Iran yesterday named seven western oil companies that it would like to see invest in Iran’s vast oil and gas sector once international sanctions are lifted.

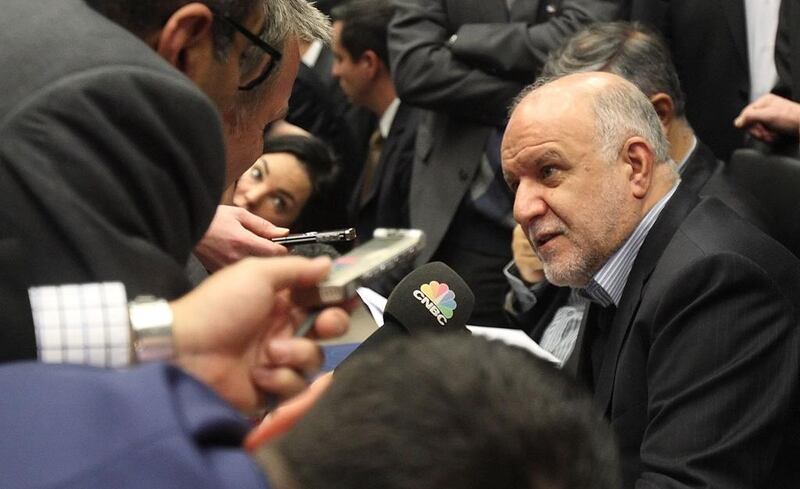

The Iranian oil minister Bijan Zanganeh named in order: Total of France, Anglo-Dutch Shell, Italy’s Eni, Norway’s Statoil, Britain’s BP and the US companies Exxon and Conoco.

Speaking to reporters at Opec’s meeting in Vienna yesterday, he said he was already talking with some companies but so far not those from the United States.

“We had no limitations for US companies,” said Mr Zanganeh. “Twenty years ago there were limitations against them from their own administration. For doing projects in Iran, we have no limitations.”

He made no mention of Russian, Chinese or Japanese companies or those of other nationalities.

Last month, Iran reached an interim deal with six western powers to limit its nuclear programme that may result in sanctions on oil investment and trade with Iran being lifted next year.

As a group, the Opec ministers agreed yesterday to keep the organisation’s crude output target unchanged, Saudi Arabia’s Ali Al Naimi said.

“We have rolled it over,” the kingdom’s oil minister said after the closed-door talks.

The 30 million barrel-a-day target for the 12-nation group adequately matches demand and is unlikely to change much in 2014, Suhail Al Mazrouei, the UAE’s Minister of Energy, said shortly before the talks began.

Some analysts warn that excess supply, including US shale oil and a potential resurgence in exports from Iran, Libya and Iraq, may push prices lower next year if production cuts are not made. Brent crude has settled above $100 a barrel for all but five days so far this year.

Mr Al Naimi said that 30 million isn’t too much for Opec’s target. “No, no, is enough,” the minister said when asked about it.

He also said there is no need for Saudi Arabia to cut its own production level. The kingdom is Opec’s biggest oil exporter and produced 9.65 million barrels a day last month.

* Bloomberg News and Reuters