Top executives at British banking group Barclays illegally paid Qatar secret multi-million-pound fees after warning they would be “dead” without at least £1 billion from the Gulf state, a court heard on Thursday.

The senior officials lied about the commission fees of £322 million as they scrabbled to raise billions of pounds to stabilise the bank’s financial position amid the chaos of the 2008 global financial crisis, a jury was told.

The bank’s Asia chief complained that Qatar’s sovereign wealth fund had the bank over a barrel as it held out for a lucrative deal in return for several billion pounds in capital as the bank’s share price tumbled.

“Without 1bn, at the very least, from Q[atar] we are basically dead”, said another executive, Richard Boath, the bank’s former European divisional head, in a message to his line manager in late May 2008.

The Qataris eventually agreed to invest double that amount in the first round of a capital-raising move by Barclays but only after the executives agreed a bumper rate of commission, the court was told.

“Took longer than I had hoped but these people are the new cocks of the roost,” wrote then Barclays chief executive John Varley, in an email to the bank’s chairman on June 5.

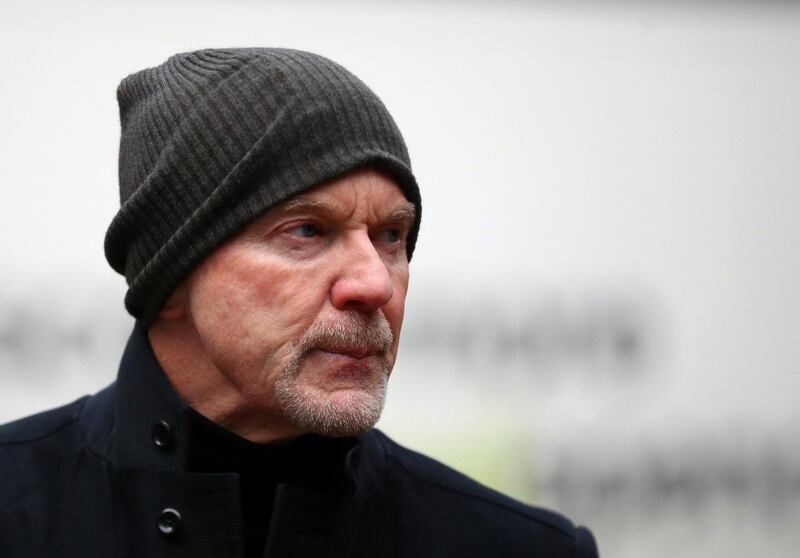

Four men, including Mr Boath, 60, and Mr Varley, 62, and Thomas Kalaris, 63, the former head of its wealth management division, are on trial accused of conspiracy to defraud for allegedly keeping secret the deal struck with Qatar.

Qatar – through its sovereign wealth fund and an investment vehicle under the control of its former prime minister Sheikh Hamad bin Jassim bin Jaber Al Thani – was identified as one of four strategic investors as the institution faced a crisis more than a decade ago.

The investors were targeted in the capital-raising operation dubbed “Project Heron” as the bank’s share price fell from 500 pence a share in April 2008 to around 300 pence less than three months later.

Barclays officials met with Sheikh Hamad at the Four Seasons Hotel in London on May 23, 2008 to discuss the deal.

A senior executive later wrote an email with the subject line: “Cigars went well” but warned there would be pressure on fees.

A few days later, the Qataris were reported as “playing hardball” over their fee for investing in the bank.

Prosecutors say the secret payments meant that other investors were unaware of the lengths that Barclays was prepared to go to secure funding - or that the Qataris were being paid more for the same services.

The jury heard a recording of a telephone call between Mr Kalaris and Mr Boath in which they discussed the deal.

“None of us wants to go to jail here,” said Mr Kalaris. “The food sucks and the sex is worse.”

The successful capital raising operation through 2008 meant Barclays was able to avoid a UK government bailout – unlike two other rival institutions - and meant that the executives did not lose very large bonus payments, the court has heard.

Southwark Crown court heard that the executives by mid-May 2008 had been buoyed by the “strong prospect” of Qatar investing up to £2bn in the struggling bank.

Barclays considered a strategic relationship with the Qataris as “very valuable” because of the country’s “enormous wealth”, said Edward Brown QC, prosecuting for the Serious Fraud Office.

“Barclays hoped that there would be a ‘succession of opportunities’ in providing various banking services, from which Barclays could earn banking fees,” said Mr Brown.

The bank finally secured nearly £4 billion of funding from Qatar during 2008 – out of a total of more than £11 billion – but with rates of commission more than double that of other investors, the court has been told.

The executives on trial are accused of lying about payments of £42 million and £280 million to Qatar in “untrue and misleading” financial statements.

Mr Varley, Mr Kalaris and Mr Boath are joined in the dock by Roger Jenkins, 63, a former head of investment banking for Barclays in the Middle East who was described as the gatekeeper to the Qataris.

A fifth man, Christopher Lucas, the group’s former financial director, is also accused of being part of the conspiracy but not on trial because of long-standing health problems.

All four men deny the charges.