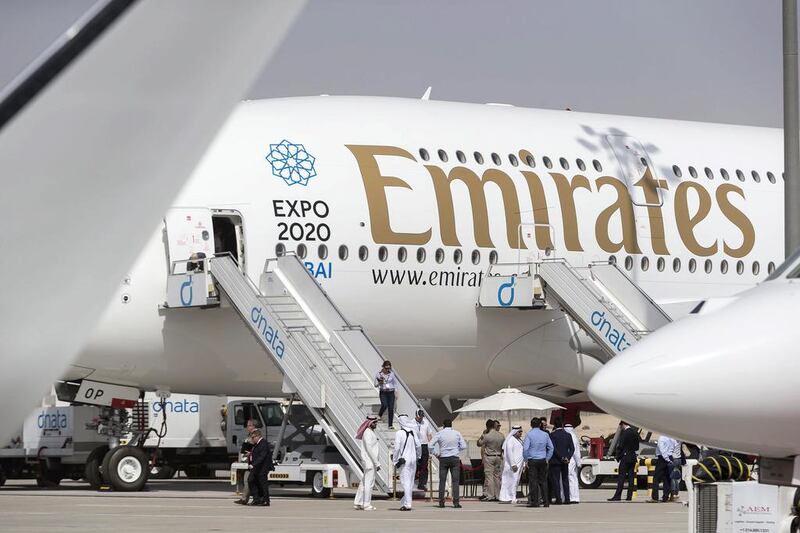

Airbus’s double-decker jet may be popular with the travelling public but it has fallen out of favour with fleet planners at the world’s major airlines. All except one, that is. Emirates, the world’s biggest long-haul carrier, has built its business around the A380 and is mulling a follow-on deal for at least 20 planes. Top Airbus managers met with Emirates last week for the handover of its 100th example and will have been delighted to hear positive comments about the likelihood of a deal in Dubai, where it is based.

* Will Asian discounters boost Dubai orders?

Four years ago, carriers announced a record $206 billion of orders in Dubai. Since then, things have cooled. Only $4bn of new contracts was unveiled at the 2015 show, but Asia may hold the brightest sales prospects. Discount giants such as AirAsia and Lion Mentari Airlines are buying hundreds of jets as they target a growing middle class, joined more recently by the likes of India’s IndiGo, and despite infrastructure constraints and fare wars there may be scope for further deals. More-traditional operators such as Cathay Pacific Airways have also been topping up their backlogs. Asian carriers have traditionally favoured high-profile events for order announcements, and Dubai would fit the bill.

______

Read more:

Etihad Airways Engineering eyes global top three slot in aviation maintenance

Airbus trails Boeing in orders ahead of Dubai Airshow

Airbus lifts pressure but Bombardier still faces challenges

______

* Gulf's aviation industry faces challenging times

Away from the A380, major orders may be thin on the ground. Emirates itself is emerging from the toughest period in a three-decade history, having posted the first earnings decline for at least five years in the 12 months through June after the US imposed a series of travel restrictions amid terror concerns and the low oil price roiled Gulf economies.

A jump in first-half profit announced Thursday will go some way to restoring the carrier’s swagger, but may have come too late for it to place an order for Airbus A350 or Boeing 787 planes that’s been in gestation for years. By comparison, the Middle East’s two other top operators are facing new challenges.

Qatar Airways said this week that it’s headed for an annual loss, wiping out a $525 million year-ago profit, amid a Saudi-led boycott. Etihad Airways, meanwhile, reported a $1.87bn loss in 2016 and bankruptcy filings at its Air Berlin and Alitalia offshoots.

* Airbus-Bombardier deal warms up Boeing rivalry

The rivalry between Airbus and Boeing, four weeks after the European company revealed that it planned to take a majority stake in Bombardier's C Series programme, may be a feature at the show. The tie-up will put Airbus’s global sales clout behind the stuttering project and allow planes to be built in Alabama, circumventing tariffs imposed by the US after Boeing argued that the single-aisle jet had benefited from illegal Canadian aid. The rivalry between the leading manufacturers is always a feature of the industry’s leading expos, with Boeing scoring an order victory in Airbus’s own backyard at this summer’s Paris event as it launched a new variant of its 737. The US company may be anticipating a low-profile show - but watch the sparks fly if Bombardier firms up its first major C Series deal in 18 months.

* $36bn hub to host expo

Already home to the world’s busiest hub for international traffic, Dubai is spending $36bn on a brand new facility at the heart of a 50-square-mile logistics and transport zone to the south of the city. Next week’s show will take place at a purpose-built venue located at the new site.

______

Read more:

Superfast internet service coming to Etihad flights

Emirates Group net profit soars 77% in first half to Dh2.3 billion

Emirates eyeing more A380 aircraft to boost its fleet

______

* Regional conflict stokes up orders

Regional rivalries have intensified amid conflicts in Syria and Yemen. Saudi Arabia, the world’s biggest oil-producing nation is the No. 1 importer of weaponry including Eurofighter’s Typhoon warplane, with the partnership of BAE Systems, Airbus and Italy’s Leonardo SpA seeking to pin down a follow-on order. Qatar in September signed an outline accord for 24 Typhoons, following deals for the same number of Rafale jets from France’s Dassault Aviation SA and 36 Boeing F-15s. The lower oil price has weighed on spending and triggered economic and social reforms including an anti-corruption crackdown in Saudi Arabia.

* Last hurrah for industry titans

The Dubai show could be the last for two giants of aviation. Emirates president Tim Clark has said that his years at the helm may be drawing to a close, while Airbus sales supremo John Leahy has already announced his retirement. Both men are aged 67 (Clark turns 68 this month) and both are likely to want to go out with a splash, something the A380 purchase would most certainly deliver. With Emirates earnings headed in the right direction, Mr Clark may be the more relaxed of the two; Mr Leahy, who has drummed up $1.7 trillion in orders including huge deals in Dubai, has already had to delay his departure after his chosen successor dropped out of the running as the planemaker’s management focuses on a corruption probe. Airbus says he’ll still be gone by February.