The indictment of three former Abraaj Group executives found a litany of improprieties by the accused, including the defunct private equity firm’s founder, who allegedly committed multiple counts of fraud, racketeering and money laundering inside and outside the US - enriching themselves and leading to over $1 billion in losses to investor-victims.

Abraaj’s legitimate business activities “could not produce and maintain the cash flow and cash flow reserves necessary to conduct basic, day-to-day functions,” the 78-page charge sheet, issued by the US Southern District of New York, reads.

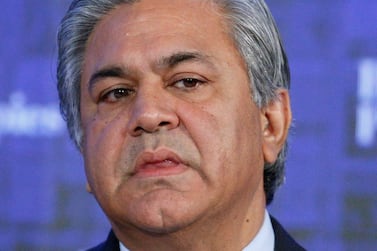

At the helm of Abraaj’s criminal activities was Arif Naqvi, the founder of the firm, who according to the indictment directed others within the company to carry out a “variety of strategies to misappropriate cash from investors and to use it to fund cash shortfalls, thereby concealing Abraaj’s true condition from investors, potential investors, creditors, and regulatory authorities.”

Abraaj, which claimed to have managed almost $14bn in funds, was forced into liquidation last June after a group of investors, including the Bill & Melinda Gates Foundation, the World Bank’s International Finance Corporation and The Overseas Private Investment Corporation (Opic), a US government agency, commissioned an audit to investigate the alleged mismanagement of money in its $1bn healthcare fund. That investigation widened the scope of scrutiny of the company and misappropriation of funds of US investors and a US government agency attracted the attention of the Securities and Exchange Commission and other US authorities.

The indictment shows Abraaj executives systematically tried to plug shortfalls and meet due payments by resorting to taking money in the health fund and another fund. When that was not enough they planned to set up a $6 billion fund, known as Fund Six, intended to help ease the liquidity crunch, according to the charges.

Mr Naqvi is out on $20 million bail in the UK, restricted to his home and facing extradition to the US. He has refuted the charges against him and said he is innocent. In April, Mustafa Abdel-Wadood, a managing partner, was arrested in New York and pleaded not guilty. He is out on $10m bail but restricted to his home. Sivendran Vettivetpillai, a managing partner, is also out on bail in the UK.

According to the charge sheet Mr Naqvi along with Waqar Siddique, a managing partner (and his brother-in law), Rafique Lakhani, a managing director (effective bookkeeper for Mr Naqvi), Mr Abdel-Wadood, Ashish Dave, the company’s chief financial officer, and Mr Vettivetpillai, “deceived and defrauded existing and potential investors in the US and elsewhere, including US financial institutions, US retirement and pension funds, US investment advisors, a US philanthropic foundation and an agency of the US government”.

In one email referred to in the charge sheet, an Abraaj employee told Mr Naqvi and other defendants the company would face a deficit of $100m on January 15, 2014 and the shortfall would need to be covered through misappropriated funds from APEFIV (Abraaj Private Equity Fund IV also known as Fund Four) and another fund.

In another email on March 2, 2014, also referred to in the charge sheet, the employee informs Mr Naqvi and executives that about $19.6m is required to repay investors in another Abraaj fund and the company does not have money to plug the shortfall. Mr Lakhani, copied on the email, responds, “We cannot pay this until further inflows come in from APEFIV investors.”

By in or around May 2015, Abraaj’s cash deficits, by account of its own leadership had surged to $219m, according to the indictment. As a result, more investor money was allegedly embezzled from the $1.6 billion Fund Four buy out fund. In response to an email from Mr Lakhani on how to address a $2.4m shortfall in February 2016, Mr Naqvi responded by asking, “We can’t pull some cash from APEF4?”

The indictment claims the largest target of Abraaj's systematic misappropriation of investor money was Fund Four. According to legal documents seen by The National, Abraaj allegedly misused as much as $300 million from the fund.

The liquidity situation of Abraaj deteriorated to such a point that in a March 2018 email Mr Lakhani wrote to Mr Naqvi, Mr Abdel-Wadood and Mr Siddique “we will be able to service the month only, if we borrow $16m from APEV IV to cover $8m payable to [bank] and $8m for [a required] regulatory deposit,” according to the indictment. By that time, nearly $220m was siphoned from the fund, Mr Lakhani said in the email.

Some $4m was withdrawn from the healthcare fund and sent to Abraaj offices, including the firm’s New York office, according to the indictment. Abraaj concealed the origin of the money by first sending the funds to its Cayman Islands entity Abraaj Investment Advisors Limited (AIML) that oversaw 40 different Abraaj funds, according to the prosecution. Abraaj transferred the funds to its other business units and investors. Some $500,000 was also transferred to a private entity under the control of Mr Naqvi, according to the indictment.

In May 2017, Abraaj withdrew $35m from the healthcare fund, sent it to AIML, and used the money for unauthorised purposes, including $1.5m, which was transferred to Mr Naqvi’s personal entity, according to the indictment.

Despite the misappropriation of millions of dollars, Abraaj was barely staying afloat. A distraught Mr Lakhani wrote to Mr Naqvi in May 2017, according to the indictment, and complained about the predicament the company was facing.

“As you are aware, I am under tremendous pressure re Abraaj cash as well, there is serious cash crunch and currently I don’t have the funds to pay essential payments like salaries for the month of June,” Mr Lakhani wrote, and added, “I humbly and respectfully request you to please help me in this situation. The tension and stress is unbearable for me and it is affecting my health and my efficiency, and performance at work. I don’t know what else to say.”

Ignoring his concerns Mr Naqvi responded to Mr Lakhani and instead instructed him to transfer money to a member of the Naqvi family and to a company run by Mr Naqvi’s former secretary. “Take a deep breath, smile, say Alhamdulillah [thanks to God] and proceed to send $300,000 to [Naqvi’s family member] in his UK account and $300,000 to the [company of former secretary] account. Both are broke, need the cash tomorrow,” according to the indictment.

Abraaj turned to a US government agency, unidentified in the indictment, to secure $150m for the healthcare fund and provided due diligence materials, in addition to other things, that “concealed Abraaj’s true financial condition and its misuse of investor monies”, according to the indictment.

Abraaj’s liquidity crisis appears to have come to the fore, when an employee of a US foundation sent an email in September 2017 inquiring about the discrepancy between the capital draw down (money requested from the investor to be deployed in the healthcare fund) and the capital actually invested.

“There seems to be an extraordinary amount of money sitting in the fund for quite an extended period of time,” the foundation’s employee wrote in an email cited in the indictment to a junior Abraaj employee. The Abraaj employee was asked for “details on where those funds are located and how they are currently invested.”

Mr Dave, Abraaj’s chief financial officer, suggested Abraaj provide a bank letter that would reflect there was $224m in Abraaj’s healthcare fund accounts. Two days before the letter was provided to the foundation, the accounts which had only about $13m, received $196m from an airline, which Mr Naqvi was a director of, according to the indictment. Following the confirmation letter, the $196m was wired back out of the healthcare fund accounts to the same external accounts, according to the indictment.

When healthcare fund investors asked again for bank account records reflecting account activity, Mr Vettivetpillai said Abraaj would return about $95.5m to investors. However, according to the indictment, because of the misappropriation of money from the healthcare fund, Abraaj had to also borrow or transfer about $195m from other parties to replace amounts withdrawn from the fund.

Mr Naqvi and other defendants “used false statements and misleading accounting subterfuge as part of their efforts to keep investors and creditors from discovering the truth about Abraaj’s dismal financial condition,” according to the indictment. In reference to a “particular deceptive transaction” on June 29, 2017, Mr Naqvi wrote to Mr Lakhani, “it’s a bit like playing poker”.

The indictment also cites Mr Naqvi authorising in June 2016 the bribery of certain officials of a foreign government with up to $20m to help facilitate the sale of an entity that the government and Abraaj had a stake in.

The level of fund misappropriation goes beyond plugging gaps or meeting due payments and extends to personal gain, according to the indictment. Mr Naqvi is said to “have transferred and caused others to transfer more than $250m of misappropriated funds to accounts under his control or under the control of his family member or personal associates,” according to the prosecution.

While Abraaj investors did not collect their expected fund distributions, the indictment alleges, between 2011 and 2018, Mr Abdel-Wadood received $8m in salary and bonuses, Mr Siddique, at least $7m, and $4.8m went to Mr Vettivetpillai between 2012 and 2018.

The indictment shows some employees pushed back against inflating valuations in presentations to existing and potential investors for Fund Six (APEF VI), funds from which would have helped Abraaj plug liquidity shortfalls. However, Mr Naqvi exercised pressure, according to the indictment, to maintain higher valuations on paper while Abraaj was raising money for the fund, that made it appear to be generating profit.

“I need a minimum of 20-25mm profit at [Abraaj Holdings] in order to keep this effing business afloat and show strength to the banks,” Mr Naqvi wrote in an August 7, 2017 email.

As Mr Naqvi and other executives were actively trying to raise funds for Fund Six, which they had secured $3bn in commitments from investors, the founder of the firm started in January 2018, according to the indictment, to look at how he could reduce the inflated valuations after Fund Six investments were drawn down without spooking investors.

The indictment cites an audio recording, which shows an aloof Mr Naqvi in a meeting with other defendants, disconnected from the grave implications of the situation, rationalising his actions clearly with no regard for corporate governance.

“And, and there’s one more thing. There’s one more thing which is very important. Which is we could not have done it before now. [Naqvi laughs quietly, and continues laughing quietly as he begins the next sentence],” according to the indictment. “We just could not have done it before now. Because to do it before now, is to chop your own legs off while you’re involved in running the race. Right [chuckling]. And that’s just stupid, right? So, every time I get an email from you or someone, saying ‘This valuation is indefensible,’ I just do like this, because you know what, at the end of the day there are just some things that we have to carry forward until the time is right. And the time is right now. Okay.”

The indictment does not specify how the audio of the conversation was obtained, but it does indicate US authorities were tracking the phone calls of one employee responsible for raising funds for Abraaj in the US. The National understands, based on information in the indictment, at least two former employees may be co-operating witnesses in the case.

Mr Naqvi, according to people familiar with the matter, also used to record his meetings. Some audio files of the meetings would be subsequently deleted, others retained, according to the people. The main reason Mr Naqvi would record a meeting was so that later on he would catch people out and implicate them so they would not be able to say they didn't agree with him before and the practice was effectively more for memorialising complicity, people familiar with the matter said.

Once media reports revealed allegations of misappropriation of funds by Abraaj and increased scrutiny from investors, the company scrapped fund raising activities for Fund Six and released investors from their commitments.

With mounting pressure, Mr Naqvi stepped down as chief executive in March 2018. The same month, according to the indictment, he instructed Mr Lakhani, who had informed him that an auditor planned to visit Abraaj’s Dubai office, to arrange for nine boxes containing documents pertaining to his company, to be removed from Abraaj’s Dubai office.

“I will send my driver to pick up the boxes for [the Naqvi Personal Entity], how many boxes are there?” Mr Naqvi said to Mr Lakhani.

After Mr Lakhani confirmed there were nine boxes, Mr Naqvi messaged, “Ok pls make sure [the driver] takes the boxes out from the door near accounts and not the main reception and there is a trolly in which he can load quite a few at one time so have the trolly loaded.”

The removal of the boxes, which contained files with financial records of Mr Naqvi and his private entity may potentially also expose Mr Naqvi to obstruction of justice and evidence tampering charges.

“It is people like us that give credibility to characters such as Arif because the investors know that Arif is a strong character but at the same time they think we … probably will not support those kinds of things and since we [in] front of them confirm what … Arif says they are [then] ignoring their own instinct,” Mr Vettivetpillai wrote in an email, according to the indictment, to two senior members of Abraaj in reference to giving a veneer of legitimacy to otherwise suspicious valuations.

When an Abraaj executive told Mr Abdel-Wadood in December 2017: “It’s fraud. Simple. Misrepresentation plus the whole healthcare thing amplified that fraud and brought it out,” he responded: “Even beyond that.”