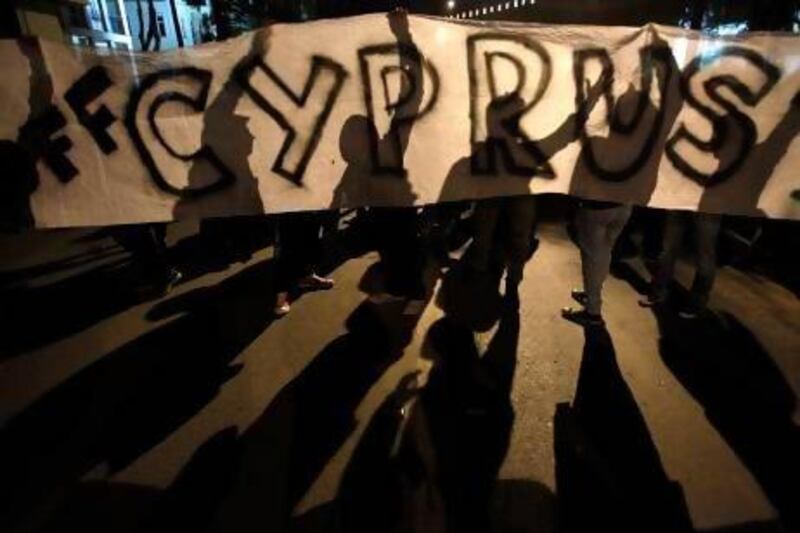

NICOSIA // There was little cheer on the streets of Nicosia yesterday after Cyprus avoided bankruptcy by securing a last-minute €10 billion bailout deal in return for a radical reform of its oversized banking sector.

Huge losses will be inflicted on wealthy savers, many of them cherished Russian customers.

Although angry with the EU, Moscow signalled it would support the bloc's efforts to overcome the economic crisis in Cyprus, a small but valued ally.

All bank deposits in Cyprus of less than €100,000 (Dh473,000) - which are insured under EU law - will be fully guaranteed, which is a relief for the island's smaller account holders.

But many Cypriots believe the draconian terms of the deal will deepen the recession in the country and send its record unemployment rate of 15 per cent soaring further.

Analysts said Cyprus could see its economy contract by 10 per cent or more in the years ahead.

The bailout agreement was clinched early yesterday morning after hours of tense and rancorous negotiations in Brussels between Nicos Anastasiades, the Cypriot president, and heads of the EU, IMF and the European Central Bank (ECB).

"It doesn't look like I'll lose anything on my hard-earned savings, but my nieces and nephews are probably going to have to emigrate to make a living," said Anastasia Georgiou, a 43-year-old civil servant.

"We will go from being a well-off nation to a poor one," said Sandro Dikaios, a British-trained accountant who has many international clients whom he fears may take their business elsewhere.

"As a financial centre, Cyprus is probably finished," said Fiona Mullen, an economist at Sapienta Economics in Nicosia.

The financial sector - even more than tourism - has propelled Cyprus's prosperity in recent years, employing thousands of lawyers, auditors and secretaries, many of whom now fear losing their jobs.

"We have to find a new economic system to create jobs. Banking is finished," said Sotiris Petsas, 48, a cafe owner and news agent in central Nicosia.

Many Cypriot commentators said Mr Anastasiades, elected just last month, had negotiated with a gun to his head in Brussels. At one point, he had threatened to resign if pushed too far.

But he eventually emerged from the marathon overnight meeting, saying: "I'm happy because we shall have a programme and it's in the best interests of the Cyprus people and the European Union."

The ECB had threatened to cut off crucial emergency assistance to Cyprus's banks by today if no agreement was reached. That could have forced Cyprus to become the first country to abandon the euro currency - and would have sent the region's markets spinning even though Cyprus represents just 0.2 per cent of the euro zone's economy.

Under the bailout deal, Laiki Bank - the country's second largest - will be wound down, with deposits of more than €100,000 taking huge hits, possibly of up to 40 per cent, analysts said.

This should raise €4.2bn, a substantial contribution to the €5.8bn that international lenders demanded that Cyprus must raise itself in return for a bailout. Laiki bank will effectively be shuttered, with thousands of job losses.

"I've been with Laiki for 13 years. What do I do now if I lose my job?" said Loucas Christodoulou, a 38-year-old father of two.

Laiki will be split into "good" and "bad" banks, with its good assets eventually merged into the Bank of Cyprus, the island's biggest lender. Major depositors at the latter bank could face a "haircut" of 30 per cent.

Cyprus's finance minister, Michalis Sarris, put a brave face on the outcome. "It's not that we won a battle, but we really have avoided a disastrous exit from the euro zone," he said. "A long period of uncertainty and insecurity surrounding the Cyprus economy has ended."

Cyprus's outsize banking sector, with assets several times the size of the economy, was crippled by exposure to Greece, where private bondholders suffered huge hits in a "haircut" last year.

Germany had declared Cyprus's business model obsolete while France rubbed salt into Cypriot wounds at the weekend by proclaiming "Cyprus is a casino economy".

Many Cypriots suspect that the real aim of Germany is to seize a large share of the Russian business pie from Cyprus. Bigger EU countries would never be treated in the same high-handed fashion, they said.

Cypriot lawyers with Russian customers said they are already being approached by banks in Latvia, Germany and Switzerland promising they could open new accounts for their clients within hours. The vultures are circling, the Cyprus Mail said on Saturday.

Other Cypriots believe the EU wants to impoverish Cyprus to secure better terms on the country's untapped offshore gas riches.

Ms Mullen was confident Cyprus would bounce back. "It still has a very educated workforce ... and is full of young people with very good ideas."

Mr Dikaios agreed. "We're an entrepreneurial people," he said. "We'll get back on our feet. It will just take some time."

[ mtheodoulou@thenational.ae ]

twitter: For breaking news from the Gulf, the Middle East and around the globe follow The National World. Follow us