Billions of euros in profits from frozen Russian central banks assets will be used to arm Ukraine and fund its recovery after EU member states reached an agreement "in principle" on the proposal on Wednesday.

Diplomats are yet to hammer out the details of the plan, with leaders of the 27-nation EU agreeing in March to move ahead with the proposal, which is expected to unlock €3 billion ($3.3 billion) a year for Kyiv.

The bloc's Belgian presidency said in a post on X that EU ambassadors had "agreed in principle on measures concerning extraordinary revenues stemming from Russia's immobilised assets".

"The money will serve to support Ukraine's recovery and military defence in the context of the Russian aggression," it said.

"There could be no stronger symbol and no greater use for that money than to make Ukraine and all of Europe a safer place to live," added EU Commission chief Ursula von der Leyen.

The EU froze about €200 billion of Russian central bank assets held in the bloc as part of punishing sanctions imposed on Moscow for sending troops into its neighbour in February 2022.

Simply confiscating that money and pumping it into Ukraine's reconstruction efforts is not seen as an option, as that could rattle international markets and undermine the euro.

But EU leaders settled instead on a plan to target the interest being made by the frozen assets – which they insist is legally sound despite warnings by the Kremlin it would trigger "serious consequences".

Under the deal, to be submitted to EU ministers for formal approval, 90 per cent of the interest will go to a central fund used to pay for weapons for Ukraine, the European Peace Facility, while 10 per cent will go to the EU's separate Ukraine Facility.

About 90 per cent of the funds frozen in the EU are held by the international deposit organisation Euroclear, based in Belgium.

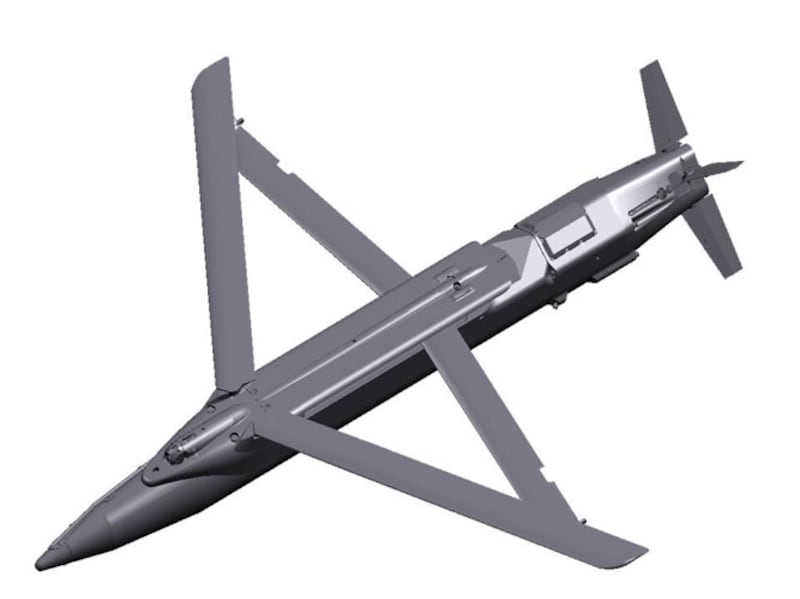

Weapons wanted by Ukraine - in pictures

As part of the agreement, diplomats said Belgium agreed to send Ukraine the totality of the tax revenue generated by the profits – which had been a sticking point in negotiations.

That is expected to free up an additional €1.7 billion in tax revenue for Ukraine this year.

Euroclear's fee for handling the assets was also slashed tenfold, to 0.3 per cent of profits, as part of the deal, diplomats said.

Meanwhile, Hungary said on Wednesday it will not participate in Nato's long-term plan to aid Ukraine, calling it a "crazy mission".

Nato allies agreed last month to initiate planning on long-term military support for Ukraine against Russia's invasion, through setting up a fund worth €100 billion.

Under the plans, Nato would take over some co-ordination work from a US-led coalition known as the Ramstein group.

Vladimir Putin tells US journalist defeating Russia is impossible - video

Hungarian Foreign Minister Peter Szijjarto reaffirmed his government's opposition to the plan.

"Hungary will stay out of Nato's crazy mission despite all the pressure," he told a Facebook-live event in London.

Government spokesman Zoltan Kovacs, responding to Nato's initiative last month, said on X that Hungary would back no Nato proposals that "might draw the alliance closer to war or shift it from a defensive to an offensive coalition".

Relations between Budapest and Nato have soured because of Hungary's foot-dragging over the ratification of Sweden's Nato accession – finally passed by Budapest in March – and also over nationalist Prime Minister Viktor Orban's warm ties with Moscow despite the Russian invasion of Ukraine.

David Pressman, the US ambassador to Hungary, said earlier that Nato allies are warning Hungary of the dangers of its "close and expanding" relationship with Russia and if this is Budapest's policy choice, "we will have to decide how best to protect our security interests".