AD Ports Group, the operator of industrial cities and free zones, reported a 50 per cent increase in its 2022 net profit as an expansion of its maritime business boosted income.

Net profit attributable to owners for the 12-month period to the end of December rose to Dh1.27 billion ($345.8 million), up from Dh854 million in 2021, the company said in a filing to the Abu Dhabi Securities Exchange, where its shares are traded.

Revenue grew 41 per cent annually to Dh5.52 billion, “mainly driven by the maritime cluster and effect from new acquisitions”, AD Ports said.

On a like-for-like basis, excluding mergers and acquisitions activity during the year, revenue growth reached 23 per cent.

An “exponential increase in the contribution of the maritime cluster to the group’s revenue [the largest revenue contributor, with 37 per cent of total revenue] ... came on the back of strategic expansion and service offering diversification that have been undertaken during the past few years”, the company said.

The division's annual revenue growth of 256 per cent to Dh2.16 billion in 2022 was driven by a wider service offering and increased activity in new business segments, including feedering, chartering, transshipment and offshore services.

The maritime cluster also added four new companies last year — Divetech Marine Engineering Services, Alligator Shipping Container Line, Transmar (one of the two entities that is part of IACC, Egypt) and Safeen Surveys and Subsea Services.

These new businesses are “expected to continue to support the cluster’s growth going forward”, AD Ports said.

“2022 was an exceptional year for AD Ports Group, with strong results reflecting the effectiveness of our ambitious growth strategy,” said Capt Mohamed Al Shamisi, managing director and group chief executive of AD Ports.

“For 2023, we will be focusing on maximising returns and generating portfolio synergies, while providing our customers with superior end-to-end supply chain outcomes.”

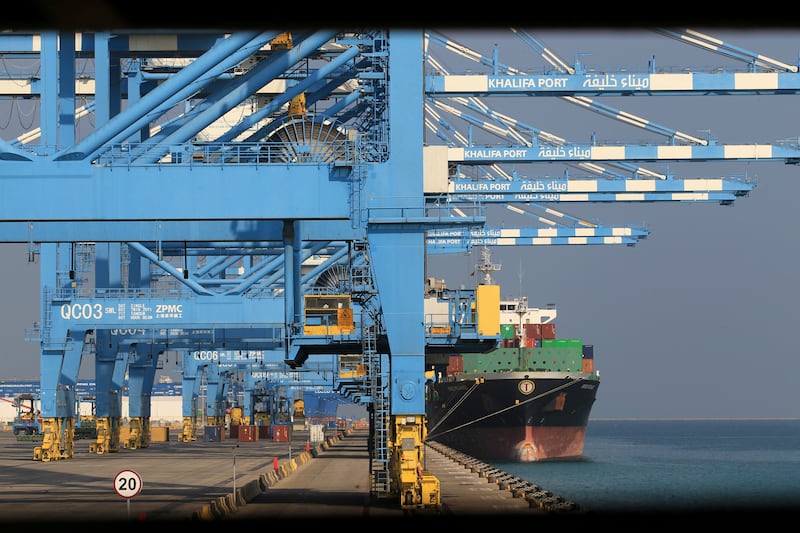

Established in 2006, the AD Ports Group, which owns and operates 10 ports in the UAE, has been expanding its operations globally.

Last month, the company teamed up with various Angolan organisations to enhance maritime connectivity along Africa’s west coast.

Under a framework agreement with Angola’s Ministry of Transport, AD Ports will explore ferry and cabotage services, maritime passenger terminals, logistics platforms and a maritime academy in the country.

It will also consider development of the Caio Deepwater Terminal at Cabinda Port, in Angola’s oil-rich north-west.

Also in January, the group signed a partnership with Kazakhstan's state energy company KazMunayGas and a preliminary accord with the country's Ministry of Industry and Infrastructural Development to co-operate in the development of a national marine fleet and coastal infrastructure in the Caspian and Black seas.

Last year, AD Ports acquired Spain’s integrated logistics platform Noatum for Dh2.5 billion, purchased a 70 per cent equity stake in Egypt's International Associated Cargo Carrier for Dh514 million and bought an 80 per cent stake in Dubai-based global container shipping company Global Feeder Shipping for Dh2.9 billion.

In 2022, earnings before interest, taxes, depreciation and amortisation (ebitda) increased 37 per cent on an annual basis to Dh2.19 billion, implying an ebitda margin of about 40 per cent, AD Ports said.

Key contributions to ebitda growth came from the maritime, ports and digital clusters.

Revenue for the ports cluster grew by 7 per cent annually to Dh1.13 billion in 2022, backed by a “healthy product mix, as well as revenue from the acquisition of TCI, one of the two entities under IACC, Egypt”, AD Ports said.

“Double-digit growth in concession fees and leases, as well as strong rebound in the Ro-Ro [roll-on and roll-off] and cruise businesses, on the back of the abated effect of the Covid-19 pandemic, more than offset the decline in general cargo revenue.”

Digital cluster revenue rose 11 per cent annually to Dh400 million in 2022.

Meanwhile, the logistics cluster registered a 12 per cent annual decline in revenue to Dh532 million, mainly due to the reduction in the vaccine business with the easing of the pandemic, as well as the revision of a contract with a key client and temporary lower volumes due to the non-availability of empty containers for exports, it said.

Cash flow from operations more than doubled last year to Dh1.6 billion while assets grew by about 37 per cent annually to Dh38.52 billion at the end of December.

The asset base increase was “driven by investments in joint ventures and associates (Aramex, NMDC), continued growth-oriented organic capex [capital expenditure], as well as [the] intangible and goodwill effect of recent acquisitions”, AD Ports said.

“Balance sheet remained strong with well-balanced capital structure and enough debt liquidity to drive both organic and inorganic growth aspirations,” it said.

The company will continue with its “ambitious organic revenue-generating” capital expenditure programme of about Dh15 billion over the next five years, said group chief financial officer Martin Aarup.

“With the recent M&A transactions announced, we update our medium-term guidance [five-year organic compound annual growth rate between 2022 and 2027] to 25 per cent to 30 per cent for revenue and 20 per cent -25 per cent for ebitda,” he said.