TUNIS // After a year featuring regime collapse, cabinet reshuffles, strikes, a tourism drop-off and a degree of instability, the state of Tunisia's economy could be worse, economists said. It could also be much better.

Looking back: Tunisia's 2011

When Tunisians remember 2011, certain cries will rush to mind: “Leave!” “Revolution!” “Freedom!” – yells of defiance and victory. But right behind them will come darker words, such as “confusion”, “anxiety” and “fear”.

Tunisia for 2012: Youth take centre stage to help rebuild their nation. Read article

Tunisia's timeline of events Read article

[ MORE ON TUNISIA ]

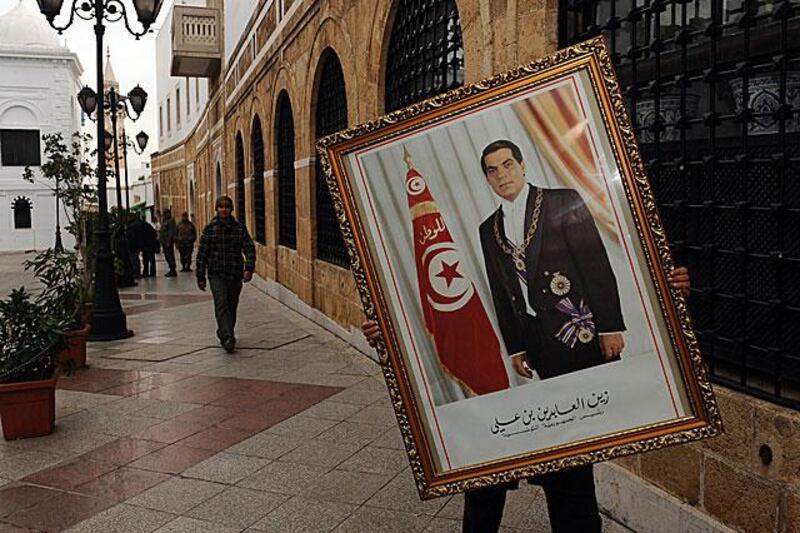

The toppling in January of president Zine El Abidine Ben Ali plunged Tunisia's future into uncertainty, triggering blows to the economy.

A new interim government issued from elections in October must now work to restore confidence.

Pain has been felt most keenly in the large tourism sector, which saw a 40 per cent drop in revenues as holidaymakers shied away from perceived instability. Other sectors have slowed in the absence of clarity on future government budgets and finance law.

Meanwhile, workers emboldened by the fall of Ben Ali's police state have staged strikes, putting factories and companies temporarily out of commission. Growth this year is predicted at 0 per cent.

However, flatline - as opposed to negative growth - is good given the circumstances, said Emanuele Santi, the chief economist on Tunisia for the African Development Bank (ADB), which is headquartered in the Tunisian capital. This year's uprising spared most infrastructure and the government has largely covered the costs of damages, Mr Santi said.

"The situation now is delicate, but far from being catastrophic," said Moez Labidi, an economics professor at Mahdia University and an independent adviser to Tunisia's central bank.

Crisis in the euro zone, Tunisia's largest trading partner, could lower demand for Tunisian exports, albeit with the potential trade-off of increasing demand for low-cost Tunisian labour. "We haven't had an exchange rate crisis and we've maintained a BBB- credit rating, which is investment grade," Mr Labidi said. "But if growth remains anaemic, it poses a problem for 2012."

Unemployment has risen, compounded by the return from war-wracked Libya of tens of thousands of Tunisian workers. Overall, Libya's war dented Tunisia's economy by -0.4 per cent of GDP this year, according to the ADB.

Ultimately, Tunisia needs structural reforms to narrow wealth gaps, improve education and target government subsidies, economists said. But some short-term progress may also be possible.

Post-war Libya could provide Tunisia jobs as the country rebuilds, Mr Santi said." A pro-active labour migration policy with Libya could have huge payoffs."

Meanwhile, Tunisia could benefit from restructuring its banking sector to improve entrepreneurs' access to loans, said Mr Labidi.

"We have many small banks that are very strict about granting credit," he said. "Normally banks should be willing to take risks for their clients."

Most fundamentally, leaders must reassure the public that economic reform is coming, economists said.

According to Mr Labidi, the formation of an elected government and assembly should make a difference.

Mr Santi noted that Ben Ali's downfall means that "politically-driven constraints to business are being removed".