Kuwait's top lawmakers proposed a new legislation to impose a fee on foreign remittances, despite being warned by the government and central bank that the bill would be counter-productive.

The parliament’s financial and economic affairs committee voted four to one on Sunday to pass the bill, which will be subject to National Assembly discretion before moving to the government for approval.

The Central Bank of Kuwait advised against the move saying the law could weaken the financial stability of the country and bolster the black market for remittances, according to local sources.

The law stipulates that those making up to KD99 (Dh1,214) would be subject to a one per cent fee; the KD100 to KD200 segment to two per cent; the KD300 to KD499 bracket will be taxed three per cent, and those making more than KD500 will be taxed five per cent.

The council opted not to include the Kuwaiti government’s suggestion that the law be applied to both residents and citizens.

Salah Khorsheed, an MP who serves as head of the financial committee, said the decision to propose the bill was made only after analysing both the humanitarian and legislative aspects of the proposed law.

“Our intention was to make sure that the fee on the lowest-income earners bracket would be much less than those who are higher to ensure that those making more would be compelled to reinvest their earnings in Kuwait,” he said.

Mr Khorsheed predicts that the fee could amount to KD70 million from remittances. He said the committee found that approximately KD19 billion was sent abroad over the last five years.

The MP argued that the proposed fees would not create a black market for remittances and that those suggesting it were guilty of complacency and failed to understand the purpose of financial institutions.

“Why do we have a central bank, why do we have financial regulation, why do we have employees? To make excuses and say it’s out of our hands?” asked Mr Khorsheed.

“That’s why we have a penalty for those who fail to comply. You’re talking about money laundering.”

_______________

Read more:

Kuwait and Philippines strike domestic worker deal

Domestic workers still face 'abuse and fraud' in the Middle East says leading UN body

Murder shocks Filipinas in Kuwait, but some vow to stay

_______________

The proposed bill stipulates that anyone who attempts to circumnavigate the fee could receive up to five years in jail and a fine of twice the amount illegally sent abroad.

The move was justified as one of many proposals coming out of parliament to diversify Kuwait’s economy, as it continues to cope with its dependency on oil revenue.

A source in the ministry of finance said the lack of transparency is the financial institution’s main concern.

"Show us the research you used to make your 'informed decisions’ and let the public scrutinise it,” said the source, who asked to remain anonymous.

“They’re trying to put a band aid on wounds that require stitches. Some members of parliament who are targeting foreigners should be spending their time targeting the policies that got us into this situation in the first place,” he said.

Kuwait announced their annual budget in January with a huge $17 billion (Dh62.4 billion) deficit.

The parliament, which has 24 opposition members out of a total of 50, has been tackling government policies and proposing new legislative reforms attempting to restrict the cabinet's ability to impose added fees on citizens.

Austerity measures in Kuwait have been curtailed by outspoken members of parliament like Safaa Al Hashem, who is also a member of the financial and economic affairs committee.

Last year, she criticised government efforts to save money by increasing energy costs in a country with one of the most heavily subsidised utilities prices.

Several members of parliament have framed solutions to the national deficit at the expense of foreigners living in the country by proposing bills they believe would be perceived as popular among their exclusively Kuwaiti constituents.

The law is not exclusive to Kuwait. The UAE, Saudi Arabia and Bahrain all impose fees on remittances.

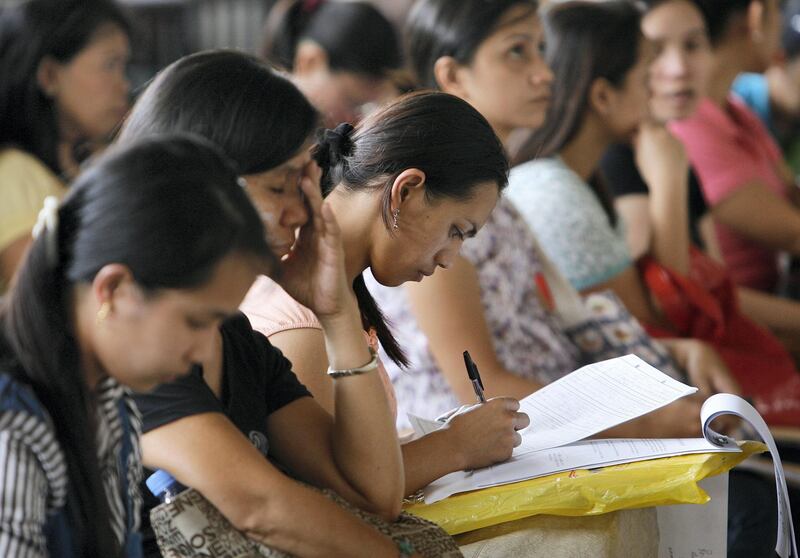

Kuwait is home to one of the largest Filipino expatriate communities with 250,000 mostly working in the service sector.

Philippines president Rodrigo Duterte in February announced a ban on maids looking to work in Kuwait after the body of a murdered Filipina was discovered in a freezer.

A Kuwaiti court on Sunday sentenced a Lebanese man and his Syrian wife to death over her murder.

Kuwait, having struck a deal with the Filipino government last month, is looking to raise the minimum wage of Filipino workers in the country to $400 a month.