Iranian businesses in the UAE are being squeezed by tightening sanctions as visas are refused, profits are hit and banking becomes more difficult.

Tougher business conditions for Iranians outside the Islamic republic mirror the increasing problems Iran’s economy is facing at home.

The deteriorating outlook follows the US last week imposing fresh economic sanctions targeting Iran’s central bank and the financial sector.

The actions are heavily impacting commerce with an important non-oil trading partner. Iranian business people in Abu Dhabi and Dubai are feeling the strain.

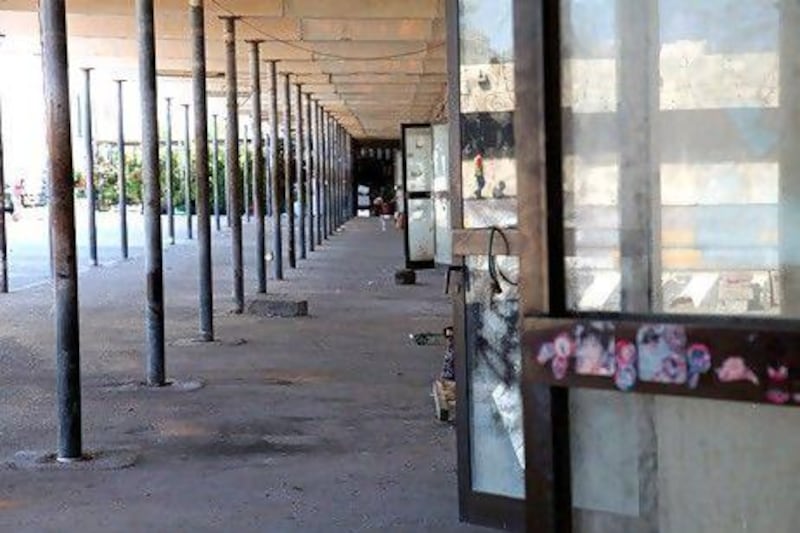

Until recently a bustling trading centre for everything from saffron to carpets, Abu Dhabi’s Iranian Souq is now largely abandoned.

Difficulties obtaining 21-day visas mean fewer Iranian traders have been making the trip to the UAE in recent months.

“Only a few months ago, this place was so busy that it would be hard for customers to walk between the stalls and items on display,” said Reza Mohamed, a stallholder who sells pots. “The traders, who used to come on a 21-day visit visa to capitalise on tourists to the city, are coming far less often.”

Iranian businessmen resident in Dubai are also facing problems.

“US sanctions have tightened the situation, particularly on the banking side, as that has affected traders dealing with Iranian businesses. Financing trade is almost impossible if you are Iranian,” said Morteza Masoumzadeh, a member of the executive committee of the Iranian Business Council in Dubai and the chairman of Jumbo Line Shipping Agency.

The bank accounts of some Iranian traders were closed in the past few months. Others had closed businesses in the emirate and relocated to countries such as Turkey or Malaysia.

Profits of Jumbo Line were down 70 per cent compared with two years ago, he said.

"A lot of our business used to be with Iran, but now we are forced to do almost no trade with Iran," he said.

For Iranians, securing letters of credit from a bank was becoming increasingly difficult, he said.

Iranian businessmen were able to obtain only cash rather than letters of credit from Bank Melli and Bank Saderat, the Iranian banks operating in the UAE.

The US, UK and Canada have stepped up sanctions against Iran since November, targeting financial institutions that do business with the country and banning exports of key goods.

The US sanctions that came into force at the weekend are the strongest yet, barring any financial institution that deals with Iran's central bank from gaining access to the US financial system.

As a major conduit for re-exports to Iran, the UAE is coming under increasing international pressure to close its own business links with the country. Re-export trade to Iran rose 36 per cent in the first six months of last year to Dh19.5 billion (US$5.3bn) compared with Dh14.3bn in the same period a year earlier.

As tensions rise between Iran and the outside world, the country's economy is becoming increasingly shaky, say analysts.

Prices of everyday items have soared as inflation has reached about 20 per cent.

"There's some economic misery in Iran and some aspects of the economy are feeling the pinch," said Ali Al Saffar, a Middle East economist at the Economist Intelligence Unit in London. "The problems are a combination of the impact of sanctions and political interventions in the economy."

International sanctions have yet to seriously hurt Iran's oil sector, its main revenue earner.

halsayegh@thenational.ae

twitter: Follow our breaking business news and retweet to your followers. Follow us