Lucira Health, the US maker of Covid-19 home testing kits, has filed for Chapter 11 bankruptcy.

Publicly traded Lucira listed $146 million in assets and about $85 million in liabilities in its bankruptcy petition.

The company will remain operational during the bankruptcy proceedings as it seeks to find a buyer.

"The company intends to use available cash on hand, which stands at approximately $4.5 million as of the filing date, to fund post-petition operations and costs in the ordinary course," a Securities and Exchange Commission filing said.

"The company continues to operate its business as a 'debtor-in-possession' under the jurisdiction of the bankruptcy court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the bankruptcy court."

It added that Lucira Health "cannot be certain that holders of the company’s common stock will receive any payment or other distribution on account of those shares following the Chapter 11 case".

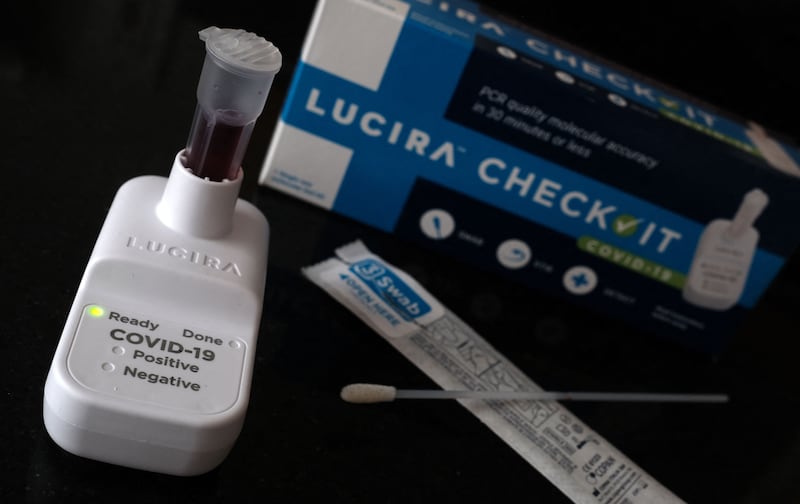

Lucira sells Covid home testing kits that provide “lab-quality results” in 30 minutes, according to its website. A single test is listed for $35 on the site.

Declining Covid-19 restrictions affected demand for the testing kits, squeezing Lucira, chief executive Erik Engelson said.

Lucira Health grew rapidly over the past few years as the Covid-19 pandemic spread throughout the world.

However, "the unpredictability of selling into a pandemic made for a very challenging operating environment”, Mr Engelson said.

“Unfortunately, as restrictions lessened in 2022, we saw lower demand for Covid-19 tests," he said.

"This, combined with slower than anticipated regulatory approval for the new combined test kit developed for the 2022-2023 flu season, led to insufficient revenue and capitalisation to offset expenditures.

"Despite every effort to reduce capital outlays and restructure our business, we took this action to protect and maximise the value of our assets.”

All you need to know about rapid-spreading 'Kraken' Covid variant

Lucira intends to use available cash on hand to fund post-petition operations and costs in the ordinary course of business, the company said.

"We managed to grow significantly, reached positive net income, and drove continued innovation in our offering," Mr Engelson said.

The company generated net sales of $34.4 million in and $151 million in the quarter and nine-month period, respectively, that ended September 30, 2022.

Venture capital firm Eclipse Ventures holds a stake of about 10 per cent in Lucira, making it the company’s biggest shareholder, court papers show.