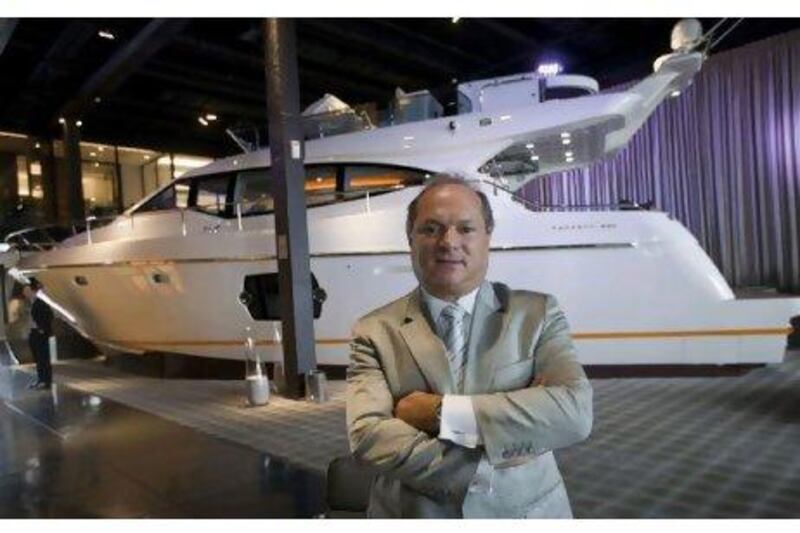

SAO PAULO // Marcio Christiansen reeled off tales of the growing ranks of rich Brazilians who visit his luxury Ferretti yacht showroom, where clients sip espressos on an oversized sable sofa and electronic music bubbles in the air.

One man paid US$2 million (Dh7.34m) for a ship, Mr Christiansen said, after succumbing within 30 minutes to his children's pleas of: "Buy it, daddy, buy it!" Another toured the sparkling 53-foot yacht on the showroom floor, then asked to discuss it over lunch.

"The waiter comes over to take our order and the client asks to borrow a piece of paper from his pad," said Mr Christiansen, the CEO of Ferretti's Brazil group. "He starts working out a contract on it and we've agreed to it before I've asked for a sandwich."

Brazil has always had its select group of super-rich with extravagant tastes. But booming commodity prices fuelled by Chinese demand, along with some of the world's biggest offshore oil discoveries, have created a new class of wealthy Brazilians. They, in turn, have boosted the international yacht market even as it plummets in the US and Europe.

The number of millionaire households in South America's most populous nation is forecast to more than triple by 2020. Their spending, along with that of a growing middle class, has protected Brazil from the economic downturn that the world has faced since 2008.

Exporting sugar, gold, coffee and rubber, Brazil has been a boom-and-bust place since the 16th century. Past golden ages created a thin strata of the wealth at the top and extreme inequality below. Since the mid-1990s, however, economic reforms following a return to democracy have slowly spread the wealth, and aggressive government social programs since 2003 have lifted 20 million people out of poverty.

A report on the geography of wealth from the US-based consulting firm Deloitte, which was released in May, forecasted that US and European nations would remain the global centres for wealthy households during the next decade. Nonetheless, emerging-market economies were likely to prove to be more dynamic in terms of growth rates, creating significant opportunities for wealth managers seeking to gain a share of these potentially lucrative markets.

The boom in Brazil's yacht market attests to that growth.

Annual boat sales in Brazil have grown up to 30 per cent annually since 2008 depending on the specific segment of the market, industry leaders said. Meanwhile, in the more traditional boating markets in the US and Europe, sales of high-end boats have dropped by 70 per cent, analysts said.

For the Italian boat maker Ferretti, one of the world's leading yacht manufacturers, sales in Brazil represented less than 5 per cent of global revenue in 2007, according to Mr Christiansen.

This year, sales from Ferretti's Brazil group are expected to reach nearly $290 million, or about 40 per cent of the company's global revenue, said Mr Christiansen, who has more than three decades of experience selling upper-end boats in Brazil.

Mr Christiansen opened a massive $310m Ferretti shipyard on the outskirts of Sao Paulo two months ago to meet the new demand. It is expected to produce 120 yachts a year once it reaches capacity.

In the past two years, more than a dozen high-end foreign boat makers have either built a shipyard in Brazil or have been partnering with local dealers to export their wares to the market, despite tariffs that range between 70 and 100 per cent on imported vessels.

"I never imagined I would get to this level, nor that the established markets would fall so much," Mr Christiansen said. "English, French and American boat builders are targeting this market. I've been in this business for more than three decades and now I'm seeing an invasion from foreigners. They've discovered Brazil."

At the same time, Brazil's burgeoning class of rich people have discovered luxury.

According to a report released late last year by the Association of Executive Search Consultants, executives in Sao Paulo now earn more than their counterparts in New York, London, Hong Kong or Singapore, and their disposable income has flooded Brazil's consumer market.

The number of millionaire households in the nation of 190 million would increase 230 per cent to more than 1 million by 2020, according to the Deloitte report.

Giovanni Luigi, the CEO of Brazil's largest boat vendor, YachtBrasil, points out that the country is also awash in lakes and rivers, yet the freshwater boating market is virtually untapped. He says his company projects sales growth of 28 per cent this year after racking up $840m in sales over the last four years.

However, Eduardo Colunna, the president of the Brazilian Boat Builder Association, which represents domestic makers, is more circumspect. Foreign companies may be overestimating the market, Mr Colunna said, and the lack of marinas to service yachts could hinder sales.

Yet even Mr Colunna's conservative estimates put market growth at 10 per cent a year, attractive enough for foreign companies who have seen the US and European markets dwindle.

Mr Christiansen, for one, believes the boom would not cool anytime soon, despite recent projections of a slowing economy. The talk in his showroom on a recent afternoon centred on the doubling of annual sales over recent years and more growth to come.

"I used to only sell ships to the extremely rich owners of businesses, never a professional CEO or CFO, just the owners," Mr Christiansen said. "That's changed now, there is more meritocracy in Brazil. More people are earning bonuses based upon the success of their work, and they want to spend it."